Arbitrage Funds

Retail investors usually keep their short term funds parked in their savings bank account. With increasing awareness of mutual funds among investors, some investors now park their short term funds in overnight or liquid fund schemes as they may give higher returns than savings bank interest rate. Another low risk investment option for parking your short term funds is Arbitrage Funds which have the added advantage of being more tax efficient than debt funds like overnight or liquid funds. In this article, we will discuss about arbitrage funds.

What are arbitrage funds?

Arbitrage funds are hybrid mutual fund schemes which aim to generate arbitrage profits by exploiting price differences of the same underlying assets in different capital market segments. These funds can also invest in debt and money market instruments. As per SEBI’s directive, arbitrage funds must invest at least 65% of their assets in equity and equity related securities (e.g. stock futures, index futures etc). These mutual fund schemes have a low risk profile. Since 65% of the assets of these funds are invested in equity and equity related securities, they enjoy equity taxation.

What is arbitrage?

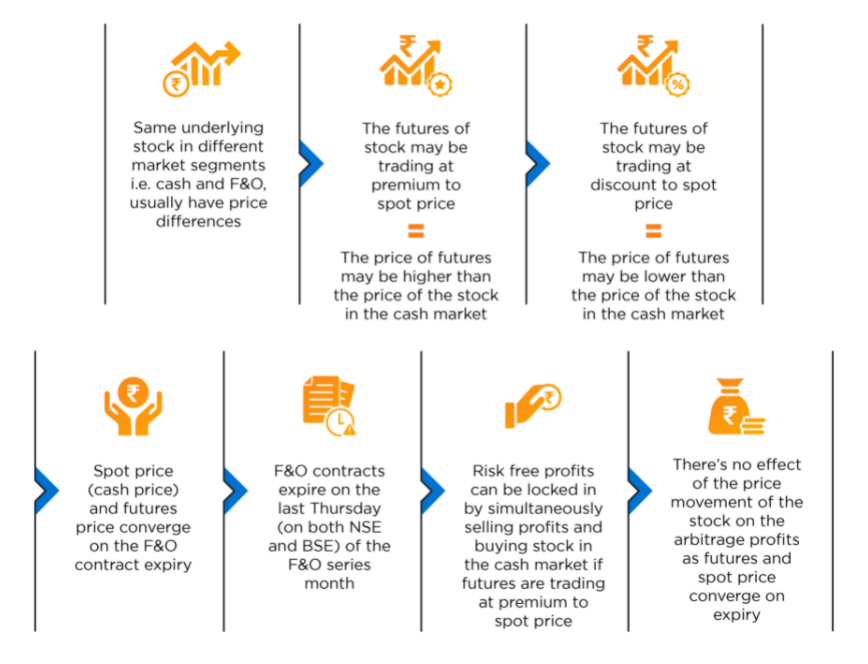

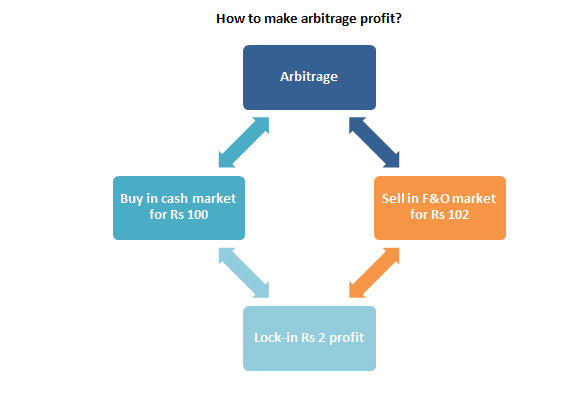

Arbitrage is simultaneous buying and selling the same underlying security in different market segments to make risk free profits. If the price of a security is different in different markets, you can make risk free profits by buying the security in the market where price is lower and simultaneously selling it in the market where price is higher. It is important that both the buy and sell transactions are executed simultaneously so that you are not be exposed to price movement risk. Since arbitrageurs aim to make risk free profits the buy and sell positions are totally (100%) hedged.

How does arbitrage work?

Example of Arbitrage

Let us assume the price of a stock in the cash market is Rs 100 and its price in the futures market is Rs 102.

Share Price Movement will have no impact on the arbitrage profit

| Share Price on expiry | Profit / (loss) in futures market | Profit / (loss) in cash market | Final Profit |

|---|---|---|---|

| Rs 90 | Rs (10) loss [90 – 100] | Rs 12 profit [102 – 90] | Rs 2 [12 – 10] |

| Rs 95 | Rs (5) loss [95-100] | Rs 7 profit [102-95] | Rs 2 [7 – 5] |

| Rs 100 | Nil [100 – 100] | Rs 2 profit [102 -100] | Rs 2 [2 – 0] |

| Rs 105 | Rs 5 profit [105 – 100] | Rs (3) loss [102 – 105] | Rs 2 [5 – 3] |

| Rs 110 | Rs 10 profit [110 -100] | Rs (8) loss [102 – 100] | Rs 2 [10 – 8] |

You can see that arbitrage profit is the same whether the share price moves up or down. Investors who are interested in knowing more about arbitrage should know that arbitrage is theoretically possible even if futures are trading at discounts. In that case, you will have to do the opposite trades i.e. buy futures and sell in the cash market. However, since short-selling has been banned in India by SEBI, such a trade is not possible under current regulations.

Taxation Advantage

Let us assume that Investor A has Rs 20 lakhs in his savings bank account. The bank pays 4% interest on savings bank balance. Investor B invested Rs 20 lakhs in an arbitrage fund. Investor C invested the same in a debt fund. All are in the 30% tax bracket. Let us compare their post tax returns.

| Particulars | Investor A (Savings Bank) | Investor B (Arbitrage Fund) | Investor C (Debt Fund) |

|---|---|---|---|

| Investment | 20,00,000 | 20,00,000 | 20,00,000 |

| Interest rate / Return | 4.0% | 4.0% | 4.0% |

| For investments less than 1 year | |||

| Investment tenure (months) | 6 | 6 | 6 |

| Interest / Profit | 40,000 | 40,000 | 40,000 |

| Exemption u/s 80TTA | 10,000 | - | - |

| Income / STCG Tax | 9,000 | 6,000 | 12,000 |

| For investments more than 1 year | |||

| Investment tenure (months | 13 | 13 | 13 |

| Interest / Profit | 86,667 | 86,667 | 86,667 |

| Exemption u/s 80TTA | 10,000 | - | - |

| Exemption under LTCG | - | 1,00,000 | - |

| Income / LTCG Tax | 23,000 | - | 26,000 |

Why invest in arbitrage funds?

.jpg?sfvrsn=6c6e83f2_2)

Know Risks of investing in Arbitrage Fund

- Arbitrage funds can invest up to 35% of their assets in debt or money market instruments. These instruments may carry credit risks. Check the credit quality of the debt portion of arbitrage funds.

- The returns of arbitrage funds depend on market conditions. In extreme bear markets, futures may trade at a discount to cash prices. Since short selling is not allowed in India, arbitrage is difficult in extremely bearish conditions.

- Since cash and futures positions in arbitrage funds are marked to market, there may be days when the NAVs of these funds can fall. Investors need to sufficiently long investment horizons; at least 1 month for arbitrage funds.

Who should invest in arbitrage funds?

- Investors who want higher returns (compared to savings bank) on their short term funds.

- Investors who want very low risk for their investment.

- Investors in higher tax brackets who want to take advantage of equity taxation.

- Investors who have investment tenures of at least 3 month or longer. Arbitrage funds may not be suitable for just a few days or weeks.

- Investors should consult with their financial advisor if arbitrage funds are suitable for them.

Articles

Arbitrage Funds

Arbitrage Funds are low risk investment options for parking your short term funds instead of keeping it idle in your savings bank account at very low interest rates.

Read MoreVideos

All About Arbitrage Fund

Kya hote hai Arbitrage Funds

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.