MIRAE ASSET

NIFTY 100 LOW VOLATILITY 30 ETF (NSE Symbol : LOWVOL, BSE Code: 543858)

(An open ended scheme replicating/tracking Nifty 100 Low Volatility 30 Total Return Index)

| Type of Scheme | An open ended scheme replicating/tracking Nifty 100 Low Volatility 30 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty 100 Low Volatility 30 Total Return Index, subject to tracking error. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Ms. Ekta Gala (since March 24, 2023) Mr. Vishal Singh (since August 28, 2023) |

| Allotment Date | 24th March 2023 |

| Benchmark Index | Nifty 100 Low Volatility 30 TRI |

| Minimum Investment Amount^ |

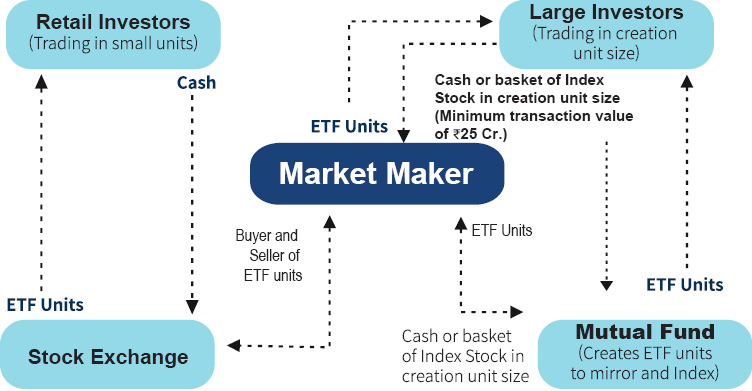

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange in multiple of 1 unit. With AMC: In multiples of 30,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: NIL |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on December 31, 2023 | 7.07 |

| Net AUM (₹ Cr.) | 7.35 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.10% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on December 31, 2023 | 0.29% |

| **For experience of Fund Managers Click Here | |

| ^The applicability of said threshold limit for all investors (other than Market Makers) has been extended for the below categories of investors till April 30, 2024:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 173.5476 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

Parwati Capital Market Private Limited

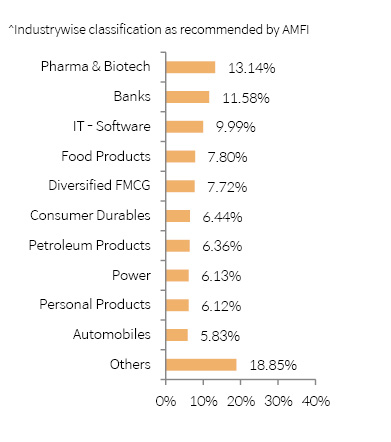

| Portfolio Holdings | % Allocation |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Ltd | 3.95% |

| Dr. Reddy's Laboratories Ltd | 3.47% |

| Torrent Pharmaceuticals Ltd | 2.98% |

| Cipla Ltd | 2.74% |

| Banks | |

| ICICI Bank Ltd | 4.10% |

| Kotak Mahindra Bank Ltd | 3.75% |

| HDFC Bank Ltd | 3.73% |

| IT - Software | |

| Tata Consultancy Services Ltd | 3.48% |

| Wipro Ltd | 3.44% |

| HCL Technologies Ltd | 3.07% |

| Food Products | |

| Nestle India Ltd | 3.94% |

| Britannia Industries Ltd | 3.86% |

| Diversified FMCG | |

| Hindustan Unilever Ltd | 4.09% |

| ITC Ltd | 3.63% |

| Consumer Durables | |

| Asian Paints Ltd | 3.62% |

| Berger Paints (I) Ltd | 2.82% |

| Petroleum Products | |

| Reliance Industries Ltd | 3.48% |

| Indian Oil Corporation Ltd | 2.88% |

| Power | |

| NTPC Ltd | 3.15% |

| Power Grid Corporation of India Ltd | 2.98% |

| Personal Products | |

| Dabur India Ltd | 3.09% |

| Colgate Palmolive (India) Ltd | 3.03% |

| Automobiles | |

| Bajaj Auto Ltd | 3.07% |

| Hero MotoCorp Ltd | 2.76% |

| Cement & Cement Products | |

| UltraTech Cement Ltd | 3.57% |

| Construction | |

| Larsen & Toubro Ltd | 3.32% |

| Agricultural Food & other Products | |

| Marico Ltd | 3.05% |

| Chemicals & Petrochemicals | |

| Pidilite Industries Ltd | 3.00% |

| Auto Components | |

| Bosch Ltd | 2.99% |

| Insurance | |

| SBI Life Insurance Company Ltd | 2.92% |

| Equity Holding Total | 99.96% |

| Cash & Other Receivables Total | 0.04% |

| Total | 100.00% |

| Returns (in%) | ||||

| 6 Months (Annualized) | SI (Annualized) | |||

| Mirae Asset Nifty 100 Low Volatility 30 ETF | 41.90% |

48.42% |

||

| Scheme Benchmark* | 42.50% |

49.25% |

||

| Additional Benchmark** | 27.39% |

38.16% |

||

| NAV as on 29th December, 2023 | ₹ 173.5476 | |||

| Index Value (29th December, 2023) | Index Value of benchmark is 23,557.98 and Nifty 50 Index (TRI) is 31,933.93 | |||

| Allotment Date | 24th March, 2023 | |||

| Scheme Benchmark | *Nifty 100 Low Volatility 30 TRI | |||

| Additional Benchmark | **Nifty 50 Index (TRI) | |||

Fund manager : Ms.Ekta Gala & Mr. Vishal Singh managing the scheme since March 24, 2023 & (w.e.f August 28, 2023).

Note: Returns (%) for less than 1 year calculated on simple annualized basis, others are CAGR- Compounded Annualized Growth returns.

Latest available NAV has been taken for return calculation wherever applicable

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 127.9150. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option

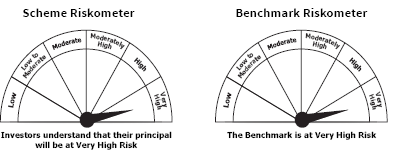

This product is suitable for investors who are seeking*

• Returns that commensurate with the performance of Nifty 100 Low Volatility 30 Total Return Index, subject to tracking error over long term

• Investment in equity securities covered by Nifty 100 Low Volatility 30 Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :LOWVOL

BSE Code:543858

Bloomberg Code:LOWVOL IN Equity

Reuters Code: MIRA.NS