MIRAE ASSET

Banking and PSU Debt Fund - (MABPDF)

(Banking and PSU Fund - An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds.

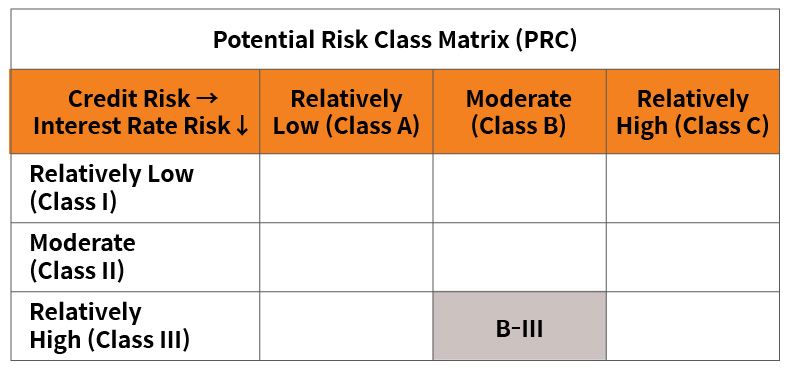

A relatively high interest rate risk and moderate credit risk

| Type of Scheme | Banking and PSU Fund - An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds. A relatively high interest rate risk and moderate credit risk |

||||||||||||||||||||||||

| Investment Objective | The investment objective of the scheme is to generate income / capital appreciation through predominantly investing in debt and money market instruments issued by Banks, Public Sector Undertakings (PSUs) and Public Financial Institutions (PFIs) and Municipal Bonds.The Scheme does not guarantee or assure any returns. |

||||||||||||||||||||||||

Fund Manager** |

Mr. Mahendra Jajoo - (since July 24, 2020) Allotment Date |

24th July 2020 Benchmark Index |

CRISIL Banking and PSU Debt Index Minimum Investment |

Amount ₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹ 1/- thereafter. Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) Monthly and Quarterly: ₹ 1000/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. Load Structure |

Entry load: NA Exit load: Nil Plans Available |

Regular Plan and Direct Plan Options Available |

Growth Option and IDCW^ Option (Payout & Re-investment) Monthly Average AUM (₹ Cr.) as on October 31, 2022 |

99.58 Net AUM (₹ Cr.) |

96.84 Monthly Avg. Expense Ratio |

(Including Statutory Levies) as on October 31, 2022 Regular Plan: 0.84% Direct Plan: 0.41% **For experience of Fund Managers Click Here |

^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. |

| |||||||||||||

| NAV: | Direct | Regular |

| Growth | ₹ 10.8107 | ₹ 10.7027 |

| IDCW^ | ₹ 10.8108 | ₹ 10.7036 |

| Weighted Average Maturity | 1.85 Years |

| Modified Duration | 1.45 Years |

| Macaulay Duration | 1.56 Years |

| Yield to Maturity | 7.28% |

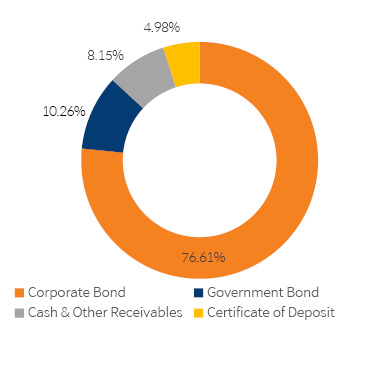

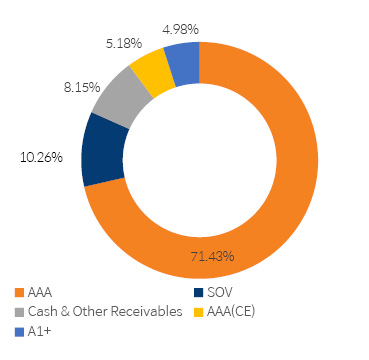

| Portfolio Holdings | % Allocation |

| Corporate Bond | |

| 6.79% Housing & Urban Development Corporation Ltd (14/04/2023) ** | 10.30% |

| 5.32% National Housing Bank (01/09/2023) ** | 10.16% |

| 6.39% Indian Oil Corporation Ltd (06/03/2025) ** | 7.56% |

| 5.2% Export Import Bank of India (04/03/2025) ** | 7.53% |

| 8.7% Power Grid Corporation of India Ltd (15/07/2023) ** | 5.20% |

| 8.62% Food Corporation Of India (22/03/2023) ** | 5.18% |

| 7.52% NHPC Ltd (06/06/2024) ** | 5.17% |

| 6.55% NTPC Ltd (17/04/2023) ** | 5.14% |

| 7% Hindustan Petroleum Corporation Ltd (14/08/2024) ** | 5.13% |

| 6.99% REC Ltd (30/09/2024) ** | 5.11% |

| 7.13% Power Finance Corporation Ltd (15/07/2026) ** | 5.09% |

| 4.64% Oil & Natural Gas Corporation Ltd (21/11/2023) ** | 5.02% |

| Corporate Bond Total | 76.61% |

| Government Bond | |

| 7.38% GOI (20/06/2027) | 5.16% |

| 7.26% GOI (22/08/2032) | 5.10% |

| Government Bond Total | 10.26% |

| Certificate of Deposit | |

| Bank of Baroda (05/05/2023) ** # | 4.98% |

| Certificate of Deposit Total | 4.98% |

| Cash & Other Receivables Total | 8.15% |

| Total | 100.00% |

**Thinly Traded / Non Traded Security #Unlisted Security

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MABPDF | 2.17% |

3.04% |

||

| Scheme Benchmark* | 2.21% |

3.78% |

||

| Additional Benchmark** | -0.96% |

0.62% |

||

| NAV as on 31st October, 2022 | ₹ 10.7027 | |||

| Index Value (31st October, 2022) | Index Value of benchmark is 4,836.21 and CRISIL 10 Year Gilt Index is 4,037.47 |

|||

| Allotment Date | 24th July, 2020 | |||

| Scheme Benchmark | *CRISIL Banking and PSU Debt Index | |||

| Additional Benchmark | **CRISIL 10 Year Gilt Index | |||

Fund manager : Mr. Mahendra Jajoo managing the scheme since 24th July, 2020.

Note: Returns (%) for less than 1 year calculated on simple annualized basis, others are CAGR- Compounded Annualized Growth returns

This product is suitable for investors who are seeking*

. Income over short to medium term

. To generate income/ capital appreciation through predominantly investing in debt and money market instruments issued by Banks, Public Sector Undertakings (PSUs), Public Financials Institutions (PFIs) and Municipal Bonds.

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Note : With reference to SEBI Circular no. SEBI/HO/IMD/IMD-11 DOF-3/CIR/2021/573 dated June 07, 2021 disclosure of Potential Risk Class (PRC) Matrix is provided for debt Schemes of Mirae Asset Mutual Fund.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.00. The performance of other funds managed by the same fund manager is given in the respective page of the schemes and on

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option