Introduction

Exchange Traded funds or simply know as ETFs are a type of Mutual Funds that aims to provide returns similar to the index it is tracking, by investing in the basket of securities which are part of the underlying index. ETFs can be based on indices tracking various asset classes like equity shares (NIFTY 50 ETF), bonds (10 year G-Sec ETF), Gold (Gold ETF), Tri-party Repo (Liquid ETF) etc. It also can be created to provide focused exposure to various sectors like Bank, strategy like Momentum or theme like ESG.

In order to give similar performance, In an ETF the weight of all securities mirrors the weight of the securities in the underlying benchmark index. For example, A NIFTY 50 ETF will invest in 50 stocks which are part of NIFTY 50 index in the same weightages and hence will aim to give you returns similar to the NIFTY 50 index.

As the name implies, Exchange Traded Fund are listed and trades like stock on the stock exchange and hence can be bought and sold at intra-day market levels.

ETFs are called passive funds because the fund manager does not try to outperform the benchmark index but instead tries to mirror its performance.

ETF: Two investment ideas brought together

Exchange Traded Fund (ETF) aims to generate total returns of the underlying index like NIFTY 50 by investing in the index portfolio

ETF Timeline

Source: AMFI Reports, ETFGI , DIAPM and EPFO

Advantages of an ETF

The Exchange Traded Funds (ETFs) are:

- Easy to Transact (Can be bought or sold on exchange)

- Transparent (Replicates the portfolio and return of stated index (subject to tracking error)

- Frugal (Usually Low cost)

ETFs are an investment medium which combine the features of mutual fund & stock investing. On one hand, investors can buy an ETF with an aim to get underlying Index returns at relatively low cost (low expense ratio) and on the other hand they can trade in an ETF like a stock at live NAV, to benefit from intra-day volatility, if desired.

Some of the features of investing through an ETF :

Liquidity- Trades on exchange like stocks throughout the day

- Priced close to Live NAV, hence can be bought and sold intra day at current value

Low Cost

- Usually Lower expense ratio than active equity funds since active fund management is not required

- No exit load

Transparency

- Portfolio is disclosed on a daily basis

- Aims to Replicates the return of the underlying index (subject to tracking error)

Performance

- NIFTY 50 ETFs have outperformed 93% and 81% of large cap mutual funds in the previous 3 year and 5 year period respectively (as on Jun 30, 2020)*

*Source: ACE MF. ETF performance is compared against 28 large cap funds Regular plan (Growth). As on Jun 30, 2020. Investors should read the offer document to know in details about the product. Past performance may or may not sustain in future.

The above is pertaining to performance of the category of Funds and does not in any manner indicate the performance of any individual scheme of any Fund.

Difference between an ETF and Mutual Fund

Exchange Traded Funds (ETFs) are a professionally managed investment instrument like Mutual Funds. Both provide access to securities and asset classes depending on the desired risk return objective of the fund.

---copy.png)

The key differences between ETFs and Active Mutual Fund Scheme are mentioned in the table below.

| Parameter | Exchange Traded Fund | Active Mutual Fund Scheme |

| Trading | Listed and traded on exchange just like stocks | Open ended mutual funds are usually not listed on exchange |

| Transaction Price | Can be bought and sold at live Nav (iNAV), hence investor can use intra-day market movement | Open ended mutual funds are bought and sold only at day closing NAV |

| Returns Objective | Aims to generate returns which are similar to the benchmark Index | Aims to generate returns based on fund managers skill and view & aims to outperform the benchmark Index |

| Portfolio | Replicates the portfolio of the benchmark Index | Portfolio is created based on fund manager view, within the investment objective of the fund |

| Cost | Lower cost since active management of the portfolio is not required Average expense ratio of Nifty 50 ETFs is 0.08%*1 | Active management of portfolio etc. leads to higher cost Average expense ratio of large funds is 2.2% (Regular)*2 |

| Exit Load | No Exit Load | Can have Exit Load |

*Source: ACE MF. *1 Average of 17 NIFTY 50 ETFs. *2 Average of 28 large cap funds Regular plan (Growth). Behaviour of Plain vanilla ETFs and open ended mutual funds are explained in this note. As on Jun 30, 2020.

What is the difference between ETFs and Index Funds?

| Parameter | Index Fund | ETF |

| Track the performance of index? | Yes | Yes |

| Is it traded like stock? | No | Yes, on exchange where it is listed |

| Transaction basis? | NAV (EOD) | around intraday indicative NAV |

| From where can you buy? | AMC | Exchange where it is listed/ AMC |

| Who provides Liquidity? | AMC | Stock Market/Authorize Participants/ AMC (for direct transaction) |

| Portfolio Disclosure? | Once in month | On Daily Basis |

| Intra-Day Trading? | Not Possible | Possible |

| Transaction cost? | Spread across all the investor | Each investor bears his own transaction cost |

How to trade in an ETF?

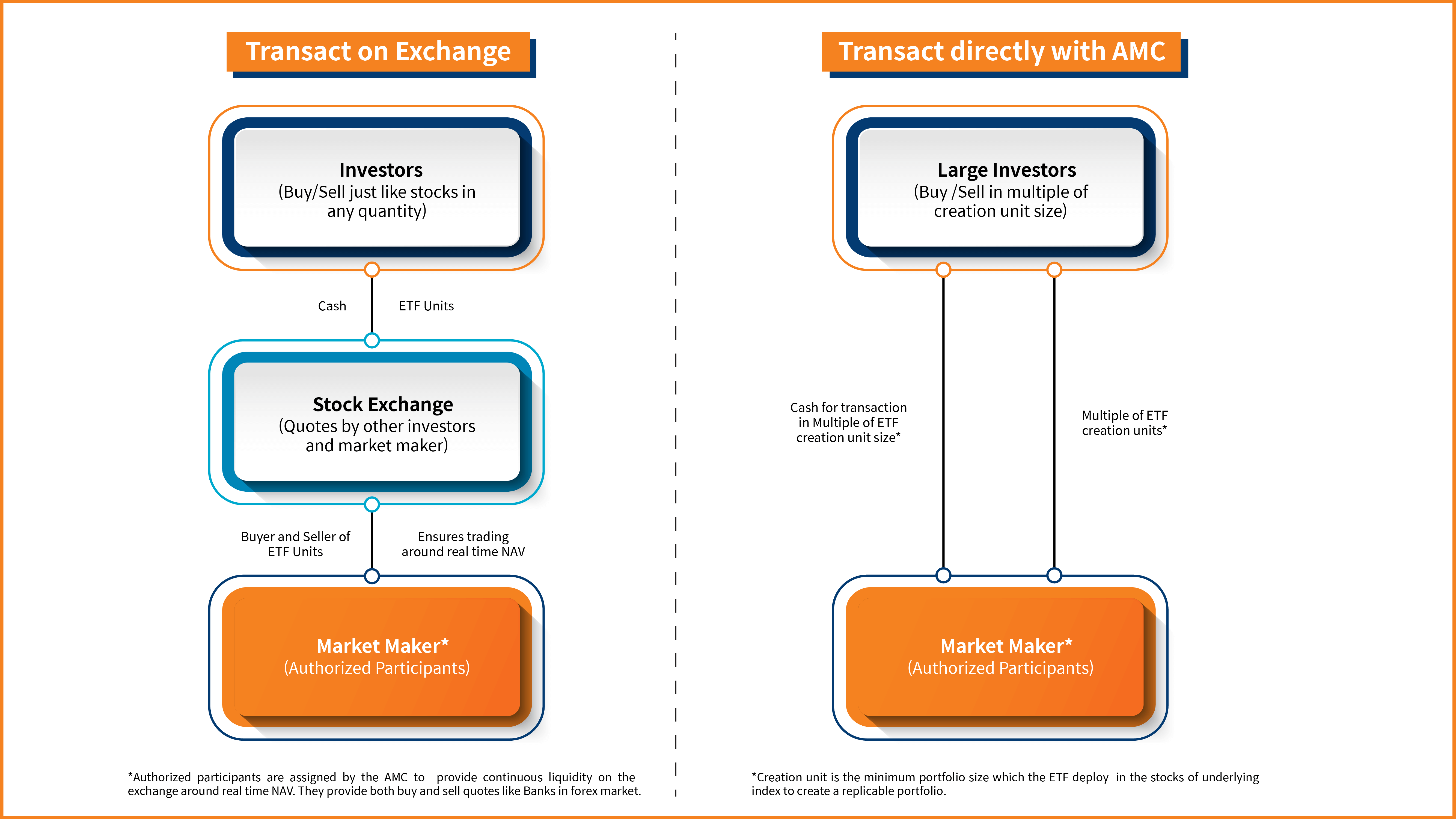

There are two modes of transacting in ETF which happens around intraday indicative net asset value

- On Exchange, just like stocks, in as low as 1 unit

- Directly with the AMC, in larger quantum as specified for an ETF

Articles

Exchange Traded Funds

While awareness about Exchange Traded Funds (ETFs) is quite low in India, these funds are gaining traction amongst investors over the last few years. In the last 5 years, the mutual fund industry assets under management (AUM) in ETFs have grown at a CAGR of more than 100%. In the developed markets, ETFs and index funds are hugely popular with investors. In this article we will discuss about ETFs and whether these funds can be suitable for their investment needs.

Read More

Exchange Traded Fund: Power of Passive Investment

ETFs are types of Mutual Funds that aim to track the performance of a specific index such as NIFTY 50, NIFTY Next 50, NIFTY Bank etc. These ETFs can be based on indices tracking various asset classes like equity shares (NIFTY 50 ETF), bonds (10 year G-Sec ETF), Gold (Gold ETF), Tri-party Repo (Liquid ETF) etc. In an ETF, the weight of all securities mirrors the weight of the securities in the underlying benchmark index. For example, if ABC Bank has a weight of 10.52% in NIFTY 50, a NIFTY 50 ETF will also have ~10.52% of ABC Bank by weight in its portfolio

Read More

ETF Brochure

ETFs are types of Mutual Funds that aim to track the performance of a specific index such as NIFTY 50, NIFTY Next 50, NIFTY Bank etc. These ETFs can be based on indices tracking various asset classes like equity shares (NIFTY 50 ETF), bonds (10 year G-Sec ETF), Gold (Gold ETF), Tri-party Repo (Liquid ETF) etc.

Read More

Build core portfolio around large cap etfs with an aim to beat volatility

The equity markets have taken a severe beating amid the Covid-19 pandemic and concerns about the potential economic damage from the lockdowns. Despite the market volatility, large companies with stable businesses, significant market presence, strong cash flows and steady dividend payouts, among other parameters, continue to fare better. Their stocks have performed better than the broad market and the stocks in the lower market capitalisation.

Read More

Nifty Brochure

Equity, as an asset class, is an attractive investment avenue for investors with high-risk appetite and a long-term investment horizon. Within the equity universe, the safety quotient draws investors to large cap companies and often away from higher returns promised by small and mid-caps.

Read More

Build core portfolio around large cap etfs with an aim to beat volatility

The Covid-19 pandemic delivered a blow to the equity market and the resultant volatility notwithstanding, large companies with stable businesses, significant market presence, strong cash flows and steady dividend payout continue to fare better than others.

Read More

Nifty Brochure

Equity, as an asset class, is an attractive investment avenue for investors with high-risk appetite and a long-term investment horizon. Within the equity universe, the safety quotient draws investors to large cap companies and often away from higher returns promised by small and mid-caps.

Read More

Investing in ETFs - A global trend that is taking India’s fancy

Exchange traded funds (ETFs) have emerged as a global force to reckon with, accounting for ~11% of the global regulated funds industry. Worldwide, the total net assets in ETFs stood at $6.3 trillion as of end-2019, with the world’s largest financial market, the United States (US), alone accounting for ~70% or ~$4.4 trillion of assets.

Read MoreETF Ke Funde

#ETFKeFunde is a unique digital series from Mirae Asset MF for all the investors. We have lined up our best speakers who will be part of this ETF investment training journey. Every week we will bring to you one crisp video by our in-house expert explaining nuisances of ETF investing and hope to give some insightful content though ETF ke funde knowledge series, starting 5th March 2021.

ETF Channel

Exchange Traded Funds Simplified

The Future of Investing | In conversation with Mirae Asset AMC

ETF: The Future of Investing

Investing Mantras: What role can ETF play?

ETF - Aim to take benefit of realtime NAV

ETF - A basket of options

ETF - A low cost option

Videos

FAQ's

How can I Invest in ETF?

You can buy or sell ETF units from the stock exchange through your stock broker in any quantity, just like stocks. Alternatively, a large Investor can buy or sell ETF units directly from the AMC in only creation unit lot size.

Is Demat account required for transacting in ETF ?

Yes, Demat account is mandatory since ETF units are issued and traded in Demat form only.

What is the scheme characteristic of Exchange Traded Funds in India?

ETFs are schemes which try to replicate the return of an Index it is tracking. The fund has to invest minimum 95% of its total assets in securities of the Index that it is tracking.

What happens to dividends?

Dividends received by the Scheme will be reinvested in the scheme. However, the Fund may also decide to distribute dividends to the investors

Does ETF gives you return as per price return index or total return index ?

ETF tracks the performance of the Total return index and hence gives investor both the price and and dividend returns

How are ETFs taxed?

ETFs are taxed like Mutual Funds depending on its asset category. For example, a NIFTY 50 ETF will be taxed like an equity mutual fund.

How is the market price of an ETF determined?

The market price of an ETF is determined by the prices of the securities held by the ETF (indicative net asset value) as well as market supply and demand. The market maker (Authorized Partner) of the ETF, which is appointed by the AMC, provides buy and sell quotes on the exchange to ensure liquidity and keeps the price around indicative net asset value throughout the day.

Why is the market price sometimes different from the net asset value (NAV) of an ETF?

The market price of an ETF is driven in part by supply and demand. Depending on these market forces, the market price may be above or below the NAV of the fund, which is known as a premium or discount.

The materials are a part of Investor Education and Awareness initiative of Mirae Asset Mutual Fund.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance. Click here!