MIRAE ASSET

ULTRA SHORT DURATION FUND - (MAUSF)

(An Open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration* of the portfolio is between 3 months to 6 months (*please refer to page no.33 of SID)

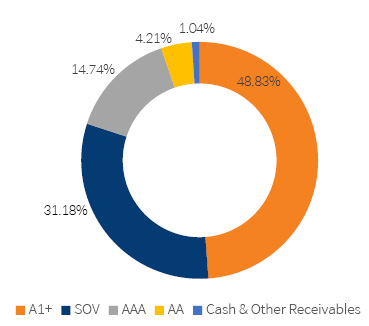

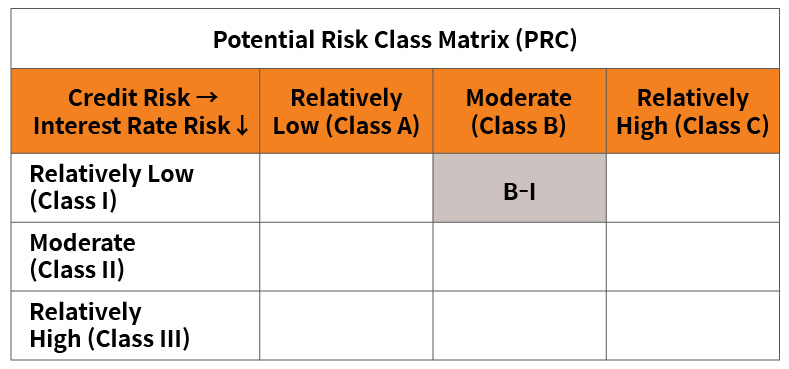

A relatively low interest rate risk and moderate credit risk

| Type of Scheme | An Open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration* of the portfolio is between 3 months to 6 months (*please refer to page no.33 of SID A relatively low interest rate risk and moderate credit risk |

||||||||||||||||||||||||

| Investment Objective | The investment objective of the scheme is to generate regular income and provide liquidity by investing primarily in a portfolio comprising of debt & money market instruments. There is no assurance or guarantee that the investment objective of the scheme will be realized. |

||||||||||||||||||||||||

Fund Manager** |

Mr. Mahendra Jajoo - (since inception) Allotment Date |

07th October, 2020 Benchmark Index |

NIFTY Ultra Short Duration Debt Index Minimum Investment |

Amount ₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹ 1/- thereafter. Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) Monthly and Quarterly: ₹ 1000/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. Load Structure |

Entry load: NA Exit load: Nil Plans Available |

Regular Plan and Direct Plan Options Available |

Growth Option and IDCW^ Option (Payout & Re-investment) Monthly Average AUM (₹ Cr.) as on November 30, 2021 |

247.72 Net AUM (₹ Cr.) |

239.69 Monthly Avg. Expense Ratio |

(Including Statutory Levies) as on November 30, 2021 Regular Plan: 0.47% Direct Plan: 0.26% **For experience of Fund Managers Click Here |

^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. |

| |||||||||||||

| NAV: | Direct | Regular |

| Growth | ₹ 1,043.2776 | ₹ 1,040.3639 |

| IDCW | ₹ 1,043.3577 | ₹ 1,040.0326 |

| Weighted Average Maturity | 95.77 Days |

| Modified Duration | 0.26 Years |

| Macaulay Duration | 0.26 Years |

| Yield to Maturity | 3.82% |

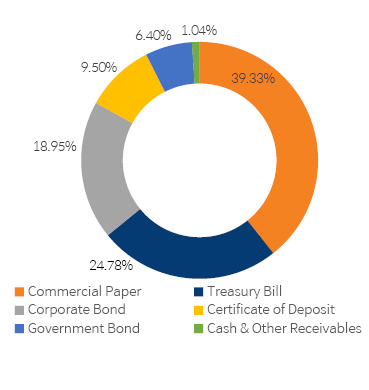

| Portfolio Holdings | % Allocation | |

| Commercial Paper | ||

| IIFL Wealth Prime Ltd (25/02/2022) | 8.25% | |

| Export Import Bank of India (30/12/2021) | 6.24% | |

| Reliance Industries Ltd (28/02/2022) | 6.20% | |

| Godrej Agrovet Ltd (16/03/2022) | 6.19% | |

| NABARD (12/01/2022) | 4.16% | |

| L&T Finance Ltd (12/01/2022) | 4.15% | |

| Network18 Media & Investments Ltd (25/02/2022) | 4.14% | |

| Commercial Paper Total | 39.33% | |

| Treasury Bill | ||

| 364 Days Tbill (24/02/2022) | 6.21% | |

| 364 Days Tbill (03/03/2022) | 6.20% | |

| 364 Days Tbill (17/03/2022) | 6.19% | |

| 364 Days Tbill (30/03/2022) | 4.12% | |

| 182 Days Tbill (28/04/2022) | 2.05% | |

| Treasury Bill Total | 24.78% | |

| Corporate Bond | ||

| 9.25% Manappuram Finance Ltd (14/02/2022) | 4.21% | |

| 6.6% REC Ltd (21/03/2022) | 4.20% | |

| 7.17% National Highways Auth Of Ind (23/12/2021) | 4.18% | |

| 7.35% Power Finance Corporation Ltd (15/10/2022) | 2.13% | |

| 8.58% Housing Development Finance Corporation Ltd (18/03/2022) | 2.11% | |

| 7.6653% L&T Finance Ltd (18/03/2022) | 2.11% | |

| Corporate Bond Total | 18.95% | |

| Certificate of Deposit | ||

| RBL Bank Ltd (28/02/2022) | 5.37% | |

| IDFC First Bank Ltd (14/03/2022) | 4.13% | |

| Certificate of Deposit Total | 9.50% | |

| Government Bond | ||

| 8.15% GOI (11/06/2022) | 6.40% | |

| Government Bond Total | 6.40% | |

| Cash & Other Receivables Total | 1.04% | |

| Total | 100.00% | |

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MAUSDF | 3.39 |

3.51 |

||

| Scheme Benchmark* | 3.87 |

3.96 |

||

| Additional Benchmark** | 3.49 |

3.56 |

||

| NAV as on 30th November, 2021 | 1,040.3639 | |||

| Index Value (30th November, 2021) | Index Value of benchmark is 4,372.40 and CRISIL 1 Year T-Bill is 6,246.02 | |||

| Allotment Date | 07th October, 2020 | |||

| Scheme Benchmark | *Nifty Ultra Short Duration Debt Index | |||

| Additional Benchmark | **CRISIL 1 Year T-Bill | |||

Note:1. Different Plans under the scheme has different expense structure. The reference and details provided herein are of Regular Plan - Growth Option

2. Fund manager : Mr. Mahendra Jajoo managing the scheme since 07th October, 2020.

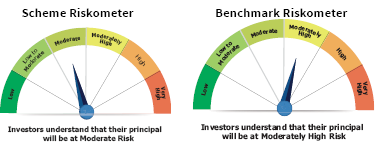

This product is suitable for investors who are seeking*

. Income over a short term investment horizon

. Investment in debt & money market securities with portfolio Macaulay duration between 3 months and 6 months

• Degree of risk - Moderate

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 1000. The performance of other funds managed by the same fund manager is given in the respective page of the schemes and on