Banking and Financial Services Sector Funds

The banking sector is the lifeblood of an economy. People deposit their money in banks and banks provide credit to businesses. With bank financing, companies setup factories, grow their capacities and businesses. Banks also provide

the payment ecosystem needed by people to carry out their day to day financial transactions. A strong and well functioning banking system is essential for economic growth of any country.

Read More

The banking system in India is fairly well developed. We have 12 public sector banks and 21 private sector banks (source RBI). In addition, we have thousands of urban and rural co-operative banks. In 2021 (as on 31st March 2021), we also have 46 foreign banks with operations in India. The Government has implemented several reforms in the banking sector ever since the Indian economy was liberalized in 1991. Over the past 7 years, the Government has enacted a number of reforms for public sector banks including mergers, recapitalization, recognition of NPAs and recoveries.

The financial services sector is much broader than purely the banking sector. The financial services sector encompasses among others non banking finance companies including term lending institutions, NBFCs, housing finance, commercial vehicle financing, leasing and hire purchase, etc. It also includes life insurance, general insurance and asset management companies. Out of the 20 companies comprising the Nifty Financial Services Index, just 5 are banks and only one PSU bank. The rest of the index constituents are from the non banking sectors in financial services. Several of the index constituents went public only in the last couple of years.

What banking and financial services sector funds invest in?

Banking and financial services sector funds invest primarily in equity and equity related securities of banks and financial services companies. Some banking sector funds may invest only in bank stocks and among these schemes, some may invest only in private bank stocks. However, most banking and financial services sector funds invest in banks as well as non-bank financial services companies. You should read the scheme information document very carefully or consult with your financial advisor to know which type of stocks your banking and financial services sector fund invests in.

Performance of the banking and financial services sector

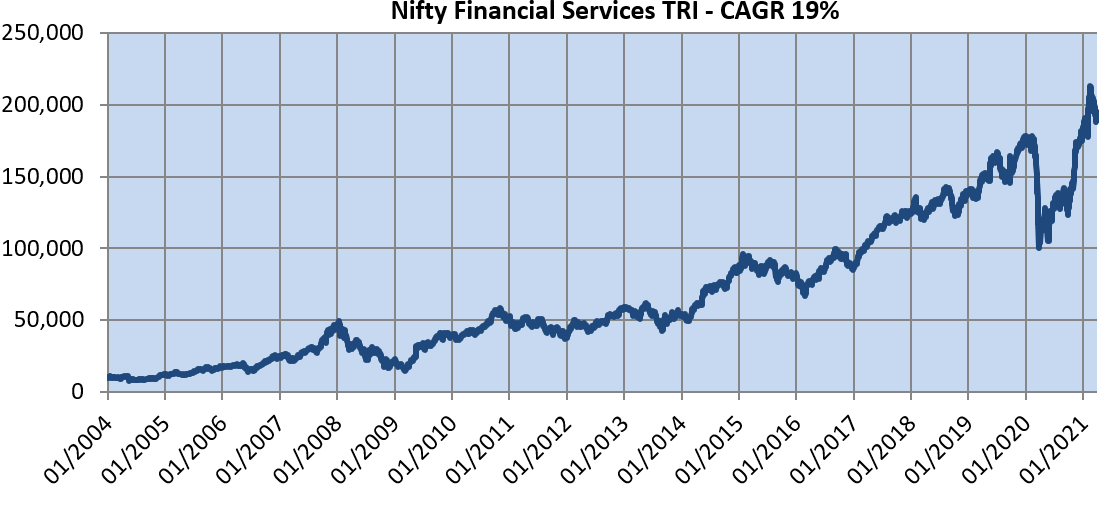

The chart below shows the growth Rs 10,000 invested in Nifty Financial Services Total Returns Index (TRI) from April 2004 to 31st March 2021.

Why invest in banking and financial services sector?

We are seeing consolidations in the banking sector; we may see even more consolidations in both banking and NBFC spaces in the future. Non lending financial institutions e.g. insurance, asset management companies will see impressive growth in the medium to long term. The Pradhan Mantri Jan Dhan Yojana aimed at providing financial inclusion to all Indians has brought 41 crore Indians under the banking system. The Government has made a major thrust for digitization of payments through the Jan Dhan, Aadhaar and Mobile (JAM) trinity. The long term outlook of the sector is positive on the back of the Government reforms and long term growth potential on the Indian economy.

Who should invest in banking and financial services sector funds?

- Investors who are looking for long term capital appreciation by investing in the banking and financial services theme.

- Investors with high to very high risk appetites.

- Investors with minimum 5 years of investment horizon

- Investors should read the scheme information document carefully and / or consult with their financial advisors before investing.