MIRAE ASSET

NIFTY 8-13 YR G-SEC ETF$ (NSE Symbol : MAGS813ETF, BSE Code: 543875)

(Exchange Traded Fund (ETF) - An Open-Ended Index Exchange Traded Fund tracking Nifty 8-13 yr G-Sec Index. Relatively High interest rate risk and Relatively Low Credit Risk)

| Type of Scheme | Exchange Traded Fund (ETF) - An Open-Ended Index Exchange Traded Fund tracking Nifty 8-13 yr G-Sec Index. Relatively High interest rate risk and Relatively Low Credit Risk |

| Investment Objective | The investment objective of the Scheme is to provide returns before expenses that correspond to the returns of Nifty 8-13 yr G-Sec Index, subject to tracking errors. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns |

Fund Manager** |

Mr.Amit Modani (since March 31, 2023) |

| Allotment Date | 31st March 2023 |

| Benchmark Index | Nifty 8-13 yr G-Sec Index |

| Minimum Investment Amount |

On exchange in multiple of 1 unit. With AMC: In multiples of 2,50,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: NIL |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on April 30, 2023 | 75.36 |

| Net AUM (₹ Cr.) | 77.11 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.04% |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on April 30, 2023 | 0.09% |

| **For experience of Fund Managers Click Here | |

| ₹ 24.1536 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

| Average Maturity | 9.00 Yrs |

| Modified Duration | 6.42 Yrs |

| Macaulay Duration | 6.65 Yrs |

| Annualized Portfolio YTM* | 7.27% |

*In case of semi annual YTM, it will be annualized.

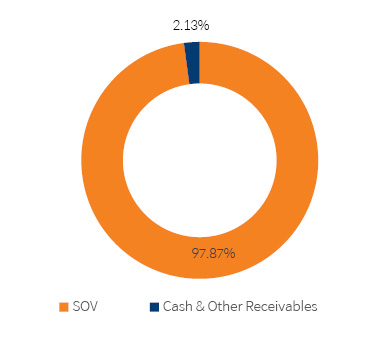

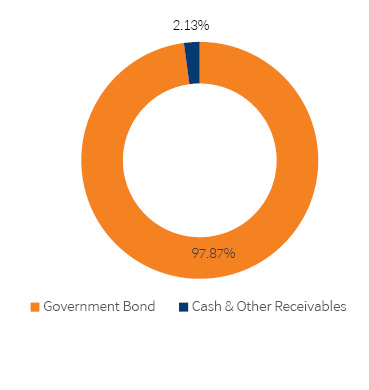

| Portfolio Holdings | % Allocation |

| Government Bond | |

| 7.26% GOI (22/08/2032) | 59.41% |

| 6.54% GOI (17/01/2032) | 28.31% |

| 7.26% GOI (06/02/2033) | 10.15% |

| Government Bond Total | 97.87% |

| Cash & Other Receivables Total | 2.13% |

| Total | 100.00% |

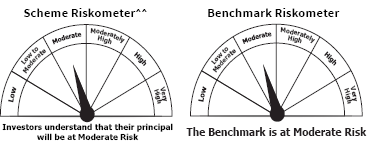

This product is suitable for investors who are seeking*

• Income over long term

• Investment in securities in line with Nifty 8-13 yr G-Sec Index to generate comparable returns subject to tracking errors

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :MAGS813ETF

BSE Code:543875

Bloomberg Code:MAGS813ETF IN Equity

Reuters Code: MIRA.NS