MIRAE ASSET OVERNIGHT FUND - (MAONF)

(Overnight Fund - An open ended debt scheme investing in overnight securities)

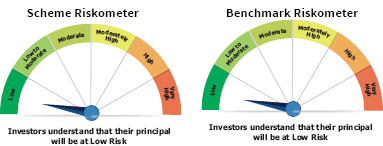

A relatively low interest rate risk and relatively low credit risk

| Type of Scheme | Overnight Fund -An open ended debt scheme investing in overnight securities A relatively low interest rate risk and relatively low credit risk |

||||||||||||||||||||||||

| Investment Objective | The investment objective of the scheme is to generate returns commensurate with low risk and providing high level of liquidity, through investments made primarily in overnight securities having maturity of 1 business day. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any returns. |

||||||||||||||||||||||||

Fund Manager** |

Mr. Abhishek Iyer (since December 28, 2020) Allotment Date |

15th October, 2019 Benchmark Index |

NIFTY 1D Rate Index Minimum Investment |

Amount ₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹ 1/- thereafter. Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) Monthly and Quarterly: ₹ 1000/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. Load Structure |

Entry load: NA |

Exit load: NIL Plans Available |

Regular Plan and Direct Plan Options Available |

Growth Option and IDCW^ Option (Payout & Re-investment) Monthly Average AUM (₹ Cr.) as on May 31, 2022 |

517.94 Net AUM (₹ Cr.) |

492.13 Monthly Avg. Expense Ratio |

(Including Statutory Levies) as on May 31, 2022 Regular Plan: 0.21% Direct Plan: 0.11% **For experience of Fund Managers Click Here |

^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. |

| ||||||||||||

| NAV: | Direct | Regular |

| Growth | ₹ 1,096.3654 | ₹ 1,093.6419 |

| Daily IDCW^ | ₹ 1,000.0007 | ₹ 1,000.0000 |

| Weekly IDCW^ | ₹ 1,000.6766 | ₹ 1,000.6594 |

| Monthly IDCW^ | ₹ 1,000.7859 | ₹ 1,000.7673 |

Weighted Average Maturity |

1.05 Days |

Modified Duration |

0.00 Years |

Macaulay Duration |

0.00 Years |

Yield to Maturity |

4.25% |

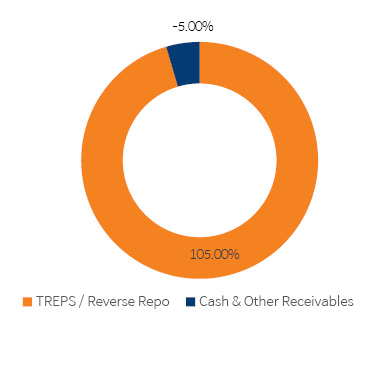

| Portfolio Holdings | % Allocation |

| TREPS / Reverse Repo | |

| TREPS / Repo Net Receivables/ (Payables) | 105.00% |

| Cash & Other Receivables Total | -5.00% |

| Total | 100.00% |

| IDCW (₹) Per Unit | |||

| Record Date | IDCW (₹) | Face Value (₹) | Cum Nav (₹) |

24-Feb-22 |

2.8541 |

2.8541 |

1,002.8541 |

24-Mar-22 |

2.5383 |

2.5383 |

1,002.5383 |

25-Apr-22 |

2.9857 |

2.9857 |

1,002.9857 |

24-May-22 |

3.0926 |

3.0926 |

1,003.0926 |

Face value ₹ 1000/-. Past Performance may or may not be sustained in future. Pursuant to payment of IDCW the NAV of the IDCW option of the scheme will fall to the extent of payout and statutory levy (if any). IDCW history is for MAONF- Regular Plan - Monthly IDCW Option

| Returns (in%) | |||||||

| 7 D | 15 D | 30 D | 1 Yr | SI | |||

| MAONF | 4.00% |

3.97% |

3.96% |

3.35% |

3.47% |

||

| Scheme Benchmark* | 4.16% |

4.14% |

4.08% |

3.46% |

3.53% |

||

| Additional Benchmark** | 3.52% |

5.22% |

-6.83% |

2.78% |

4.35% |

||

| NAV as on 31st May, 2022 | 1,093.6419 | ||||||

| Index Value (31st May, 2022) | Index Value of benchmark is 2,017.42 and CRISIL 1 Year T-Bill is 6,312.24 | ||||||

| Allotment Date | 15th October, 2019 | ||||||

| Scheme Benchmark | *NIFTY 1D Rate Index | ||||||

| Additional Benchmark | **CRISIL 1 Year T-Bill | ||||||

Fund manager : Mr. Abhishek Iyer managing the scheme since December 28, 2020

Note: Returns (%) for less than 1 year calculated on simple annualized basis, others are CAGR- Compounded Annualized Growth returns

This product is suitable for investors who are seeking*

. Regular income over short term that may be in line with the overnight call rates.

. Investment in overnight securities

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

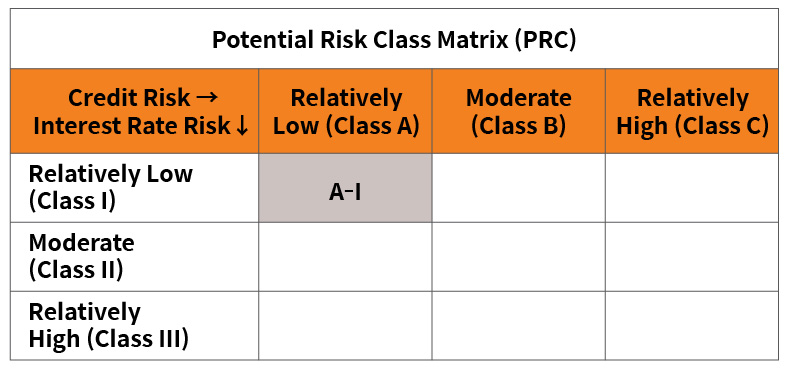

Note : With reference to SEBI Circular no. SEBI/HO/IMD/IMD-11 DOF-3/CIR/2021/573 dated June 07, 2021 disclosure of Potential Risk Class (PRC) Matrix is provided for debt Schemes of Mirae Asset Mutual Fund.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 1000. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option