MIRAE ASSET

S&P BSE SENSEX ETF$ (NSE Symbol : SENSEXETF BSE Code: 43999)

(An open-ended scheme replicating/tracking S&P BSE Sensex Total Return Index)

| Type of Scheme | An open-ended scheme replicating/tracking S&P BSE Sensex Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the S&P BSE Sensex Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme would be achieved. |

Fund Manager** |

Ms. Ekta Gala (since September 29, 2023) Mr. Vishal Singh (since September 29, 2023) |

| Allotment Date | 29th September 2023 |

| Benchmark Index | S&P BSE Sensex (TRI) |

| Minimum Investment Amount^ |

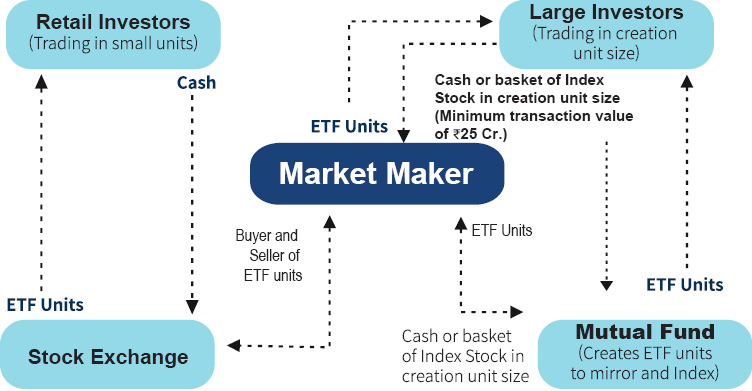

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange In multiple of 1 units Directly with AMC In multiple of 5,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: NIL |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on December 31, 2023 | 12.32 |

| Net AUM (₹ Cr.) | 12.63 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.01% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on December 31, 2023 | 0.09% |

| **For experience of Fund Managers Click Here | |

| ^The applicability of said threshold limit for all investors (other than Market Makers) has been extended for the below categories of investors till April 30, 2024:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 72.3664 (Per Unit) |

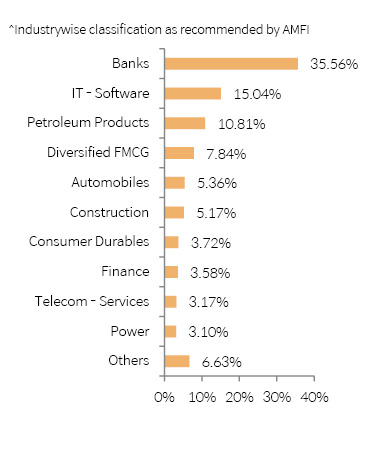

| Portfolio Holdings | % Allocation |

| Banks | |

| HDFC Bank Ltd | 15.73% |

| ICICI Bank Ltd | 8.47% |

| Axis Bank Ltd | 3.79% |

| Kotak Mahindra Bank Ltd | 3.31% |

| State Bank of India | 2.99% |

| IndusInd Bank Ltd | 1.27% |

| IT - Software | |

| Infosys Ltd | 6.68% |

| Tata Consultancy Services Ltd | 4.71% |

| HCL Technologies Ltd | 1.88% |

| Tech Mahindra Ltd | 0.96% |

| Wipro Ltd | 0.81% |

| Petroleum Products | |

| Reliance Industries Ltd | 10.81% |

| Diversified FMCG | |

| ITC Ltd | 4.96% |

| Hindustan Unilever Ltd | 2.88% |

| Automobiles | |

| Mahindra & Mahindra Ltd | 2.00% |

| Tata Motors Ltd | 1.70% |

| Maruti Suzuki India Ltd | 1.66% |

| Construction | |

| Larsen & Toubro Ltd | 5.17% |

| Consumer Durables | |

| Titan Company Ltd | 1.86% |

| Asian Paints Ltd | 1.86% |

| Finance | |

| Bajaj Finance Ltd | 2.47% |

| Bajaj Finserv Ltd | 1.11% |

| Telecom - Services | |

| Bharti Airtel Ltd | 3.17% |

| Power | |

| NTPC Ltd | 1.79% |

| Power Grid Corporation of India Ltd | 1.31% |

| Ferrous Metals | |

| Tata Steel Ltd | 1.36% |

| JSW Steel Ltd | 1.02% |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Ltd | 1.65% |

| Cement & Cement Products | |

| UltraTech Cement Ltd | 1.46% |

| Food Products | |

| Nestle India Ltd | 1.14% |

| Equity Holding Total | 99.98% |

| Cash & Other Receivables Total | 0.02% |

| Total | 100.00% |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

Parwati Capital Market Private Limited

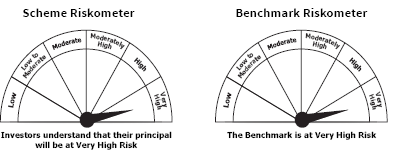

This product is suitable for investors who are seeking*

• Returns that commensurate with performance of S&P BSE Sensex Total Return Index, subject to tracking error over long term

• Investments in equity securities covered by S&P BSE Sensex Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :SENSEXETF

BSE Code:543999

Bloomberg Code:SENSEXETF IN Equity

Reuters Code: MIRA.NS

$Pursuant to clause 13.2.2 of SEBI master circular dated May 19, 2023, the scheme is in existence for less than 6 months