MIRAE ASSET

NIFTY 200 ALPHA 30 ETF$ (NSE Symbol : ALPHAETF BSE Code: 544007)

(An open-ended scheme replicating/tracking Nifty 200 Alpha 30 Total Return Index)

| Type of Scheme | An open-ended scheme replicating/tracking Nifty 200 Alpha 30 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty 200 Alpha 30 Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme would be achieved. |

Fund Manager** |

Ms. Ekta Gala (since October 20, 2023) Mr. Vishal Singh (since October 20, 2023) |

| Allotment Date | 20th October 2023 |

| Benchmark Index | Nifty 200 Alpha 30 (TRI) |

| Minimum Investment Amount^ |

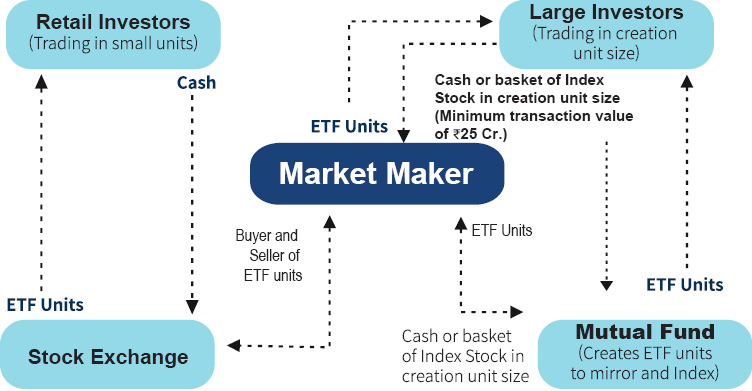

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange In multiple of 1 units Directly with AMC In multiple of 5,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: NIL |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on December 31, 2023 | 22.85 |

| Net AUM (₹ Cr.) | 25.23 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.23% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on December 31, 2023 | 0.28% |

| **For experience of Fund Managers Click Here | |

| ^The applicability of said threshold limit for all investors (other than Market Makers) has been extended for the below categories of investors till April 30, 2024:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 20.8541 (Per Unit) |

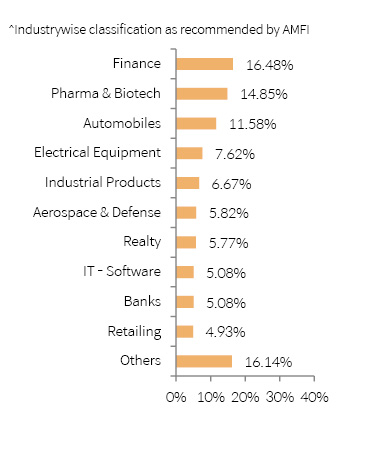

| Portfolio Holdings | % Allocation |

| Finance | |

| REC Ltd | 4.74% |

| Power Finance Corporation Ltd | 4.69% |

| L&T Finance Holdings Ltd | 3.98% |

| Cholamandalam Investment and Finance Company Ltd | 3.07% |

| Pharmaceuticals & Biotechnology | |

| Aurobindo Pharma Ltd | 4.99% |

| Lupin Ltd | 3.78% |

| Zydus Lifesciences Ltd | 3.11% |

| Alkem Laboratories Ltd | 2.97% |

| Automobiles | |

| TVS Motor Company Ltd | 4.35% |

| Bajaj Auto Ltd | 3.65% |

| Tata Motors Ltd | 3.58% |

| Electrical Equipment | |

| Bharat Heavy Electricals Ltd | 5.11% |

| ABB India Ltd | 2.51% |

| Industrial Products | |

| Polycab India Ltd | 4.98% |

| Cummins India Ltd | 1.69% |

| Aerospace & Defense | |

| Hindustan Aeronautics Ltd | 3.85% |

| Bharat Electronics Ltd | 1.97% |

| Realty | |

| DLF Ltd | 2.98% |

| Oberoi Realty Ltd | 2.79% |

| Banks | |

| Punjab National Bank | 2.77% |

| IDFC First Bank Ltd | 2.31% |

| IT - Software | |

| Persistent Systems Ltd | 2.91% |

| Coforge Ltd | 2.17% |

| Retailing | |

| Trent Ltd | 4.93% |

| Telecom - Services | |

| Vodafone Idea Ltd | 3.72% |

| Minerals & Mining | |

| NMDC Ltd | 3.00% |

| Power | |

| NTPC Ltd | 2.84% |

| Consumable Fuels | |

| Coal India Ltd | 2.82% |

| Agricultural, Commercial & Construction Vehicles | |

| Escorts Kubota Ltd | 1.93% |

| Auto Components | |

| Apollo Tyres Ltd | 1.83% |

| Equity Holding Total | 100.02% |

| Cash & Other Receivables Total | -0.02% |

| Total | 100.00% |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

Parwati Capital Market Private Limited

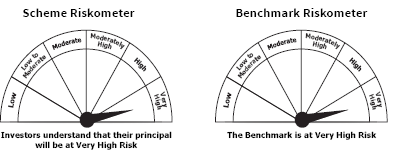

This product is suitable for investors who are seeking*

• Returns that commensurate with the performance of Nifty 200 Alpha 30 Total Return Index, subject to tracking error over long term.

• Investment in equity securities covered by Nifty 200 Alpha 30 Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :ALPHAETF

BSE Code:544007

Bloomberg Code:ALPHAETF IN Equity

Reuters Code: MIRA.NS

$Pursuant to clause 13.2.2 of SEBI master circular dated May 19, 2023, the scheme is in existence for less than 6 months