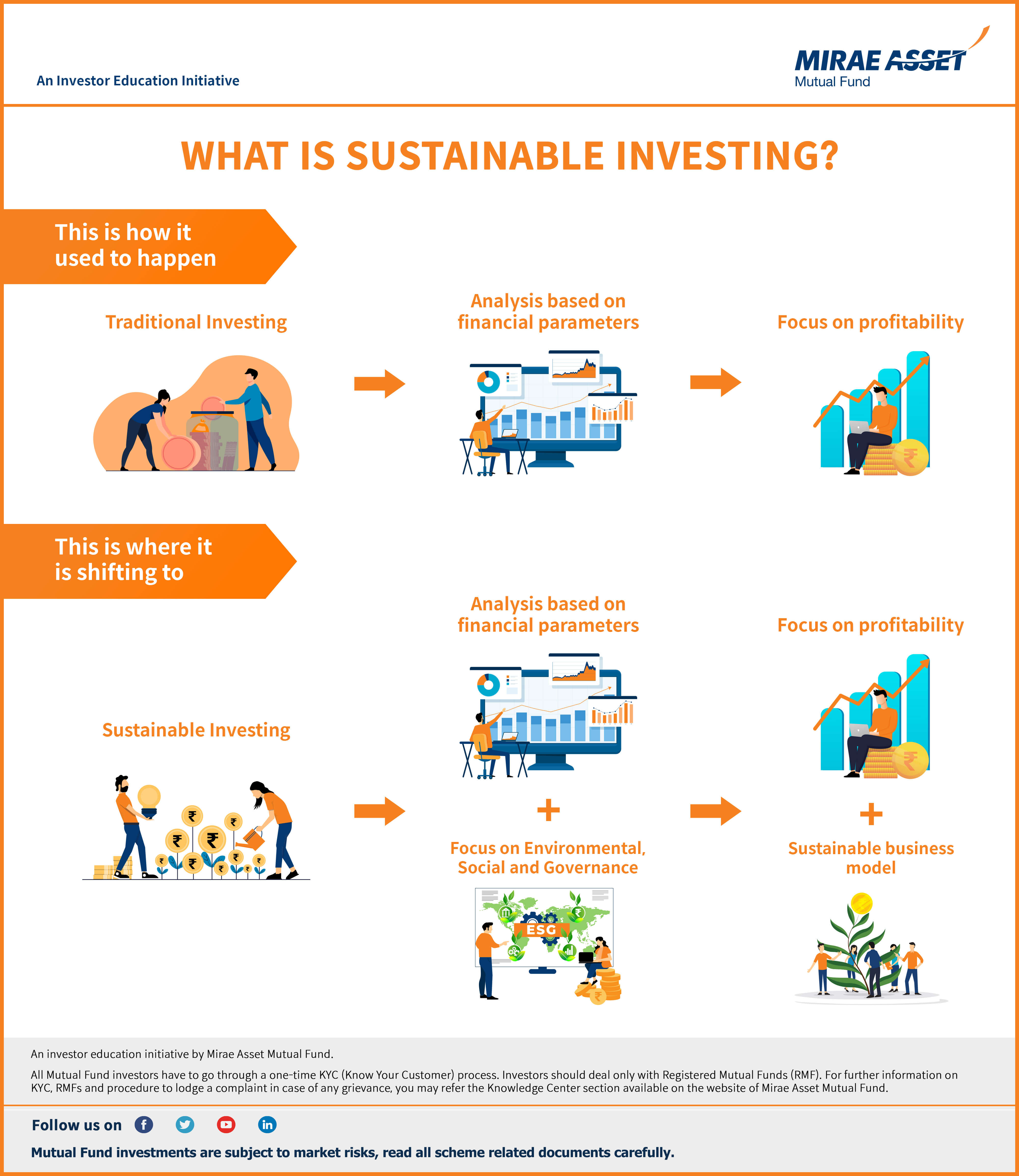

What is Sustainable Investing?

Sustainable Investing is an investment discipline which aims at considering environmental, social and corporate governance (ESG) criteria to generate long-term competitive financial return and positive societal impact (Source: US SIF).

The umbrella of sustainable investing covers Socially Responsible Investing (SRI), Impact Investing and ESG Investing. These terms are often used inter-changeably when discussing about sustainable investment.

History of Sustainable Investing ?

The genesis of sustainable investing can be traced back to Quaker and Methodist community. They refrained from investing in business involved in dealing of alcohol, gambling and tobacco.

First socially responsible mutual fund was launched in the United States known as PAX World Balanced Fund in 1971, which avoided investment in any companies which were profiteering directly or indirectly from Vietnam War.

In 1990 one of the first SRI Indices called Domino 400 social index (currently known as MSCI KLD 400 Social Index) was launched. This would track 400 companies which were in socially responsible business.

In 2004 under the guidance of United Nations paper titled “Who Care Wins” was published. The term ESG was first coined in this paper.

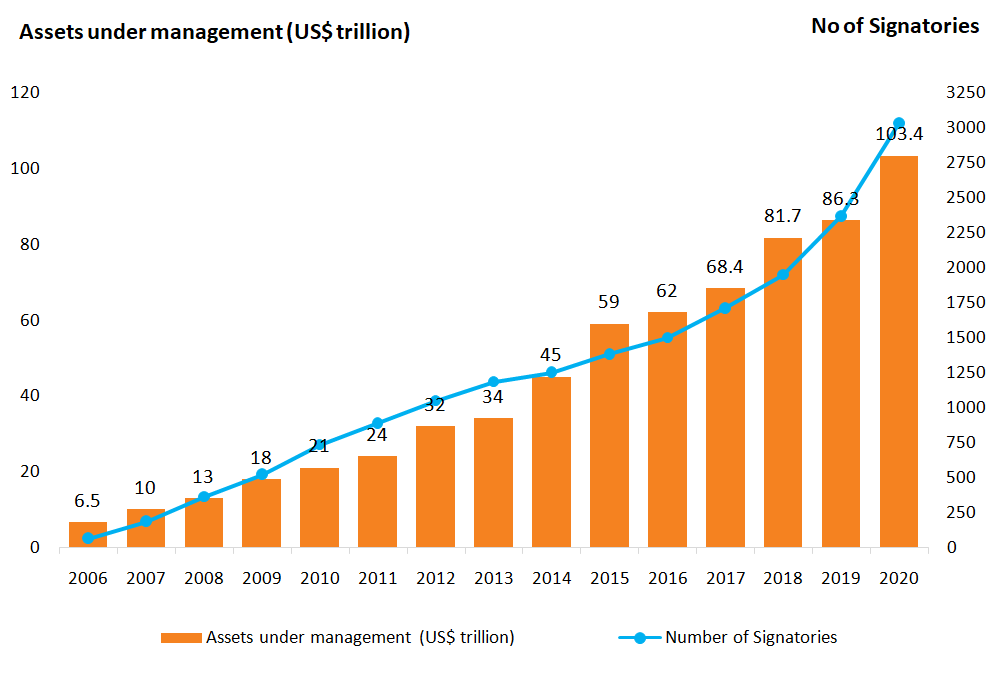

In 2006 Principle for Responsible Investment (PRI) initiative was launched in 2006. The PRI is UN backed largest global network of institutional investors pledging to incorporate ESG into principle of investment.

Source: Morningstar, Bailard Thought Series, United Nations ReportHow big is sustainable investment globally?

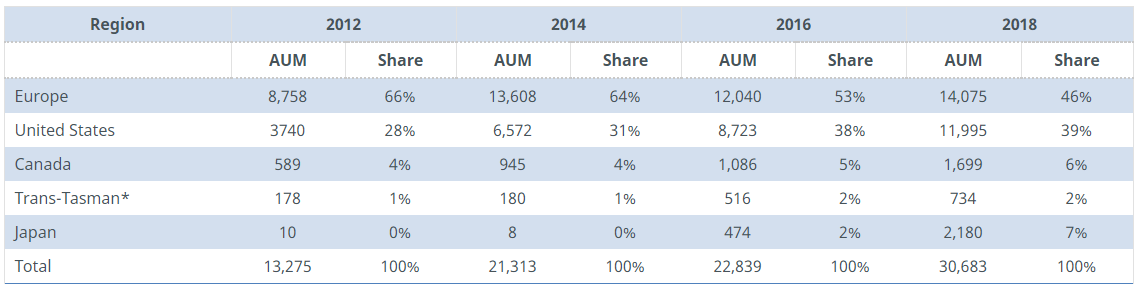

Notwithstanding the fact that one of first socially responsible fund was launched in United States back in 1971, today sustainable investing has its footprint across the globe. Europe leads the flock followed by United States. Five major regions where sustainable investment has grown tremendously are Europe, United States, Japan, Canada and Australia and New Zeeland.

REGION-WISE BREAK UP OF SUSTAINABLE INVESTMENT FROM 2012 – 2018 (IN US $ BILLION)

Source: Global Sustainable Investment Review Reports 2012, 2014, 2016 & 2018 *It includes Australia and New Zealand

Further the AUM under Principles for Responsible Investment has increased from US$6.5 billion in 2006 to US $ 103.4 billion as of March 2020. The number of signatories to the initiative has increased from 63 in 2006 to 3038 in 2020.

Source:PRI

What is ESG Investing?

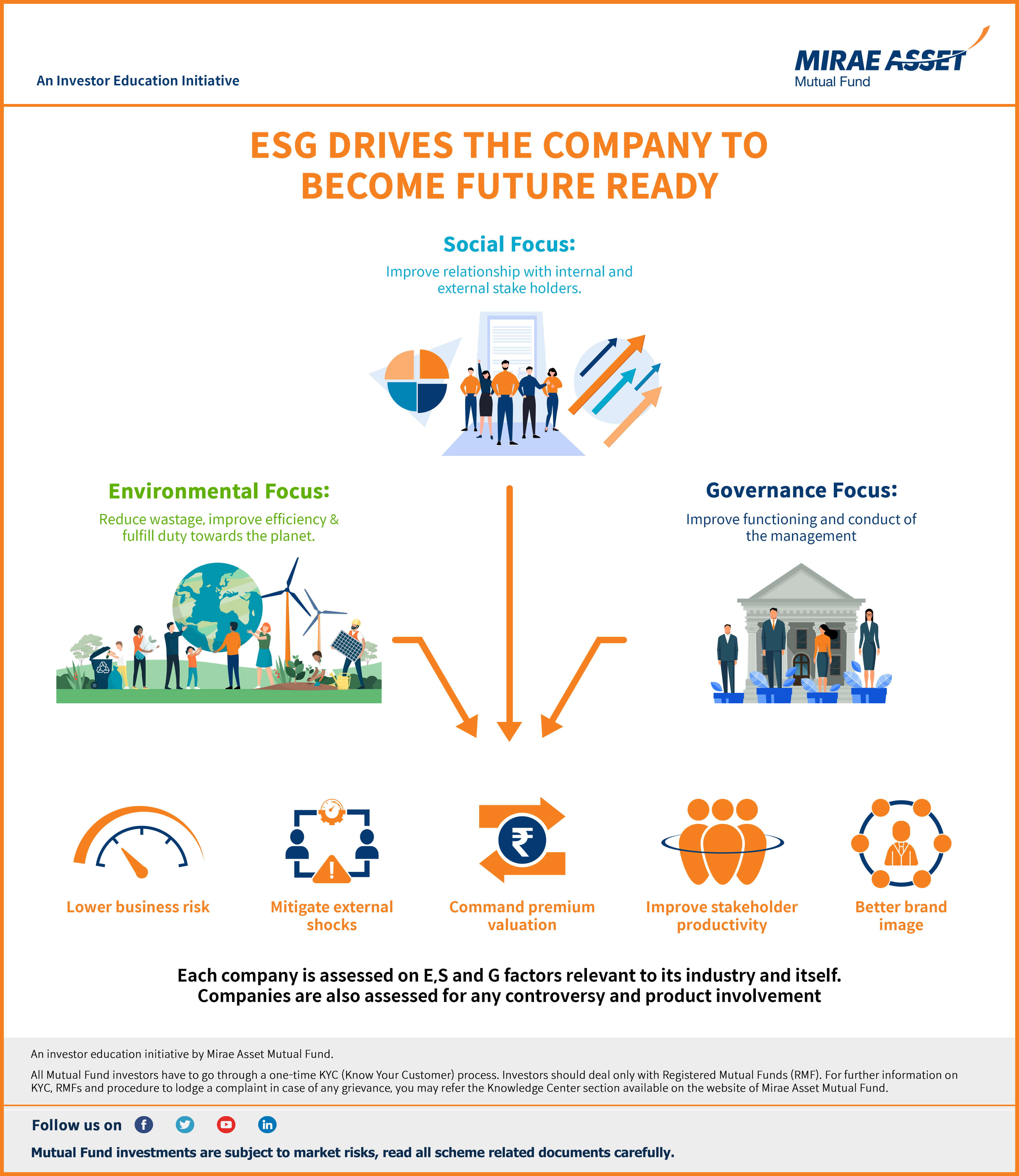

The term ESG however stands for Environment, Social and Corporate Governance (ESG). ESG investing refers to investment method which explicitly incorporates the impact of environment, social and governance on companies process along with other financial parameters while making investment decision.ESG investing provides extra non-financial information that helps in identifying long term sustainability of the business over the years.

Why ESG Investing?

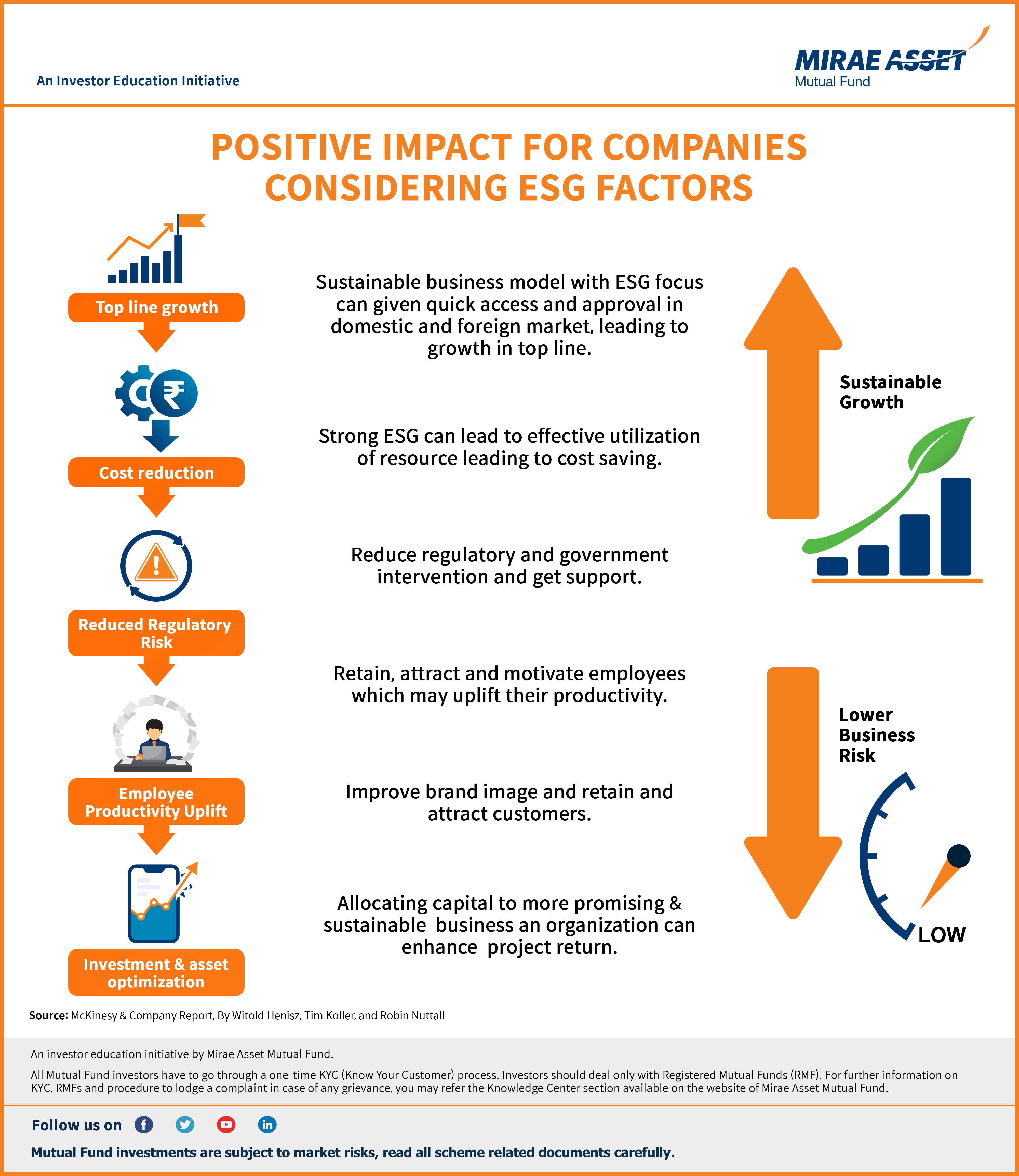

For Companies:

- Sustainable business model with ESG focus can give quick access and approval in domestic and foreign market, leading to growth in top line.

- Strong ESG can lead to effective utilization of resource leading to cost saving.

- Reduce regulatory and government intervention and get support

- Retain, attract and motivate employees which may uplift their productivity.

- Improve brand image and retain and attract customers

- Allocating capital to more promising & sustainable business an organization can enhance project return.

For Shareholders:

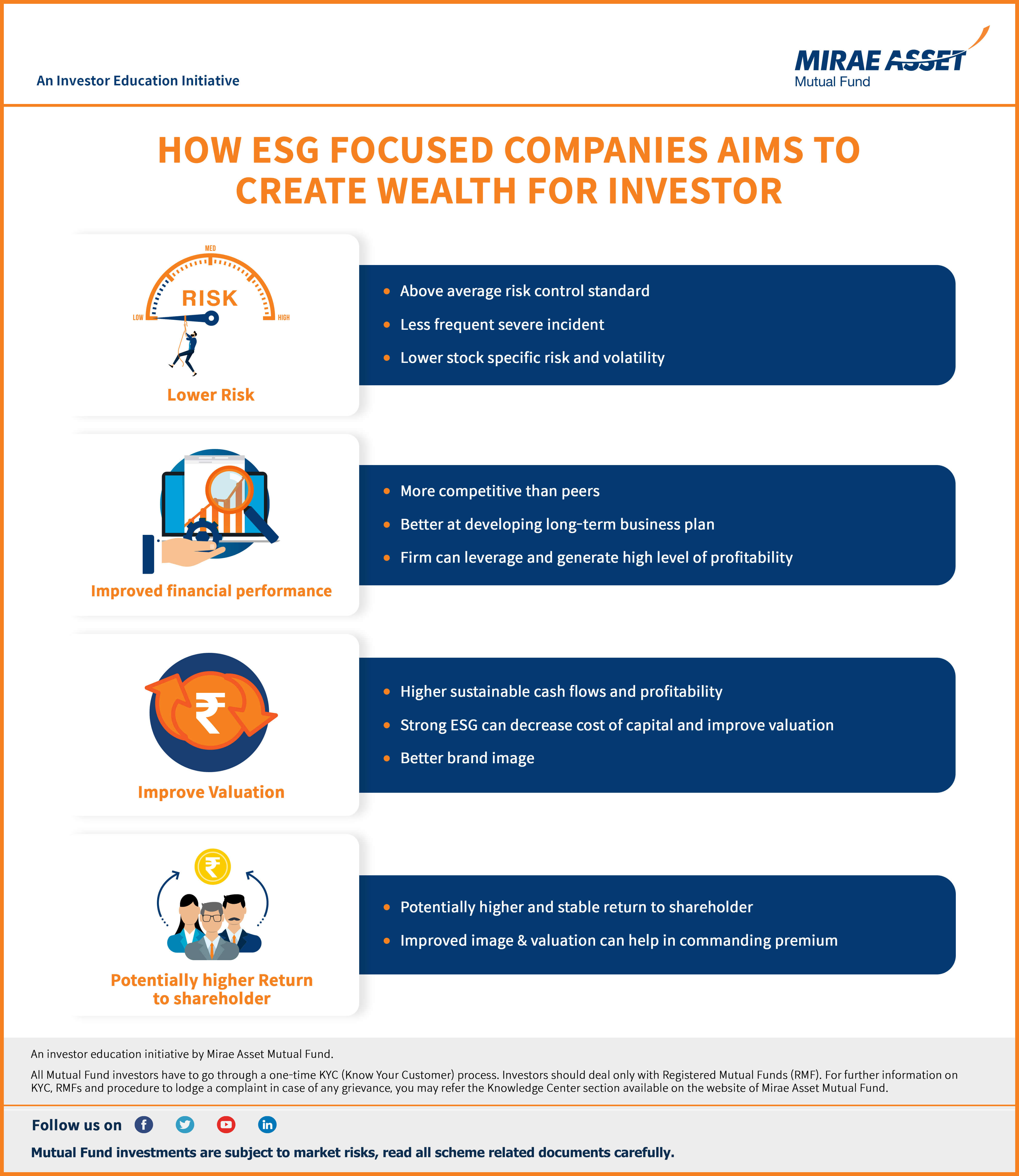

Simply put ESG focused companies have the potential to generate more wealth for stakeholder by :

- Lower Risk : Strong ESG focused companies tend to have an above average risk management mechanism that helps in lowering probability of occurrence of any extreme events.

- Improved financial performance:Strong ESG Integrated into business practice can lead to companies have strong competitive advantage over others which generally translate into higher profitability and higher free cash flow to the companies

- Improved Valuation: Companies with strong ESG integration have shown to command higher/premium valuation, as strong ESG practice leads to lower cost of capital and higher cashflow which in turn translates to higher valuations.

- Higher Return to Shareholder:Shareholder can aim to enjoy higher return on their investment with companies who have strong ESG practices simply because of higher valuation, lower probability of occurrence of extreme event and long-term competitive advantage.

What does Global Study tells ?

As per study conducted by University of Oxford in 2014 under the paper titled “From Stockholder to the stakeholder” found out that:

- 90% of the times sound sustainability standards lower cost of capital

- 88% of the times ESG integration has helped to improve operational performance of the firms

- 80% of the times it was found out that that stock price performance of companies is positively influenced by strong ESG practices

Non-financial factors affecting the sustainable growth of Companies

FAQ's

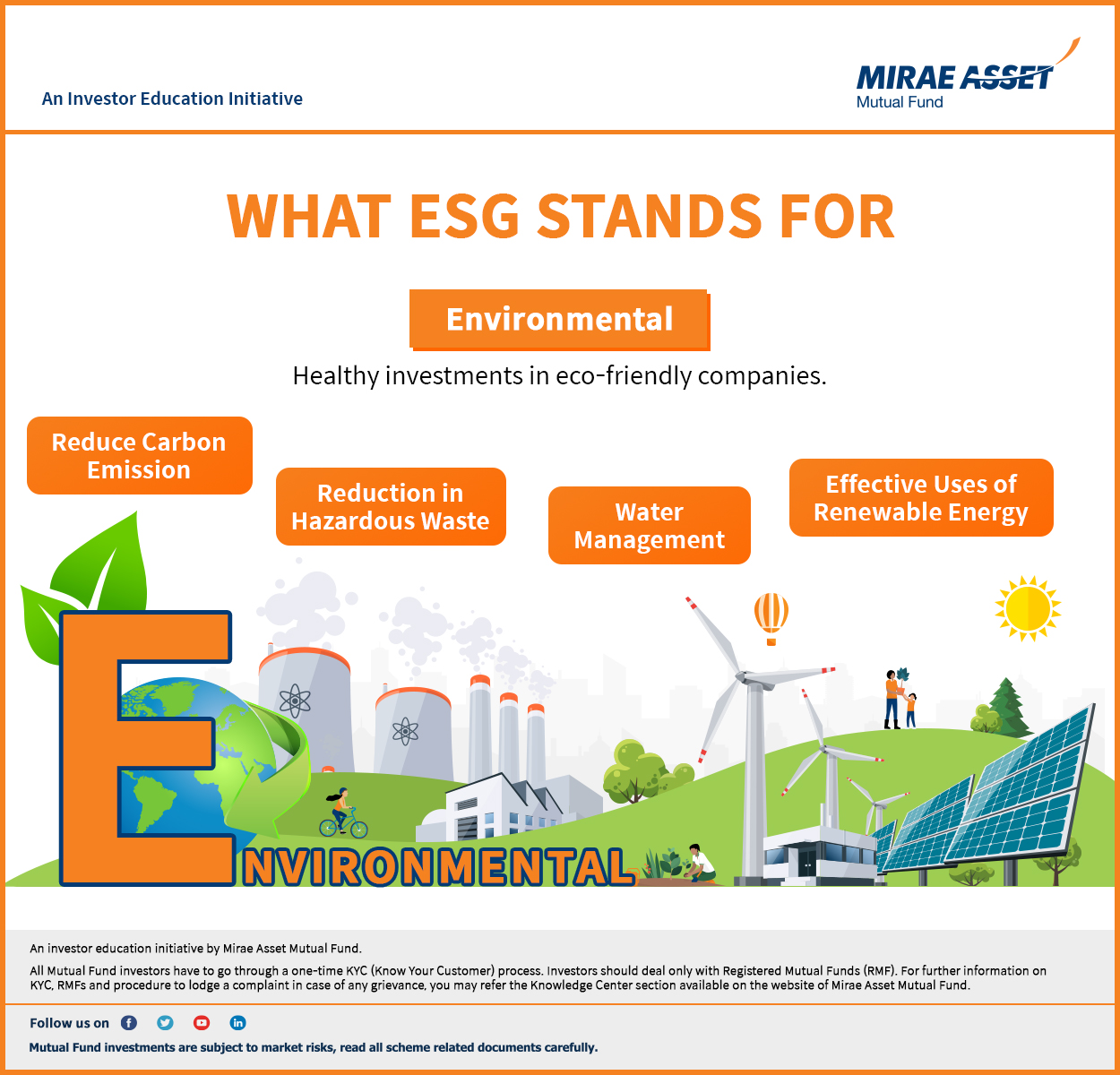

What ESG stands for?

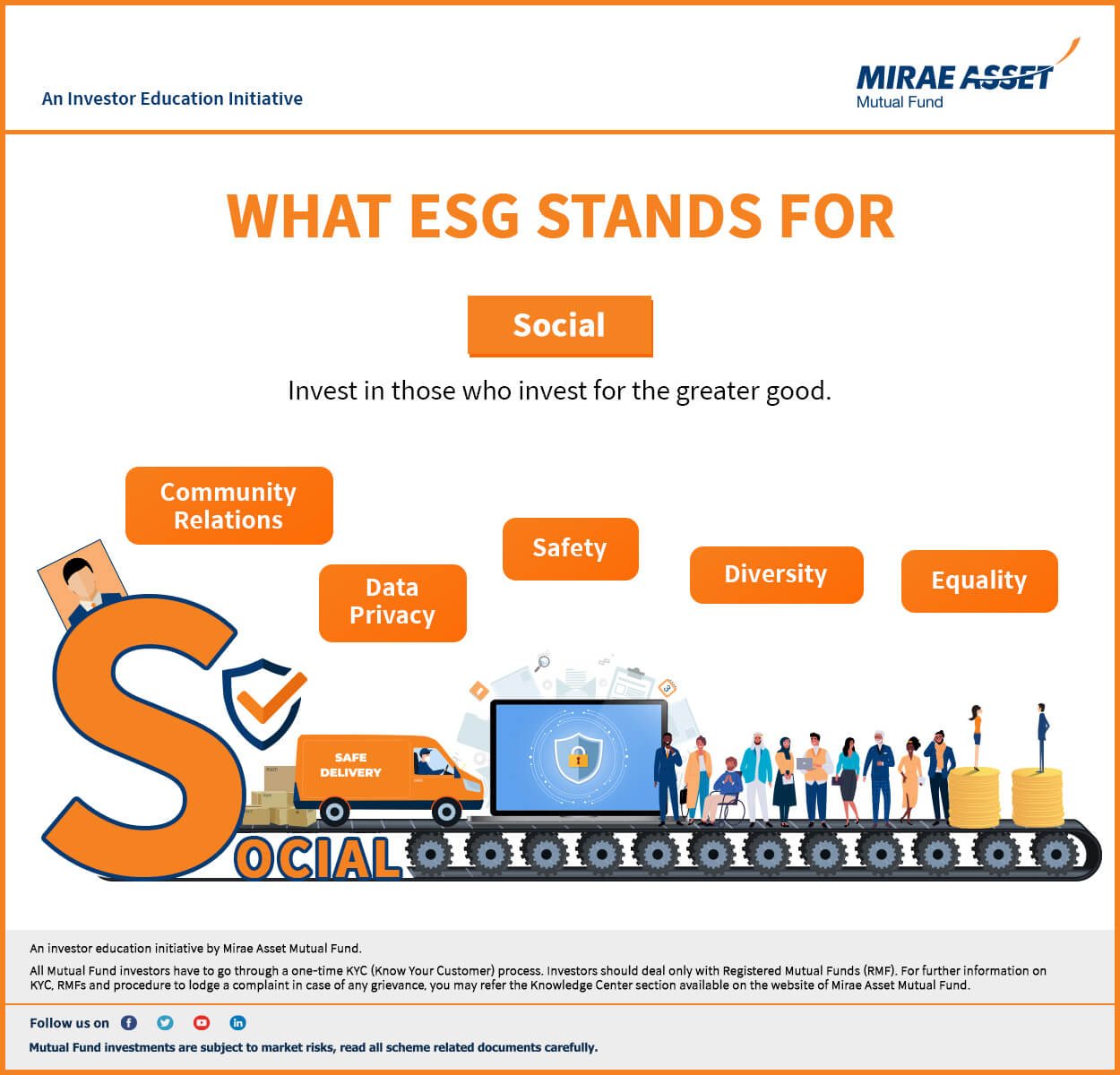

ESG stands for Environmental, Social and Governance. Any company which is doing well today and hopes to sustain the progress in future as well will mostly be compliant with ESG. There is also growing evidence that suggests that if ESG factors are integrated into portfolio construction and investment analysis, it may offer investors potential long-term superior performance.

Breaking down ESG – What are E, S and G individually stands for?

E stands for the Environment. As world is getting more conscious about pollution control and climate change, the companies following this will be less likely to be impacted compared to those companies which do not regard this aspect. Some of the E factors are supply chain efficiency, recycling and waste management etc.

S stands for Social which includes the social responsibility that the responsible companies are adhering to. This includes CSR initiatives, human rights, consumer protection, employee well-being and their safety measures and working towards work life balance etc. Obviously, the companies which are socially responsible are more appreciated by their employees, Government and other stake holders.

G stands for Governance. Governance risks concern the way companies are run. It addresses areas such as corporate brand independence, increasing diversity and accountability of the board, protecting shareholders interest and their rights. Also, when it comes to financial disclosures, it needs to be checked if the board upholds the highest standards of corporate governance consistently and remain unaffected by any regulatory changes etc.

Why is ESG theme gaining popularity with investors?

- Global sustainability challenges such as flood risk, ozone layer depletion, rising sea water levels, extreme weather, forest wildfires, clean water crises etc. are new risk factors for companies and investors that may not have been seen before.

- There are other changing dynamics like changing demography (ageing global population), data privacy and security related matters with explosive growth in IT, changing regulations, demand for tax transparency etc. result in companies facing complexities that they not had to deal with before.

- Explosive growth in social media over the past decade has also raised general awareness about environmental issues, social issues, consumer, employee and shareholder rights. Weak proposition on various ESG factors can cause damage to a company’s brand through social media networks.

- Institutional investors are increasingly integrating ESG principles in their investing mandates.

- With improvement in IT, companies are collecting reliable and better quality data about different ESG parameters. With advancements made in the field of analytics, there is high quality ESG Research available to investors.

How does ESG may produce favourable results for investors?

- Enhancing returns: Several studies have suggested that integrating ESG in investments has a positive effect on returns. According to MSCI, higher ESG rated companies tend to produce higher sustainable free cash flows and better returns than lower ESG rated companies. ESG rated companies are better managed and are able to generate superior operating margins and net profits.

- Lower idiosyncratic risks: Idiosyncratic risk refers to the inherent factors that can negatively impact individual securities or a very specific group of assets. According to MSCI, high ESG rated companies have lesser idiosyncratic risks compared to low ESG rated companies. Companies have seen their revenues and profits decline after pollution spills, accident in factories, weather related supply chain disruptions, products which have harmful chemicals etc. Higher idiosyncratic risks will result in bigger drawdowns.

- Lower systematic risks: According to MSCI, high ESG rated stock have lower earnings volatilities and lower betas than low ESG rated stocks. Therefore, in adverse market conditions, high ESG rated stocks tend to be less volatile than low ESG rated stocks.

- Possibility of superior return on capital employed: ESG companies are able to deploy their capital more efficiently in the long term and are less likely to have asset write-downs compared to companies with weak ESG propositions. Therefore, high ESG rated companies / stocks can deliver superior return on capital employed.

Why ESG investing matters in India?

- Industrial operations are increasingly being impacted by extreme weather, natural disasters, reputation risk and relationships with key stakeholders.

- Avoiding companies with ESG issues helps to avoid risks associated with environment, social and governance related concerns

- Corporate Governance is also coming increasingly under lens after the judicial proceedings and court rulings against the promoters and board of directors of number of companies ranging from real estate, media to NBFC and banks. It directly affects the share prices and investor returns

- Evolving regulations will help companies with strong ESG propositions

- ESG compliant companies will be able to attract more FII investments (both debt and equity)

- High ESG rated companies can also deliver superior risk adjusted returns and may create alphas for investors.

The materials are a part of Investor Education and Awareness initiative of Mirae Asset Mutual Fund.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance. Click here!

.png)