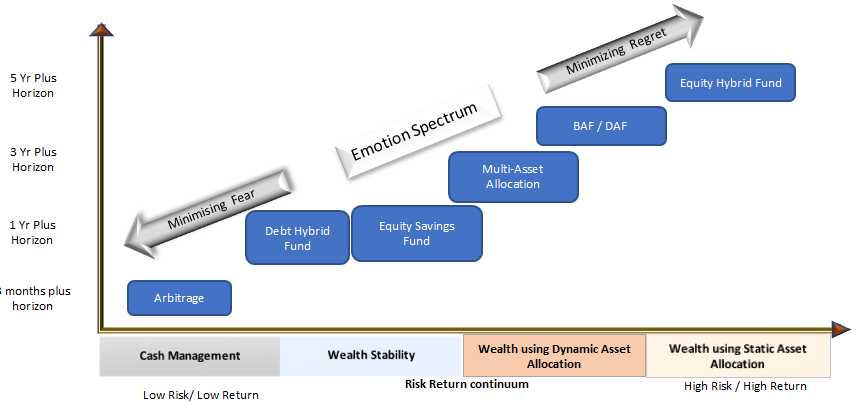

In last module we saw how emotions impact our choices. In this article we shall see how by using Hybrid Funds, an investor may find their

place on the emotion continuum and may make still rational decision. That is: from a point where you are willing to assume fear (in hope of a better future) to a point where you want to minimize fear. This calibration of investment experience

is managed by tuning the equity allocation in the portfolio. Therefore, each investor has to ask, as to how much participation in equities would they want. *respective Indices taken to represent the

respective product category.

Source: Amfiindia.com Data as on 28th Feb 2022. Performance is based on mandated Indices to represent the respective product category. The risk spectrum shown above is for broadly explaining the risk spectrum of Mutual fund schemes under Hybrid category. The actual risk of the schemes of Hybrid categories mentioned above may or may not be in line with the risk curve shown above.

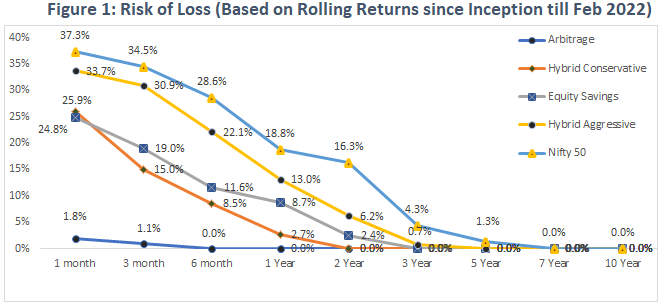

The cost of minimizing regret (high future performance) is risk of loss in short term (refer Fig:1). Take example of an arbitrage investor. This investor has almost no capital loss after 3 months. But the Hybrid-aggressive / Nifty 50 fund

investor will see loss in the same time one-out-of-three times. The below table makes this more evident. The risk of loss declines as time horizon expands. By 3-5 year the risk of loss in most hybrid funds may usually be either nil or

very low.

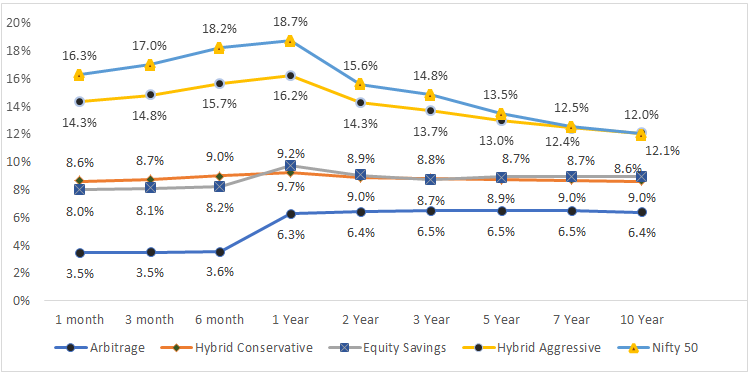

Thus, the choice is to either minimize fear or to minimize regret in short term. The below chart (refer Fig :2) is the average return each product segment provides over a period of time. One can notice that low fear products remain high on

long term regret. While high short-term fear products have high regret in the future.

Figure 2: Average Rolling Return in Hybrids (Since Inception till Feb 2022)

Source: Amfiindia.com Data as on 28th Feb 2022. Performance is based on mandated Indices to represent the respective product category. The return spectrum shown above is for broadly explaining the return spectrum of Mutual fund schemes under Hybrid category. The actual return of the schemes of Hybrid categories mentioned above may or may not be in line with the return curve shown above.

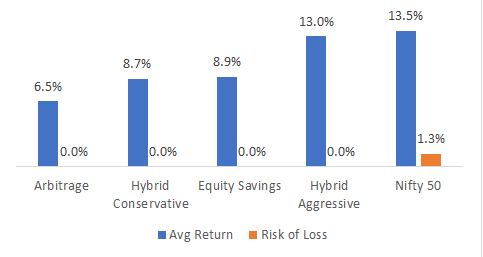

Figure 3: Risk Return Profile on 5 Year Horizon

Take arbitrage for example. It’s a low fear-high regret product. This risk of loss is low to nil from 3 month onwards. But the return remains largely in the low range of around 5-6% no matter the extent of horizon.

On other hand, Aggressive hybrid fund is a high fear – low regret product. As the investment time horizon increases in this product, the risk of loss continues to decline and becomes nil by around 5-6 year. So if you are a long term investor and you are not in this product (or in high equity product), your regret may be higher.

Figure 4: Emotion Tradeoff on Time Scale

The risk-return spectrum shown above is for broadly explaining the risk-return spectrum of Mutual fund schemes under Hybrid category. The actual risk-return of the schemes of Hybrid categories mentioned above may or may not be in line with the risk-return curve shown above.

Take an example of an investor who has an investment horizon of 5 years(refer Fig :3). For such an investor the risk of loss is nil in almost all hybrid equity products. But then are all the choices same here? In this case, the investor aim

must be to minimize regret. One look at the chart and we know what the obvious choice is. This is what one can also call as sweet spot (in timescale) for the product category.

For low equity exposure products, the sweet spot is lower. Say for equity arbitrage, it’s around 3 months plus time horizon. Likewise, for Hybrid conservative and equity savings products, the ideal time horizon is 1 year plus.

Balanced Advantage Fund: Can I Have Both?

The unknown variable in this pack is the Dynamic Asset Allocation / Balanced Advantage Fund (BAF) product segment. This is a relatively new product category vis-à-vis others. The benchmark for this product category also does not fully represents

this product. That’s because the asset allocation in the funds tends to be dynamic. While the benchmark has static allocation.

Each product in this segment has different methods to manage the allocation. But the underlying principle is same: to time the market cycles.

The features of the BAF segment indicate that this product class occupies the risk-return space between Equity Savings and Aggressive Hybrid asset class. Ergo, the investor in this class either wants to upgrade on the risk-return profile of

the Equity savings category. Or, that the investor wants to reduce the risk experience observed in the Hybrid aggressive category. We believe that the investor here requires robust down-side protection while still wanting an optimal participation

in equities.

Conclusion

It’s clear that there is no one product category that delivers for all requirements. The tradeoff is between short term fears and long-term regret.

The investor will have to make a clear choice based on the time horizon he/she has, the risk appetite and the desire for higher performance. Having said that, there does emerge a rule of thumb from this. The rule is the ‘lower the time horizon: lower the equity allocation’ and ‘higher the time horizon, the higher the equity allocation’. It’s a cliché, but it’s the truth. The long and short of it is: Aim for investing through Systematic Investment Plan (SIP) for the long term in high risk products;

Park cash for the short term; and may use conservative hybrids to generate inflation adjusted Systematic Withdrawal Plan (SWP) from medium term onwards.

Disclaimers & Note:

Nifty & Crisil Index benchmarks for the respective products have been used to represent the performance profile of each product category.

Risk of Loss data chart implies the percentage negative performance for the rolling returns observed for the respective indices in the given period. The loss is estimated using respective annualized rolling return period on daily basis

since 2002.

(The Scheme categorisation is as per SEBI Categorisation circular dated October 06, 2017. The risk spectrum shown above is for broadly explaining the risk spectrum of Mutual fund schemes under Hybrid category. The actual risk of the schemes

of Hybrid categories mentioned above may or may not be in line with the risk curve shown above)

Data source : ACEMF and amfiindia.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure

to lodge a complaint in case of any grievance Click Here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Please consult your financial advisor or mutual fund distributor before investing

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada