.jpg?sfvrsn=90195a1a_2)

Healthcare thematic fund

Healthcare is one of the most critical services of human society. The COVID-19 pandemic has brought into focus the importance of health and healthcare than ever before. The pandemic has also shown us the weaknesses of our healthcare infrastructure. The healthcare sector in India is growing at a CAGR of more than 16% over the past 12 years (source: Frost & Sullivan analysis, LSI Financial Services, Jan 2020). The pharmaceutical sector is one of biggest exporters in India. Read More

The medium to long term outlook of the healthcare sector is strong. With outbreak of COVID-19 diversification of API/intermediate exposures from China is expected to other countries and India is likely to be a key beneficiary for the same. There is also a likelihood of significant increase in healthcare budgets by governments in the post Covid era and the focus to move incrementally to availability and supply security versus accessibility. As it is India’s healthcare spending lags behind developed markets (US, UK, Germany etc) and also many emerging markets (China, Brazil etc).

What healthcare thematic funds invest in?

Many investors associate healthcare primarily with the Pharma industry. Healthcare however, is a broader theme covering hospitals, diagnostics, medical insurance, medical equipment, fine chemicals and other allied sectors.

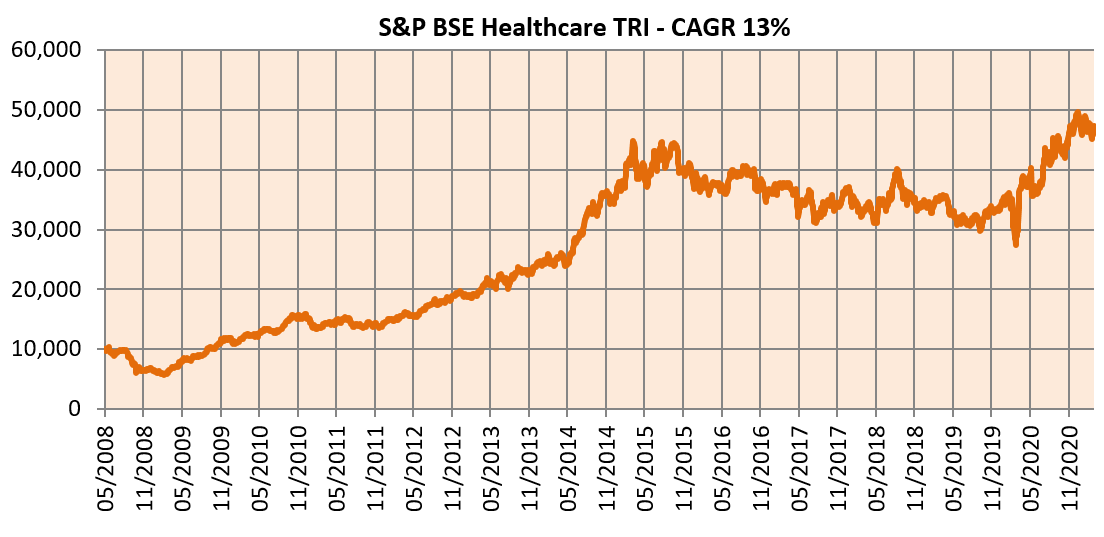

Performance of the healthcare theme

The chart below shows the growth Rs 10,000 invested in Nifty India Consumption Total Returns Index (TRI) from June 2008 to 31st March 2021.

Source: Bombay Stock Exchange (TRI), Advisorkhoj Analysis (Period: 30/05/2008 to 31/03/2021). Disclaimer: Past performance may or may not be sustained in the future

Why invest in healthcare theme?

Healthcare companies are likely to benefit in the long term due to higher awareness and spending towards healthcare in the post COVID era with significant increase in insurance coverage, government spending and discretionary testing aiding the healthcare sector. Overall the long term outlook of the healthcare sector in India is quite positive.

Who should invest in healthcare thematic funds?

- Investors who are looking for long term capital appreciation by investing in the healthcare theme.

- Investors with high risk appetites.

- Investors with minimum 5+ years investment horizon.

- Investors should read the scheme information document carefully and / or consult with their financial advisors before investing.