Banking and PSU debt funds

One of the most important considerations in fixed income investments is credit risk. Interest rate risk can cause NAV fluctuations in debt mutual funds due to change in interest rates, but this risk is temporary in nature because interest rates move in cycles. Interest rate risk reduces over long investment horizons as loss made in periods of rising interest rates can be recovered in subsequent periods of falling rates. Credit risk, on the other hand, can cause permanent loss to your investment. If a bond defaults on its interest or principal payments, then there is a chance that you may not recover your capital. Therefore, you should always take credit risk of a debt fund into consideration when making fixed income investments.

Which debt securities have low credit risk?

Sovereign debt securities issued by the Central Government (Government Securities or G-Secs) or State Governments (State Development Loans or SDLs) have no credit risk because they have sovereign guarantee (i.e. interest and principal payments are guaranteed by the Government). Collaterized Borrowing and Lending Obligations (CBLOs) also have very low credit risks because these securities need to have G-Secs as collateral. However, CBLOs are meant for very short term investments viz. overnight, few days, few weeks etc. since the yields are very low.

Next in the pecking order of credit risk are the highest rated corporate bonds or commercial papers (e.g. AAA, A1 rated securities). However, investors should understand that the credit rating of bond / non-convertible debenture (NCD) or commercial paper can change; an AAA rated bond can get downgraded. If a bond gets downgraded, its price will fall. Within the AAA/A1 rated papers, some type of securities may have lower chance of downgrade or default. In this article, we will discuss about banking and PSU funds, which invest in securities of fundamentally high credit quality.

What are Banking and PSU funds?

Banking and PSU Funds are debt mutual fund schemes which invest in debt and money market instruments issued by banks, public sector undertaking (PSU) and public financial institutions (PFI). As per SEBI’s mutual fund classification guidelines, Banking and PSU Funds must invest at least 80% of their assets in instruments issued by such institutions. These funds are considered to have superior credit quality compared to several other debt fund categories.

Why do these funds have high credit quality?

Debt and money market instruments issued by Banks, PSUs and PFI are usually of high credit quality. PSUs are Government owned entities - Government is the majority shareholder in these entities. PSUs enjoy quasi sovereign status due to Government backing. Investors should know that debt or money market instruments with Sovereign status have no credit risks. Since PSUs enjoy quasi Sovereign status, their credit risk is very low. PFIs are also Government entities – they can be owned either by the Central Government or the State Governments. Like PSUs, PFI also enjoy quasi sovereign status.

Banks (both public sector and private sector) enjoy high credit rating because they are regulated entities and are usually adequately capitalized. Most banks enjoy high credit ratings. It is important for investors to know that Banking and PSU funds will not invest in Non Banking Financial Companies (NBFCs) which may have varying credit ratings. The credit quality of Banking and PSU funds, by the nature of the issuers of the underlying securities viz. PSU, PSI and Bank corporate bonds, is very high.

Investment strategy of Banking and PSU funds

There is no duration restriction on part of SEBI for Banking and PSU funds as long as the issuers of the underlying instruments are Banks, PSUs and PFIs. The fund manager has the flexibility to take duration calls. Usually, Banking and PSU fund managers will invest in short to medium duration instruments with an accrual strategy (hold to maturity), but from time to time, they can also invest in longer duration instruments if they have a favourable outlook on interest rates.

Investors should understand that duration is the interest rate sensitivity of a fixed income security. Bond prices have an inverse relationship with interest rates – bond prices fall when interest rates go up and vice versa. Longer duration bonds will see more of an adverse impact on prices due to unfavourable interest movement compared to shorter duration bonds. As such, longer duration debt funds tend to be more volatile than shorter duration funds. Different banking and PSU funds may have different durations. Investors should check the duration profile of the scheme portfolio (from the monthly fund factsheet available on the AMC websites) and make sure that they are comfortable with the interest rate risk profile of these funds. You should consult with a financial advisor if required.

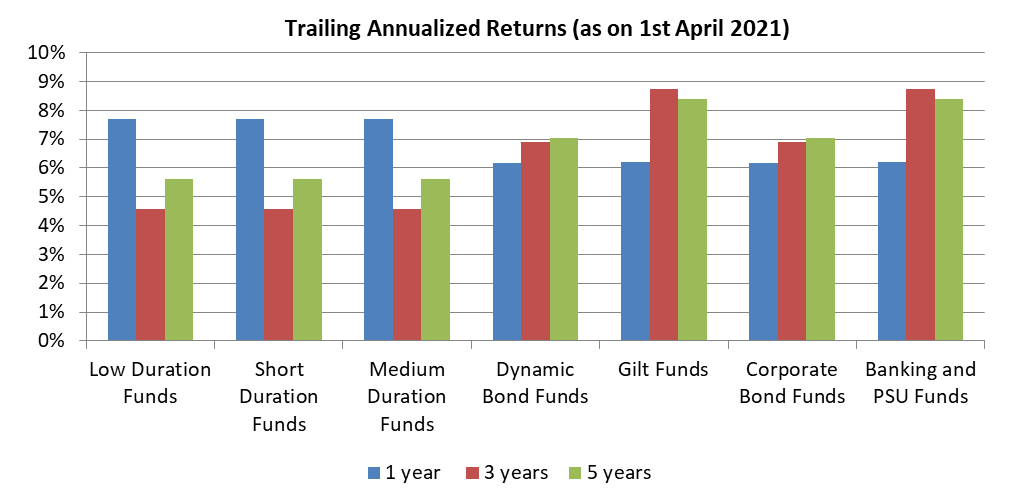

Banking and PSU funds can give superior stable returns in the long term

Why invest in Banking and PSU funds?

.jpg?sfvrsn=ff2ba483_2)

Investors should consult with their financial advisors if Banking and PSU Funds are suitable for their fixed incomeinvestment needs.

Articles

Banking and PSU funds

Though Banking and PSU funds have existed for a long time, a separate category was carved out by the Securities.

Read More

Debt mutual fund - a stable and steady investment choice

Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households.

Read More

Banking and PSU Funds

Banking and PSU Funds are debt mutual fund schemes which invest in debt and money market instruments issued by banks, Public Sector Undertaking (PSU) and Public Financial Institutions (PFI).

Read MoreFor information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.