What is Flexicap Funds?

Flexicap funds are diversified equity mutual fund schemes which can invest across various market cap segments. In a Flexicap fund, there is no upper or lower limits with respect to investing in any market cap segment. Any percentage of fund assets can be invested basis the view of the fund manager or the market outlook, in any market cap segment known as large cap, midcap and small cap. This is the primary reason why Flexicap mutual fund is one of the most popular mutual fund category as far as equity funds are concerned.

In summary Flexi cap fund meaning, funds which can invest across various market caps without any restriction.

As per the SEBI circular, Flexi-cap funds will have to have a minimum of 65% of their assets in equity and equity-related investments. There is no cap on how much these funds can or need to invest in large, mid, or small caps.

What are market capitalization segments?

A stock’s market capitalization is derived from the market price of the stock X the number of shares outstanding. According to SEBI (Securities Exchange Board of India), stocks can be classified into 3 market capitalization segments – large cap (top 100 stocks by market capitalization), midcap (101st to 250th stocks by market capitalization) and small cap (251st onward stocks based on market capitalization).

We discussed what is Flexi cap mutual funds, let us now read why invest in?

Why invest in Flexicap Funds?

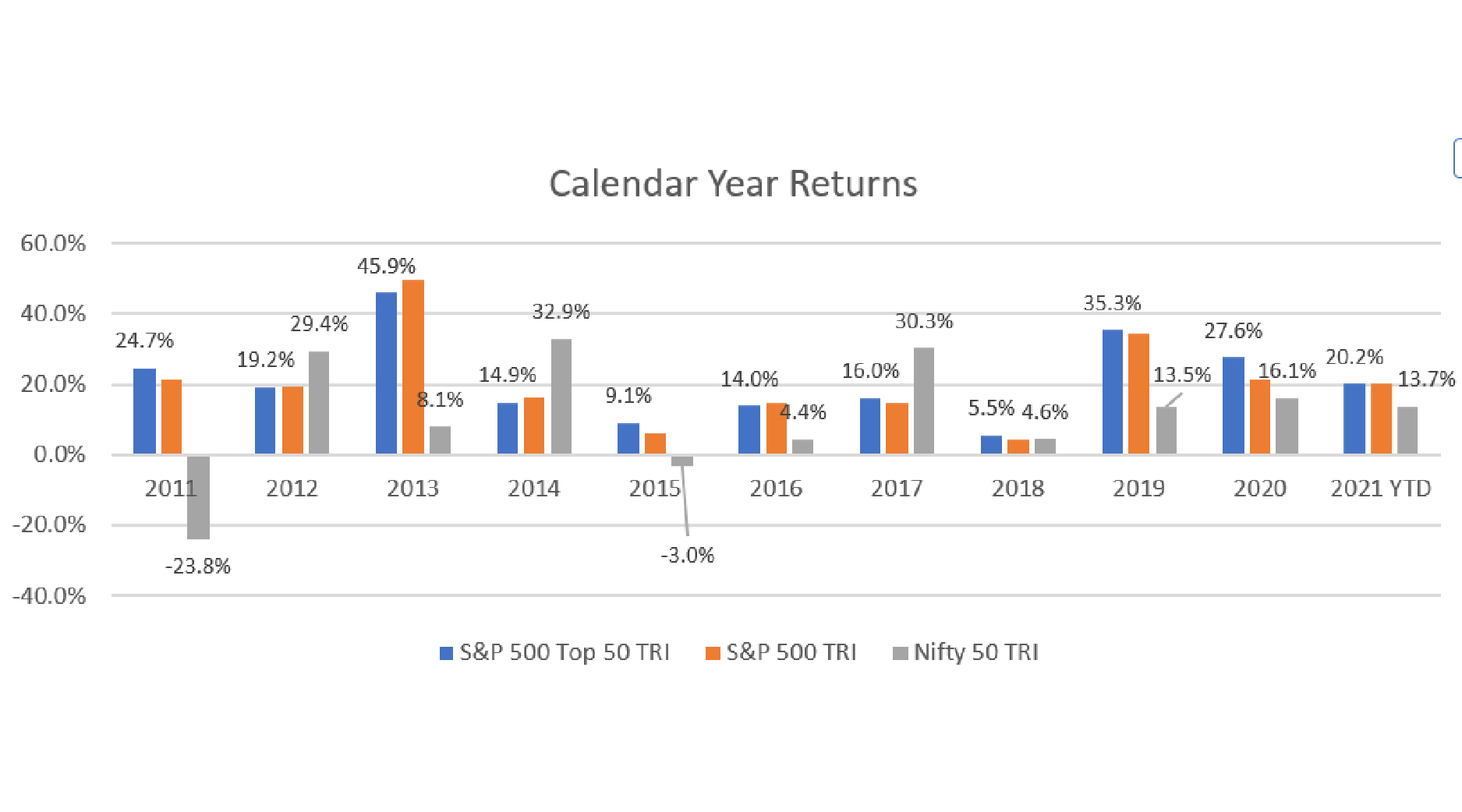

One market cap segment cannot keep outperforming across all market conditions over the various investment cycles. Winners keep rotating based on the historical data available for different market cap segments during various investment cycles as you can see the chart below. Flexicap funds may generate better risk adjusted returns by rotating allocations to different market cap segments based on the fund manager’s outlook.

Source: National Stock Exchange, Advisorkhoj Research (as on 24th January 2023). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

Benefits of Flexicap Funds

- Aids in mitigating risk and managing volatility: The table below shows the 5 biggest market drawdowns in the last 10 years or so and the impact on various market capitalization segments. You can see that large caps (Nifty 100 TR) are considerably less volatile than midcap (Nifty Midcap 150 TRI) and small cap (Nifty Small Cap250 TRI) stocks. A Flexi Cap Fund has no ceiling on a particular market capitalization rather it provides the ease of moving across market caps. Now not all three market caps outperform at a given point in time, neither all underperform at once. So, a fund manager can shift allocations as per the market outlook. The flexibility of moving across market caps further aids in managing volatility and mitigating risk.

- Higher chances of generating alpha: Large Caps are mature businesses with proven track record, therefore are relatively less volatile than the other two. Whereas mid and small caps are growing businesses, have potential of moving up the curve at a faster pace which makes them relatively more volatile. Therefore, large caps could act as an anchor to the portfolio while mid and small caps are fasteners aiding in potential alpha generation over longer investment horizon.

- Flexi Cap has higher liquidity over mid and small cap funds: The percentage of free floating shares of mid and small cap companies is much lesser compared to large cap stocks since these companies usually have high percentage of promoter holding.

- Suitable for retail investors: Flexicap funds are quite suitable for investors who are unable to understand / decide their investment allocation towards various market cap segments, can find Flexi cap funds as their automatic choice. The other added advantage is that due to diversification across different market cap segments, it reduces the unsystematic risks and can generate better risk adjusted returns.

| Drawdown | Event | Nifty 100 TRI (%) | Nifty Midcap 150 TRI (%) | Nifty Small Cap 250 TRI (%) |

|---|---|---|---|---|

| Feb – Mar 2020 | COVID-19 1st Wave | -36.64 | -38.03 | -42.15 |

| Aug 2015 – Feb 2016 | China Slowdown | -18.96 | -18.45 | -23.26 |

| Jul – Dec 2011 | US Sovereign Rating downgrade | -20.86 | -27.13 | -29.62 |

| Jan – Jun 2022 | Russia Ukraine War | -15.13 | -17.17 | -22.86 |

| Jan – Sep 2013 | US Fed Taper Tantrum | -14.69 | -24.05 | -31.48 |

| Aug – Oct 2018 | US China Trade War | -13.79 | -19.29 | -21.49 |

| Oct – Dec 2016 | Demonetization | -10.17 | -14.58 | -15.77 |

Source: National Stock Exchange, Advisorkhoj Research (as on 31st December 2022). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

We have read the benefits of Flexi Cap funds, let us now check who should invest in it?

Who should invest in Flexicap Funds?

- Investors with an aim for capital appreciation over long investment horizon Investors who can tolerate high to very high risk.

- Investors who have long term investment horizon of at least 5+ years investment tenures.

- You can invest in these funds either in lump sum or SIP depending on your financial situation and investment needs.

Investors should consult with their mutual fund distributors/ financial advisors to know what is flexi cap mutual funds and if it is suitable for their investment needs basis their risk profile.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.