MIRAE ASSET

FOCUSED FUND - (MAFF)

(Focused Fund - An open ended equity scheme investing in a maximum of 30 stocks intending to focus in large cap, mid cap and small cap category (i.e., Multi-cap))

| Type of Scheme | Focused Fund - An open ended equity scheme investing in a maximum of 30 stocks intending to focus in large cap, mid cap and small cap category (i.e., Multi-cap) |

| Investment Objective | To generate long term capital appreciation/income by investing in equity & equity related instruments of up to 30 companies. There is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Mr. Gaurav Misra (since inception) |

| Allotment Date | 14th May, 2019 |

| Benchmark Index | <Tier-1 - Nifty 500 (TRI) Tier-2 - Nifty 200 (TRI) |

| Minimum Investment Amount |

₹5,000/- and in multiples of ₹1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹1,000/- (multiples of ₹1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: I. For investors who have opted for SWP under the plan: a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil. b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO): •If redeemed within 1 year (365 days) from the date of allotment: 1% •If redeemed after 1 year (365 days) from the date of allotment: NIL II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out): •If redeemed within 1 year (365 days) from the date of allotment: 1% •If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW^ Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on December 31, 2021 | 8,140.72 |

| Net AUM (₹ Cr.) |

8,256.31 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on December 31, 2021 |

Regular Plan: 1.79% Direct Plan: 0.40% |

| **For experience of Fund Managers Click Here | |

| ^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. | |

| NAV: | Direct | Regular |

| Growth | ₹ 20.854 | ₹ 20.003 |

| IDCW | ₹ 20.850 | ₹ 20.006 |

| Portfolio Turnover Ratio^ | 0.33 times |

@The Volatility, Beta, R Squared, Sharpe Ratio & Information Ratio are calculated on returns from last three years Monthly data points. # Risk free rate: FBIL OVERNIGHT MIBOR as on 31st December, 2021. ^Basis last rolling 12 months. |

|

| Positions Increased |

| Stock |

| Capital Markets |

| Indian Energy Exchange Limited |

| Banks |

| ICICI Bank Limited |

| State Bank of India |

| Petroleum Products |

| Hindustan Petroleum Corporation Limited |

| Auto |

| Ashok Leyland Limited |

| Retailing |

| Zomato Limited |

| Financial Technology (FINTECH) |

| One 97 Communications Limited |

| Gas |

| Gujarat State Petronet Limited |

| Finance |

| Muthoot Finance Limited |

| Consumer Non Durables |

| Britannia Industries Limited |

| Positions Decreased |

| Stock |

| Auto Ancillaries |

| Sona BLW Precision Forgings Limited |

| Pharmaceuticals |

| Torrent Pharmaceuticals Limited |

| Software |

| Larsen & Toubro Infotech Limited |

| Infosys Limited |

| Industrial Products |

| SKF India Limited |

| Banks |

| HDFC Bank Limited |

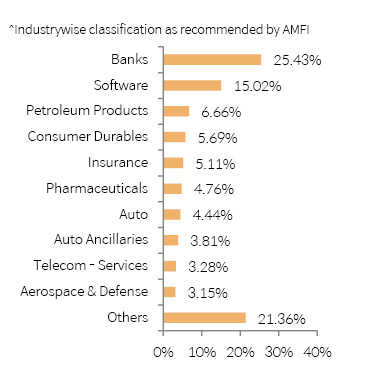

| Portfolio Holdings | % Allocation | |

| Banks | ||

| ICICI Bank Ltd | 8.82% | |

| HDFC Bank Ltd | 7.50% | |

| State Bank of India | 4.79% | |

| Axis Bank Ltd | 4.33% | |

| Software | ||

| Infosys Ltd | 9.52% | |

| MphasiS Ltd | 3.18% | |

| Larsen & Toubro Infotech Ltd | 2.32% | |

| Petroleum Products | ||

| Reliance Industries Ltd* | 5.02% | |

| Hindustan Petroleum Corporation Ltd | 1.64% | |

| Consumer Durables | ||

| Voltas Ltd | 2.98% | |

| Orient Electric Ltd | 2.71% | |

| Insurance | ||

| Max Financial Services Ltd | 3.04% | |

| HDFC Life Insurance Company Ltd | 2.07% | |

| Pharmaceuticals | ||

| Torrent Pharmaceuticals Ltd | 2.46% | |

| Gland Pharma Ltd | 2.30% | |

| Auto | ||

| Ashok Leyland Ltd | 2.66% | |

| Maruti Suzuki India Ltd | 1.77% | |

| Auto Ancillaries | ||

| Sona BLW Precision Forgings Ltd | 3.81% | |

| Telecom - Services | ||

| Bharti Airtel Ltd | 3.28% | |

| Aerospace & Defense | ||

| Bharat Electronics Ltd | 3.15% | |

| Cement & Cement Products | ||

| JK Cement Ltd | 2.80% | |

| Industrial Products | ||

| SKF India Ltd | 2.69% | |

| Gas | ||

| Gujarat State Petronet Ltd | 2.62% | |

| Capital Markets | ||

| Indian Energy Exchange Ltd | 2.57% | |

| Finance | ||

| Muthoot Finance Ltd | 2.54% | |

| Consumer Non Durables | ||

| Britannia Industries Ltd | 2.43% | |

| Healthcare Services | ||

| Syngene International Ltd | 2.12% | |

| Chemicals | ||

| Chemplast Sanmar Ltd | 1.27% | |

| Financial Technology (FINTECH) | ||

| One 97 Communications Ltd | 1.26% | |

| Retailing | ||

| Zomato Ltd | 1.05% | |

| Equity Holding Total | 98.71% | |

| Cash & Other Receivables | 1.29% | |

| Total | 100.00% | |

*Includes "Partly Paid Shares"

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MAFF | 39.56 |

30.12 |

||

| Scheme Benchmark* (Tier-1) | 31.60 |

22.00 |

||

| Scheme Benchmark* (Tier-2) | 28.88 |

20.60 |

||

| Additional Benchmark** | 23.23 |

19.85 |

||

| NAV as on 31st December, 2021 | 20.003 |

|||

| Index Value (31st December, 2021) | Index Value of Scheme benchmark is 22,990.88 / 11,796.61 and S&P BSE Sensex (TRI) is 86,926.99 | |||

| Allotment Date | 14th May, 2019 | |||

| Scheme Benchmark | *Tier-1-Nifty 500 (TRI) Tier-2-Nifty 200 (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Note:1. Different Plans under the scheme has different expense structure. The reference and details provided herein are of Regular Plan - Growth Option

2. Fund manager : Mr. Gaurav Misra managing the scheme since May, 2019

| Period | Total Amount Invested | Mkt Value as on 31-December-2021 |

SI |

310,000 |

490,030 |

1 Yr |

120,000 |

141,141 |

Returns (%) |

Period |

|

SI |

1yr |

|

Fund Return& (%) |

38.02 |

34.20 |

Benchmark Return (Tier-1)& (%) |

31.73 |

26.53 |

Benchmark Return (Tier-2)& (%) |

29.82 |

24.26 |

Add. Benchmark Return& (%) |

27.27 |

21.62 |

& The SIP returns are calculated by XIRR approach assuming investment of ₹ 10,000/- on the 1st working day of every month.

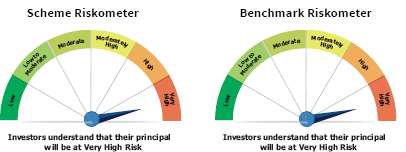

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income.

• Investment in a concentrated portfolio of equity & equity related instrument of up to 30 companies across large, mid and small cap category.

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.00. The performance of other funds managed by the same fund manager is given in the respective page of the schemes