MIRAE ASSET

NIFTY MIDCAP 150 ETF (NSE Symbol : MAM150ETF, BSE Code: 543481)

(An open-ended scheme replicating/tracking Nifty Midcap 150 Total Return Index)

| Type of Scheme | An open-ended scheme replicating/tracking Nifty Midcap 150 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty Midcap 150 Total Return Index, subject to tracking error. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Ms. Ekta Gala (since March 09, 2022) |

| Allotment Date | 09th March 2022 |

| Benchmark Index | Nifty Midcap 150 Index (TRI) |

| Minimum Investment Amount |

On exchange In multiple of 1 units Directly with AMC In multiple of 4,00,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

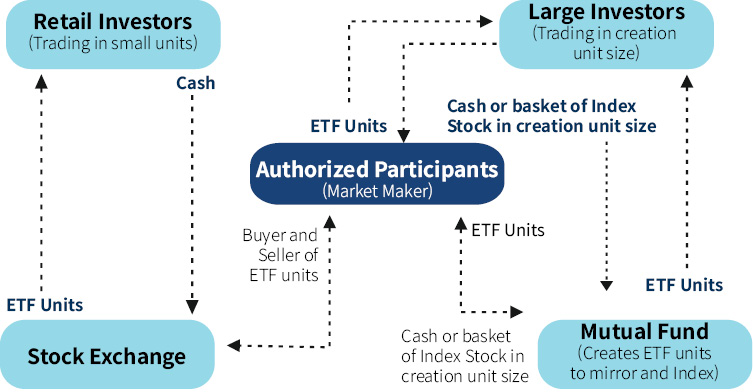

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable - The Units of, MAM150ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days." |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on April 30, 2023 | 177.86 |

| Net AUM (₹ Cr.) | 187.75 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.06% |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on April 30, 2023 | 0.05% |

| **For experience of Fund Managers Click Here | |

| ₹ 11.9953 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

| Portfolio Holdings | % Allocation |

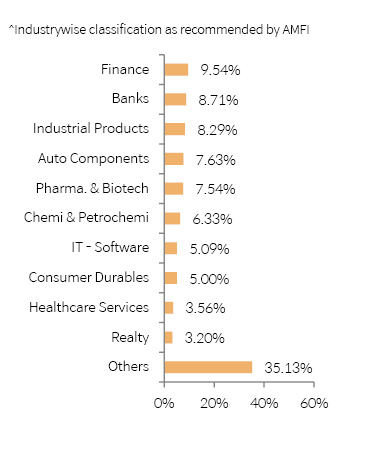

| Finance | |

| Shriram Finance Limited | 2.07% |

| Power Finance Corporation Ltd | 1.11% |

| REC Limited | 0.92% |

| Sundaram Finance Limited | 0.90% |

| Mahindra & Mahindra Financial Services Limited | 0.86% |

| LIC Housing Finance Limited | 0.58% |

| Piramal Enterprises Limited | 0.55% |

| Poonawalla Fincorp Limited | 0.53% |

| CRISIL Limited | 0.49% |

| Aditya Birla Capital Limited | 0.48% |

| L&T Finance Holdings Limited | 0.39% |

| Aavas Financiers Limited | 0.34% |

| Indian Railway Finance Corporation Limited | 0.33% |

| Banks | |

| AU Small Finance Bank Limited | 1.79% |

| The Federal Bank Limited | 1.60% |

| Yes Bank Limited | 1.11% |

| IDFC First Bank Limited | 1.07% |

| Bandhan Bank Limited | 0.95% |

| Punjab National Bank | 0.87% |

| Union Bank of India | 0.49% |

| Indian Bank | 0.45% |

| Bank of India | 0.37% |

| Industrial Products | |

| Cummins India Limited | 1.20% |

| APL Apollo Tubes Limited | 1.15% |

| Bharat Forge Limited | 1.15% |

| Supreme Industries Limited | 0.99% |

| Astral Limited | 0.96% |

| Polycab India Limited | 0.81% |

| AIA Engineering Limited | 0.60% |

| SKF India Limited | 0.54% |

| Grindwell Norton Limited | 0.50% |

| Timken India Limited | 0.39% |

| Auto Components | |

| Tube Investments of India Limited | 1.51% |

| MRF Limited | 1.01% |

| Balkrishna Industries Ltd | 0.93% |

| Sona BLW Precision Forgings Limited | 0.72% |

| Apollo Tyres Limited | 0.64% |

| Schaeffler India Limited | 0.63% |

| Sundram Fasteners Limited | 0.63% |

| Motherson Sumi Wiring India Limited | 0.51% |

| UNO Minda Limited | 0.50% |

| ZF Commercial Vehicle Control Systems India Limited | 0.27% |

| Endurance Technologies Limited | 0.27% |

| Pharmaceuticals & Biotechnology | |

| Aurobindo Pharma Ltd | 0.97% |

| Alkem Laboratories Limited | 0.97% |

| Lupin Limited | 0.96% |

| Zydus Lifesciences Limited | 0.74% |

| Laurus Labs Limited | 0.68% |

| Abbott India Limited | 0.66% |

| Biocon Ltd | 0.58% |

| IPCA Laboratories Limited | 0.54% |

| Gland Pharma Limited | 0.53% |

| Ajanta Pharma Ltd | 0.32% |

| Pfizer Limited | 0.32% |

| GlaxoSmithKline Pharmaceuticals Limited | 0.28% |

| Chemicals & Petrochemicals | |

| Navin Fluorine International Limited | 0.93% |

| Tata Chemicals Ltd | 0.83% |

| Deepak Nitrite Limited | 0.78% |

| Gujarat Fluorochemicals Limited | 0.75% |

| Aarti Industries Limited | 0.62% |

| Atul Limited | 0.61% |

| Solar Industries India Limited | 0.52% |

| Linde India Limited | 0.48% |

| Vinati Organics Ltd | 0.29% |

| Fine Organic Industries Limited | 0.19% |

| Alkyl Amines Chemicals Limited | 0.18% |

| Clean Science and Technology Limited | 0.15% |

| IT - Software | |

| Persistent Systems Limited | 1.34% |

| Tata Elxsi Limited | 1.30% |

| Coforge Limited | 0.85% |

| MphasiS Limited | 0.84% |

| Oracle Financial Services Software Limited | 0.47% |

| Happiest Minds Technologies Limited | 0.29% |

| Consumer Durables | |

| Voltas Ltd | 1.02% |

| Crompton Greaves Consumer Electricals Limited | 0.91% |

| Dixon Technologies (India) Limited | 0.60% |

| Bata India Limited | 0.53% |

| Kajaria Ceramics Ltd | 0.51% |

| Rajesh Exports Limited | 0.42% |

| Relaxo Footwears Limited | 0.34% |

| Kansai Nerolac Paints Limited | 0.29% |

| Whirlpool of India Limited | 0.24% |

| Metro Brands Limited | 0.15% |

| Healthcare Services | |

| Max Healthcare Institute Limited | 1.90% |

| Fortis Healthcare Limited | 0.76% |

| Syngene International Limited | 0.52% |

| Dr. Lal Path Labs Limited | 0.37% |

| Realty | |

| Godrej Properties Limited | 0.84% |

| The Phoenix Mills Limited | 0.75% |

| Macrotech Developers Limited | 0.63% |

| Oberoi Realty Limited | 0.60% |

| Prestige Estates Projects Limited | 0.39% |

| Leisure Services | |

| The Indian Hotels Company Limited | 1.67% |

| Jubilant Foodworks Limited | 0.96% |

| Devyani International Limited | 0.35% |

| Power | |

| Adani Power Limited | 0.97% |

| NHPC Limited | 0.67% |

| JSW Energy Limited | 0.60% |

| Torrent Power Limited | 0.52% |

| Gas | |

| Petronet LNG Ltd | 1.00% |

| Indraprastha Gas Limited | 0.97% |

| Gujarat Gas Limited | 0.45% |

| Retailing | |

| Trent Limited | 1.69% |

| Aditya Birla Fashion and Retail Ltd | 0.41% |

| Vedant Fashions Limited | 0.26% |

| Electrical Equipment | |

| CG Power and Industrial Solutions Limited | 1.11% |

| Bharat Heavy Electricals Limited | 0.57% |

| Thermax Limited | 0.49% |

| Cement & Cement Products | |

| Dalmia Bharat Limited | 0.88% |

| JK Cement Limited | 0.56% |

| The Ramco Cements Limited | 0.53% |

| Ferrous Metals | |

| Jindal Steel & Power Limited | 1.20% |

| Steel Authority of India Limited | 0.67% |

| Transport Services | |

| Container Corporation of India Limited | 0.94% |

| Delhivery Limited | 0.47% |

| Blue Dart Express Limited | 0.20% |

| Agricultural, Commercial & Construction Vehicles | |

| Ashok Leyland Limited | 1.18% |

| Escorts Kubota Limited | 0.37% |

| Automobiles | |

| TVS Motor Company Ltd | 1.49% |

| Financial Technology (Fintech) | |

| PB Fintech Limited | 0.79% |

| One 97 Communications Limited | 0.67% |

| Insurance | |

| Max Financial Services Ltd | 0.82% |

| Star Health And Allied Insurance Company Limited | 0.27% |

| General Insurance Corporation of India | 0.21% |

| The New India Assurance Company Limited | 0.15% |

| Telecom - Services | |

| Tata Communications Limited | 0.83% |

| Vodafone Idea Limited | 0.32% |

| Tata Teleservices (Maharashtra) Limited | 0.17% |

| Entertainment | |

| Zee Entertainment Enterprises Ltd | 1.02% |

| Sun TV Network Limited | 0.20% |

| Fertilizers & Agrochemicals | |

| Coromandel International Limited | 0.62% |

| Bayer Cropscience Limited | 0.29% |

| Sumitomo Chemical India Limited | 0.28% |

| Petroleum Products | |

| Hindustan Petroleum Corporation Ltd | 0.90% |

| IT - Services | |

| L&T Technology Services Ltd | 0.58% |

| Affle (India) Limited | 0.28% |

| Minerals & Mining | |

| NMDC Limited | 0.70% |

| Transport Infrastructure | |

| GMR Airports Infrastructure Limited | 0.63% |

| Beverages | |

| United Breweries Limited | 0.59% |

| Diversified | |

| 3M India Limited | 0.36% |

| Godrej Industries Limited | 0.16% |

| Oil | |

| Oil India Limited | 0.51% |

| Textiles & Apparels | |

| K.P.R. Mill Limited | 0.29% |

| Trident Limited | 0.20% |

| Non - Ferrous Metals | |

| Hindustan Zinc Limited | 0.45% |

| Industrial Manufacturing | |

| Honeywell Automation India Limited | 0.44% |

| Personal Products | |

| Emami Limited | 0.43% |

| Capital Markets | |

| Nippon Life India Asset Management Limited | 0.22% |

| ICICI Securities Limited | 0.20% |

| Agricultural Food & other Products | |

| Patanjali Foods Limited | 0.36% |

| Equity Holding Total | 100.02% |

| Cash & Other Receivables Total | -0.02% |

| Total | 100.00% |

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MAM150ETF | 7.28% |

13.00% |

||

| Scheme Benchmark* | 7.44% |

13.37% |

||

| Additional Benchmark** | 8.48% |

11.63% |

||

| NAV as on 28th April, 2023 | ₹ 11.9953 | |||

| Index Value (28th April, 2023) | Index Value of benchmark is 14,944.49 and S&P BSE Sensex (TRI) is 92,568.15 |

|||

| Allotment Date | 09th March, 2022 | |||

| Scheme Benchmark | *Nifty Midcap 150 Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Fund manager : Ms.Ekta Gala managing the scheme since March 09, 2022.

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

Past Performance may or may not be sustained in future.Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.439. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option

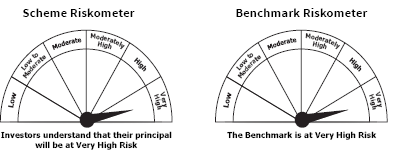

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of the NIFTY Midcap 150 Index, subject to tracking errors over the long-term

• Investment in equity securities covered by the NIFTY Midcap 150 Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol : MAM150ETF

BSE Code: 543481

Bloomberg Code: MAM150ETF IN Equity

Reuters Code: MIRA.NS