MIRAE ASSET

S&P BSE SENSEX ETF$ (NSE Symbol : SENSEXETF BSE Code: 43999)

(An open-ended scheme replicating/tracking S&P BSE Sensex Total Return Index)

| Type of Scheme | An open-ended scheme replicating/tracking S&P BSE Sensex Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the S&P BSE Sensex Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme would be achieved. |

Fund Manager** |

Ms. Ekta Gala (since September 29, 2023) Mr. Vishal Singh (since September 29, 2023) |

| Allotment Date | 29th September 2023 |

| Benchmark Index | S&P BSE Sensex (TRI) |

| Minimum Investment Amount^ |

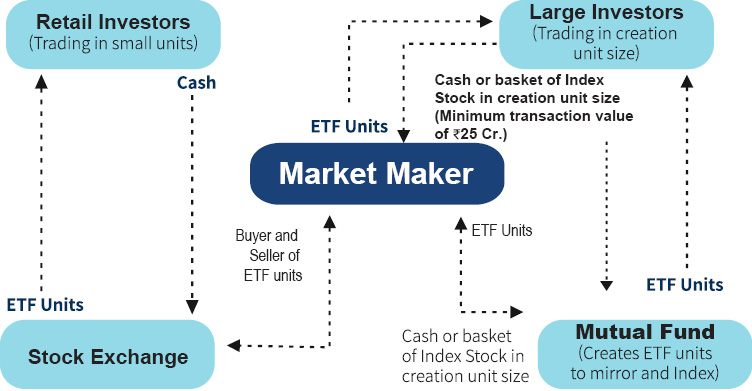

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange In multiple of 1 units Directly with AMC In multiple of 5,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: NIL |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on November 30, 2023 | 11.43 |

| Net AUM (₹ Cr.) | 11.71 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.01% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on November 30, 2023 | 0.09% |

| **For experience of Fund Managers Click Here | |

| ^The applicability of said threshold limit for all investors (other than Market Makers) has been extended for the below categories of investors till April 30, 2024:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 67.1119 (Per Unit) |

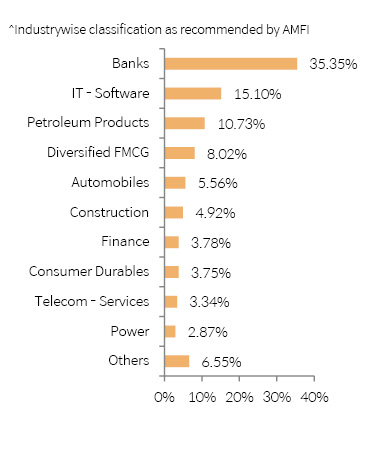

| Portfolio Holdings | % Allocation |

| Banks | |

| HDFC Bank Limited | 15.41% |

| ICICI Bank Limited | 8.57% |

| Axis Bank Limited | 3.99% |

| Kotak Mahindra Bank Limited | 3.29% |

| State Bank of India | 2.84% |

| IndusInd Bank Limited | 1.25% |

| IT - Software | |

| Infosys Limited | 6.80% |

| Tata Consultancy Services Limited | 4.68% |

| HCL Technologies Limited | 1.86% |

| Tech Mahindra Limited | 1.00% |

| Wipro Limited | 0.76% |

| Petroleum Products | |

| Reliance Industries Limited | 10.73% |

| Diversified FMCG | |

| ITC Limited | 5.05% |

| Hindustan Unilever Limited | 2.97% |

| Automobiles | |

| Mahindra & Mahindra Limited | 2.06% |

| Maruti Suzuki India Limited | 1.84% |

| Tata Motors Limited | 1.66% |

| Construction | |

| Larsen & Toubro Limited | 4.92% |

| Finance | |

| Bajaj Finance Limited | 2.59% |

| Bajaj Finserv Limited | 1.19% |

| Consumer Durables | |

| Titan Company Limited | 1.91% |

| Asian Paints Limited | 1.84% |

| Telecom - Services | |

| Bharti Airtel Limited | 3.34% |

| Power | |

| NTPC Limited | 1.62% |

| Power Grid Corporation of India Limited | 1.25% |

| Ferrous Metals | |

| Tata Steel Limited | 1.35% |

| JSW Steel Limited | 0.99% |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Limited | 1.73% |

| Cement & Cement Products | |

| UltraTech Cement Limited | 1.36% |

| Food Products | |

| Nestle India Limited | 1.12% |

| Equity Holding Total | 99.97% |

| Cash & Other Receivables Total | 0.03% |

| Total | 100.00% |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

Parwati Capital Market Private Limited

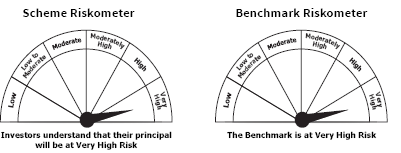

This product is suitable for investors who are seeking*

• Returns that commensurate with performance of S&P BSE Sensex Total Return Index, subject to tracking error over long term

• Investments in equity securities covered by S&P BSE Sensex Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :SENSEXETF

BSE Code:543999

Bloomberg Code:SENSEXETF IN Equity

Reuters Code: MIRA.NS

$Pursuant to clause 13.2.2 of SEBI master circular dated May 19, 2023, the scheme is in existence for less than 6 months