EXIT LOAD

Mirae Asset Large Cap Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Large & Midcap Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset ELSS Tax Saver Fund

Entry load: NA

Exit load:

NIL

Mirae Asset Focused Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Midcap Fund

Entry load: NA

Exit load:

If redeemed within 1 year (365 days) from the date of allotment:1%.

If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Great Consumer Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Healthcare Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Banking and Financial Services Fund

Entry load: NA

Exit load:

If redeemed within 1 year (365 days) from the date of allotment:1%.

If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Flexi Cap Fund

Entry load: NA

Exit load:

If redeemed within 1 year (365 days) from the date of allotment:1%.

If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Multicap Fund

Entry load: NA

Exit load:

If redeemed within 1 year (365 days) from the date of allotment:1%.

If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Overnight Fund

Entry load: NA

Exit load: NIL

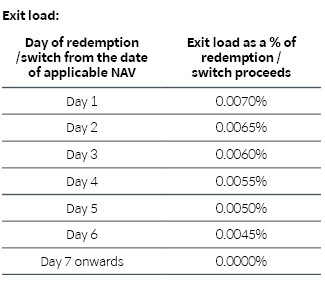

Mirae Asset Liquid Fund

Entry load: NA

Mirae Asset Ultra Short Duration Fund

Entry load: NA

Exit load: NIL

Mirae Asset Low Duration Fund

Entry load: NA

Exit load: NIL

Mirae Asset Money Market Fund

Entry load: NA

Exit load: NIL

Mirae Asset Short Duration Fund

Entry load: NA

Exit load: NIL

Mirae Asset Banking and PSU Fund

Entry load: NA

Exit load: NIL

Mirae Asset Dynamic Bond Fund

Entry load: NA

Exit load: NIL

Mirae Asset Corporate Bond Fund

Entry load: NA

Exit load: NIL

Mirae Asset Nifty SDL Jun 2027 Index Fund

Entry load: NA

Exit load: NIL

Mirae Asset Nifty AAA PSU Bond Plus SDL Apr 2026 50:50 Index Fund

Entry load: NA

Exit load: NIL

Mirae Asset CRISIL IBX Gilt Index - April 2033 Index Fund

Entry load: NA

Exit load: NIL

Mirae Asset Nifty SDL June 2028 Index Fund

Entry load: NA

Exit load: NIL

Mirae Asset Aggressive Hybrid Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Balanced AdvantageFund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Equity Savings Fund

Entry load: NA

Exit load:

I. For investors who have opted for SWP under the plan:

a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil.

b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out):

-If redeemed within 1 year (365 days) from the date of allotment: 1%

-If redeemed after 1 year (365 days) from the date of allotment: NIL

Mirae Asset Arbitrage Fund

Entry load: NA

Exit load:# 0.25% if redeemed or switched out within 15 days from the date of allotment Nil after 15 days

#As per notice cum addendum no. 56/2023 Change in exit load of Mirae Asset Arbitrage Fund. Please visit the website for more details https://www.miraeassetmf.co.in/downloads/statutory-disclosure/addendum

Mirae Asset Nifty 50 ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Nifty 50 ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Nifty Next 50 ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Nifty Next 50 ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Nifty 100 ESG Sector Leaders ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Nifty 100 ESG Sector Leaders ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset NYSE FANG+ ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset NYSE FANG+ ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Nifty Financial Services ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Nifty Financial Services ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset S&P 500 Top 50 ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset S&P 500 Top 50 ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Hang Seng TECH ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Hang Seng TECH ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Nifty India Manufacturing ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Nifty India Manufacturing ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Nifty Midcap 150 ETF

Entry load: NA

Exit load:

For Creation Unit Size: No Exit load will be levied on redemptions made by Market Makers / Large Investors directly with the Fund in

Creation Unit Size.

For other than Creation Unit Size: Not Applicable - The Units of Mirae Asset Nifty Midcap 150 ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days

Mirae Asset Gold ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty 100 Low Volatility 30 ETF

Entry load: NA

Exit load: NIL

Mirae Asset Silver ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty Bank ETF

Entry load: NA

Exit load: NIL

Mirae Asset S&P BSE Sensex ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty 200 Alpha 30 ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty IT ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty 8-13 yr G-Sec ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty 1D Rate Liquid ETF

Entry load: NA

Exit load: NIL

Mirae Asset Nifty 100 ESG Sector Leaders Fund of Fund

Entry load: NA

Exit load:

if redeemed or switched out within 5 calendar days from the date of allotment: 0.05%

if redeemed or switched out after 5 days from date of allotment: Nil

Mirae Asset Equity Allocator Fund of Fund

Entry load: NA

Exit load:

if redeemed or switched out within 5 calendar days from the date of allotment: 0.05%

if redeemed or switched out after 5 days from date of allotment: Nil

Mirae Asset NYSE FANG+ ETF Fund of Fund

Entry load: NA

Exit load:

If redeemed within 3 months from the date of allotment: 0.50%

If redeemed after 3 months from the date of allotment: NIL

Mirae Asset S&P 500 Top 50 ETF Fund of Fund

Entry load: NA

Exit load:

If redeemed within 3 months from the date of allotment: 0.50%

If redeemed after 3 months from the date of allotment: NIL

Mirae Asset Hang Seng TECH ETF Fund of Fund

Entry load: NA

Exit load:

If redeemed within 3 months from the date of allotment: 0.50%

If redeemed after 3 months from the date of allotment: NIL

Mirae Asset Nifty India Manufacturing ETF Fund of Fund

Entry load: NA

Exit load:

If redeemed within 3 months from the date of allotment: 0.50%

If redeemed after 3 months from the date of allotment: NIL

Mirae Asset Global Electric & Autonomous Vehicles ETFs Fund of Fund

Entry load: NA

Exit load:

If redeemed within 1 year (365 days) from the date of allotment: 1%

If redeemed after 1 year (365 days) from the date of allotment: NIL.

Mirae Asset Global X Artificial Intelligence & Technology ETF Fund of Fund

Entry load: NA

Exit load:

If redeemed within 1 year (365 days) from the date of allotment: 1%

If redeemed after 1 year (365 days) from the date of allotment: NIL.