Dynamic Bond Funds

Dynamic Bond Funds are debt mutual funds which invest in debt and money market instruments like Government Securities, corporate bonds etc of different durations. These funds do not have any restriction with regards to duration or maturity of the securities they invest in. The fund managers invest across durations depending on their interest rate outlook. Dynamic bond funds are usually more volatile than short duration and medium duration debt funds, but they have the potential to give superior returns across different interest rate scenarios over sufficiently investment tenures.

What is Duration of Dynamic Bond funds?

The Macaulay duration is the weighted average term to maturity of the cash flows from a fixed income security. In simplistic terms, Macaulay Duration is the weighted average number of years an investor must maintain a position in a fixed income instrument until the present value of the fixed income instrument’s cash flows equals the amount paid for the instrument. Macaulay duration is closely related to another duration measure known as Modified Duration (more commonly referred to as simply Duration), which is defined as the change in price of a bond for every 1% change in interest rate. In other words, Modified Duration is the interest rate sensitivity of a fixed income security.

Dynamic bond funds have the flexibility to invest across different durations. The duration of a Dynamic Bond will depend on the type of securities the fund manager invests in depending on the fund manager’s interest rate outlook. If the fund manager expects interest rates to go down in the future, he / she will invest in longer term (longer duration) bonds with a view to earning profits from price appreciation. If the fund manager expects interest rates to go up in the future, he / she will invest in shorter term bonds to reduce interest rate risks and also re-invest maturity proceeds of the bonds at higher interest rates in the future.

What is Yield to Maturity of Dynamic Bond Funds?

Yield to maturity is the total returns (interest payments plus maturity amount or face value) expected on a fixed income security if the instrument is held till its maturity. In other words, YTM is the internal rate of return (IRR) of an instrument which is held till maturity and all the interest payments (coupons) are made as per schedule and re-invested at the same rate.

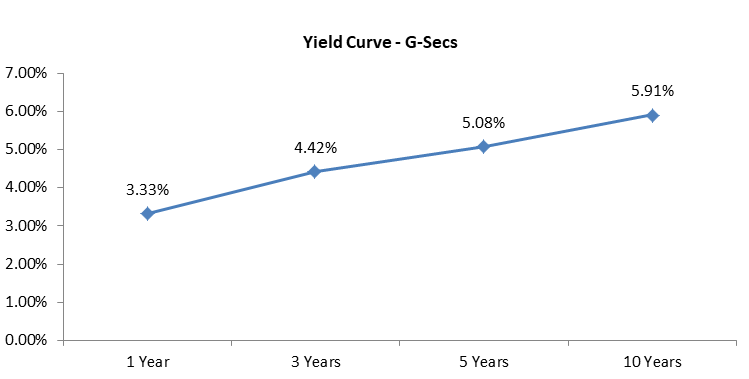

In order to understand YTM characteristics of Dynamic Bond funds investors should understand the relationship between yields and bond maturities. The relationship between bond yields and bond maturities at any point of time is depicted on a yield curve. The normal shape of a yield curve is upward sloping i.e. yields of longer term bonds are higher than yields of shorter term bonds (see the chart below). If the fund manager expects interest rates to go down, he / she will invest in longer duration bonds and get higher yield. If the fund manager expects interest rates to go up, he / she will invest in shorter duration bonds and get low yield.

For illustration purpose only.

What is credit risk of Dynamic Bond Funds?

Dynamic bonds primarily invest in Government Securities, Corporate Bonds (Non Convertible Debentures) and other debt / money market securities. Government Bonds issued by the Central Government enjoy Sovereign status i.e. there is no credit risk. Even bonds issued by State Governments enjoy quasi Sovereign status i.e. no credit risk. However, corporate bonds and debt / money market securities issued by private sector issuers are subject to credit risk.

Credit risk of debt / money market securities are evaluated by credit rating agencies. Higher rated securities have lower credit risk and vice versa. You should know that lower rated bonds give higher yields and some fund managers may invest in such bonds to increase the yield. But in doing so, the credit quality of the fund will worsen i.e. higher credit risk. Investors should always check the credit quality of the non G-Sec portion of dynamic bond fund portfolios to make sure that they are comfortable with the credit quality before investing.

Investment tenure for Dynamic Bond funds

Dynamic bond funds may have long duration profiles depending on the interest rate outlook of the fund manager. Funds with long duration profiles can be quite volatile in the short term. Therefore, investor should always have long investment tenures for dynamic bond funds. Interest rates always move in cycles. Over sufficiently long investment tenures (at least three years), you will experience different interest rate cycles and get better returns on your investments. Further, if you can remain invested for 3 years or longer, you can get the benefit of long term capital gains taxation

Why should you invest in Dynamic Bond Funds?

Things to look for in Dynamic Bond Funds

Who should invest in Dynamic Bond Funds?

- Investors looking for optimal returns across different interest rate scenarios

- Investors with moderate risk appetite

- Investors who can remain invested for at least 3 years

- Investors should consult with their financial advisors before investing.

Videos

Articles

Debt mutual fund - a stable and steady investment choice

Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households.

Read More

Dynamic Bond Funds

Dynamic Bond Funds are fixed income mutual fund schemes which invest in debt and money market securities across durations.

Read More

Dynamic Bond Funds

Dynamic Bond Funds can generate returns from two sources ‒ income from interest (yield) paid by the bonds and price appreciation of bonds if interest rates fall.

Read MoreFor information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

.jpg?sfvrsn=3c29bf78_2)