.jpg?sfvrsn=3a9dac59_2)

Consumption Thematic Fund

Domestic consumption is most important driver of economic growth in a large country. China has long been cited as an example of an exports driven economy, but the Chinese Government over the last several years are trying to transition their economy from exports driven economy to consumption driven economy because they have realized that trade alone cannot sustain economic growth for very long. Read More

Domestic consumption is also one of the most important themes of the India Growth Story. Young population and high percentage of working people in our overall population are the structural demand drivers that distinguish us from other large emerging markets, as far as consumption growth potential is concerned. According to Boston Consulting Group (February 2021), India’s domestic consumption is likely to triple by 2030, though there may be a lag of 1 or 2 years due to the ongoing COVID-19 pandemic.

What consumption thematic funds invest in?

Consumption thematic funds invest in stocks of multiple sectors that can benefit from consumption growth in India. These sectors are FMCG, auto, consumer durable/discretionary, retail, financial services like private banks, insurance, AMCs, etc.

Performance of the consumption theme

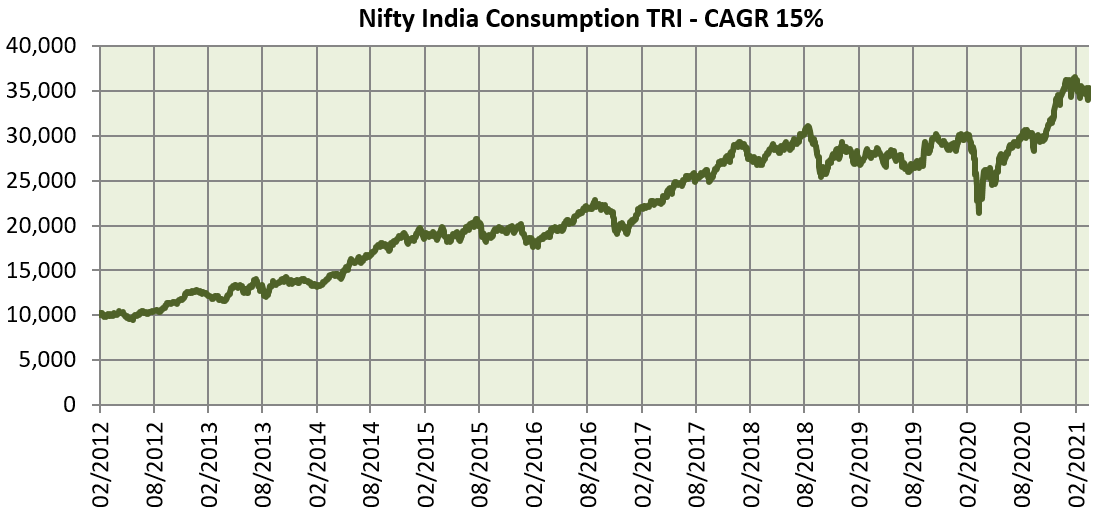

The chart below shows the growth Rs 10,000 invested in Nifty India Consumption Total Returns Index (TRI) from February 2012 to 31st March 2021.

Source: National Stock Exchange (TRI), Advisorkhoj Analysis (Period: 14/02/2012 to 31/03/2021). Disclaimer: Past performance may or may not be sustained in the future

Why invest in consumption theme?

Consumption growth is usually higher than GDP growth rate. India consumption theme continues to be a fascinating theme with multi decade opportunity driven by favourable demographic dividend. With India crossing $2000 per capita income, is at an inflection point which should result in significant growth in expenditure over next decade.

Who should invest in consumption thematic funds?

- Investors who are looking for long term capital appreciation by investing in the consumption theme.

- Investors with high risk appetites.

- Investors with minimum 5+ years investment horizon.

- Investors should read the scheme information document carefully and / or consult with their financial advisors before investing.