What are short duration funds?

Short duration funds are debt mutual fund schemes which invest in debt and money market securities such that the Macaulay Duration of the scheme is 1 to 3 years. The investment objective of these funds is income generation through accrual over the maturity term of the instruments in the scheme portfolio. These funds have moderately low interest rate risk. The credit risk of short duration funds may vary from scheme to scheme depending on the credit quality of the underlying instruments.

What is Macaulay Duration?

The Macaulay duration is the weighted average term to maturity of the cash flows from a fixed income security. In simplistic terms, Macaulay Duration is the weighted average number of years an investor must maintain a position in a fixed income instrument until the present value of the fixed income instrument’s cash flows equals the amount paid for the instrument.Macaulay duration is directly related to the interest rate sensitivity of a fixed income security. Higher the Macaulay duration, higher is an instrument’s sensitivity to interest changes. Since short duration funds have Macaulay Durations of 1 to 3 years, they have moderately low sensitivity to interest rate changes.

Yield to maturity of Short Duration Funds

Yield to maturity is the total returns (interest payments plus maturity amount or face value) expected on a fixed income security if the instrument is held till its maturity. In other words, YTM is the internal rate of return (IRR) of an instrument which is held till maturity and all the interest payments (coupons) are made as per schedule and re-invested at the same rate. Yield to Maturity (YTM) of Short Duration Funds depend on prevailing interest rates and credit quality of underlying instruments. The yield to maturity of Short Duration Funds is usually more than that of liquid, ultra-short duration and low duration funds, but less than that of medium and long duration funds.

YTM and credit risk

One important point for investors to note about YTMs of debt funds is that, YTM is directly linked to the credit quality of the underlying securities of the scheme. Lower the credit quality (higher credit risk), higher is the yield of a debt or money market instrument. While higher yields (YTMs) may seem attractive, investors should remember that they may come with higher credit risks. If the YTM of a debt fund is significantly higher than its peers in the same fund category or duration profile, then you should check the credit ratings of the underlying securities in the scheme portfolio, so that you can make informed investment decisions. Both YTM and credit ratings of underlying securities are disclosed in the scheme’s monthly fund factsheet.

Investment tenure for short duration funds

Fund managers of short duration funds usually hold the bonds or money market instruments in the scheme’s portfolio till maturity and accrue the coupons or the interest income. This is known as accrual based strategy. Though the price of bonds may change with interest rate movements, favourable or adverse, interest rate changes have no impact on return on investment if bonds are held till maturity because you will get the face value (principal amount). Investors should ensure that their investment tenures match with the fund duration in order to avoid interest rate risk. Further, if you can remain invested for 3 years or longer, you can get the benefit of long term capital gains taxation. Long term capital gains in debt funds (holding period of more than 3 years) are taxed at 20% after allowing for indexation benefits.

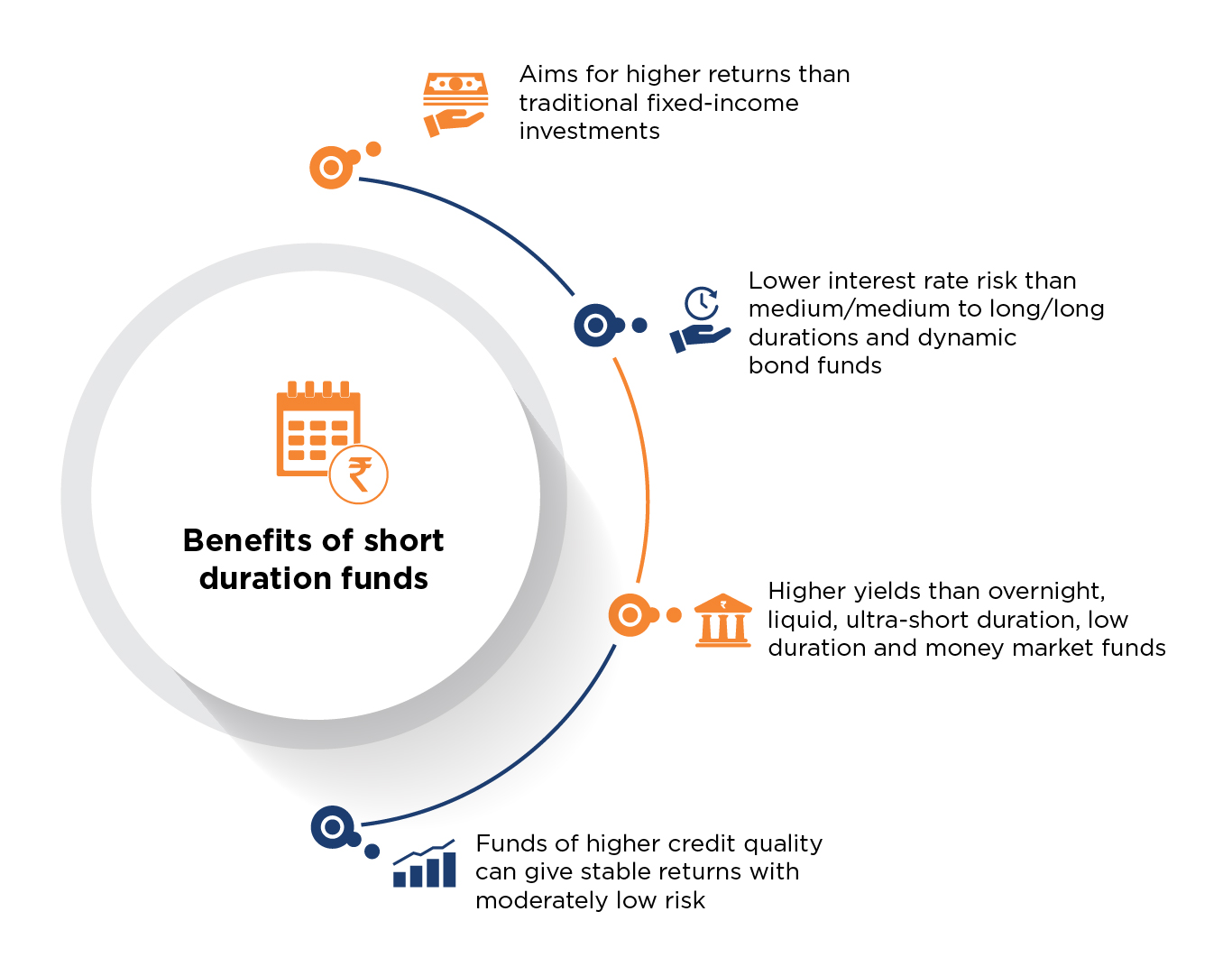

Benefits of short duration funds

Things to look for in short duration funds

Who should invest in short duration funds?

- Investors looking for stable returns

- Investors with moderately low risk appetite

- Investors who can remain invested for 1 to 3 years

- Investors should consult with their financial advisors before investing.

Articles

Debt mutual fund - a stable and steady investment choice

Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households.

Read More

Short Duration Fund

Short Duration Funds are fixed income mutual fund schemes which invest such that the Macaulay Duration of the scheme is 1 to 3 years.

Read MoreVideos

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.