What are Multicap Funds?

Multi cap funds are diversified equity mutual funds which invest across various market cap segments i.e. large cap, midcap and small cap stocks. Multi cap mutual fund schemes are one the most diversified among all equity fund categories as they are not only diversified across industries and sectors, but also across the various market cap segments.

What are different market cap segments?

As per SEBI classification, the largest 100 publicly listed companies in India by full market capitalization are classified as large cap companies, 101st to 250th publicly listed companies in India by full market capitalization are midcap companies and 251st onward publicly listed companies in India by full market capitalization are classified as small cap companies.

As per SEBI guideline, a Multi cap fund is required to invest at least 75% of its total assets in equity and equity related instruments at any point in time. And also, the portfolio must allocate at least 25% each in large cap, mid cap and small cap stocks, out of the total assets and 10% in Units issued by REITs and InvITs.

A Multi cap fund can provide diversification by investing across all these 3 market segments.

What are the benefits of Multi cap Funds?

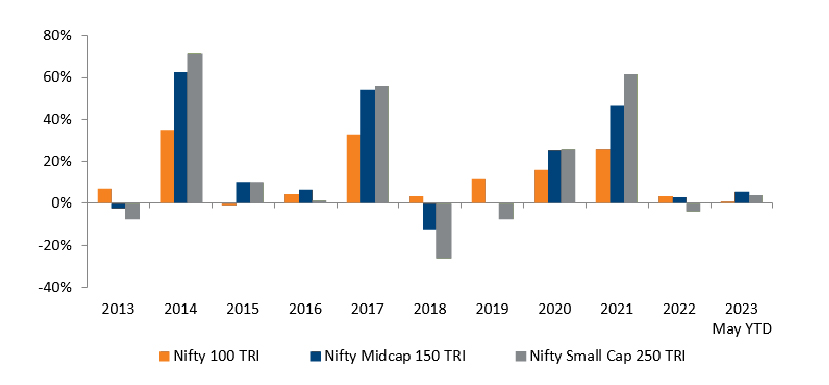

- As different segments of the market outperform each other in different market cycles, the investment in multi cap funds may be a good option for long term wealth creation. But it can be very risky in the short term since the fund has at least 50% exposure to mid and small cap stocks. However, the allocation to large cap stocks (minimum 25%) of these funds could provide lesser volatility when are markets are uncertain when the markets are volatile. From the chart below, you can see how each segment performed annually over the last 10 years.

- Multi cap mutual fund schemes provide exposure to a larger number of sectors compared to large cap mutual funds. This is because there are many sectors where large cap companies do not have any presence. For example, sectors like automobile ancillaries, specialty chemicals, textiles, media and entertainment etc. are high demand sectors but large cap companies do not have any presence in these sectors. These sectors, which also have high export driven growth potential are dominated by midcap companies. Therefore, to get exposure to these sectors, investors may invest in Multicap funds.

- Flexi Cap has higher liquidity over mid and small cap funds: The percentage of free floating shares of mid and small cap companies is much lesser compared to large cap stocks since these companies usually have high percentage of promoter holding.

- Multi cap funds can have 50 – 75% of their portfolio exposure to midcap and small cap stocks. While midcap and small cap stocks are riskier than large cap stocks, they have the potential to outperform large cap fund in the long term. Please refer the table below -

- Multi cap fund managers have the flexibility to change portfolio allocations to different market cap segments based on market conditions, subject to SEBI mandated minimum allocation limits of 25% for each market segment. Therefore, a multi cap fund manager can take advantage of market opportunities for the benefit of investors.

Source: National Stock Exchange, Advisorkhoj Research as on May 31,2023. Large cap segment is represented by Nifty 100 TRI, midcap by Nifty Midcap 150 TRI and small cap by Nifty Small Cap 250 TRI. Disclaimer: Past performance may or may not be sustained in the future

| Market Segment | Market Benchmark | Last 3 years* | Last 5 years* | Last 10 years* |

|---|---|---|---|---|

| Large Cap | Nifty 100 TRI | 22.69% | 12.29% | 14.27% |

| Midcap | Nifty Midcap 150 TRI | 34.06% | 16.08% | 20.27% |

| Small Cap | Nifty Small Cap 250 TRI | 37.74% | 12.98% | 18.46% |

What Multi cap funds are different from Flexi cap funds?

- While Multi cap funds must invest minimum 25% in each of the 3 market segments, e.g. large cap, mid cap and small cap, there is no minimum or maximum limit for flexi cap funds with respect to any market cap segment.

- A Multi cap fund will always have minimum 50% exposure to mid and small cap stocks all the time, thus these funds have the potential of giving better returns in the long term compared to large caps but they are high risky, but it may see greater drawdowns when the markets are volatile. This is not applicable to flexi cap funds as the fund manager can decide the allocation between the segments, basis his outlook of the market situation.

- Multi cap funds are true to label in terms of providing exposure to different market cap segments, which is not the case for flexi cap funds.

Taxation of Multi cap funds

Capital gain tax is applicable when you redeem the units and make profits. The rate of capital gain tax varies on the period for which the units were held before redemption.

Short term capital gains – Tax rate is 15% if the holding period is less than 12 months.

Long term capital gains - If the holding period is more than 12 months, then long term capital gains tax applies. Long term capital gains up to Rs 1 Lakh in a financial year is tax free, and thereafter, the tax rate is 10% without indexation.

Who should invest in Multicap Funds?

- Investors looking for wealth creation with high risk appetite for meeting their long-term investment goals may invest in multi cap funds.

- Investors who have not experienced investing in mid and small cap funds directly, may get exposure to these segments by investing in multi cap funds.

- Investors who have long term investment horizons of minimum 5 years and more, may invest in multi cap mutual funds.

- Investors who have high risk taking appetite for investing in mutual funds.

- Investors looking to invest in equity funds through systematic investment plans (SIP) may invest in Multi cap funds, since these schemes are more volatile than large cap funds. Investors may get benefitted by volatility through rupee cost averaging.

- Investors who have lumpsum funds in hand, but are worried about near term market volatility, may also invest in multi cap funds through systematic transfer plan (STP) route, by parking the lumpsum fund in a low volatility fund (e.g. liquid funds, overnight funds or ultra short term funds) and transferring a fixed amount to multi cap funds at a certain frequency, say weekly, fortnightly or monthly.

- Investors should always invest according to their risk-taking appetite and investment needs. They must clearly understand the risk profile of a scheme before investing, and if required, should consult their mutual fund distributor or a financial advisor, to know if they can invest in multi cap mutual funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.