Equity Allocator Philosophy

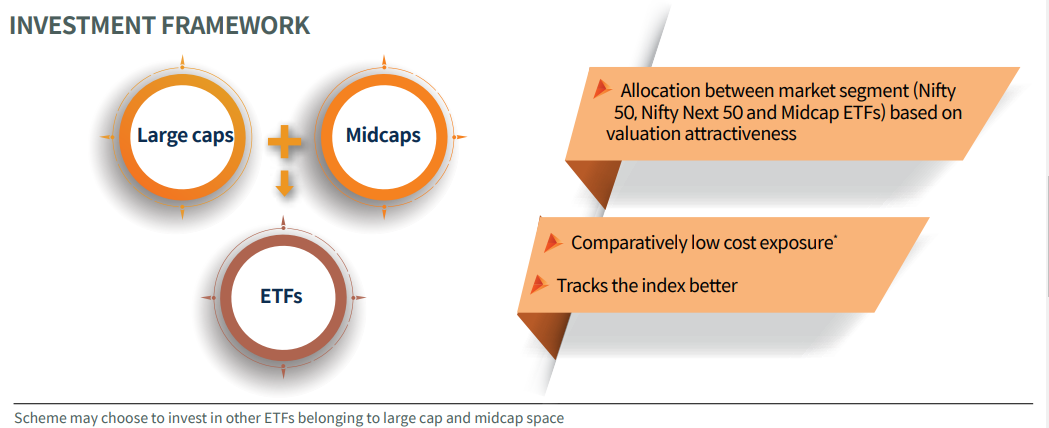

Mirae Asset Equity Allocator Fund of Fund will invest in the domestic equity Exchange Traded Funds. The aim of the fund is to provide investor

- Passive exposure to large and midcap segment

- Use low cost ETFs with an aim to generate market returns

- Use active asset allocation with an aim to generate nominal alpha

- Provide convenience of mutual fund for investing in ETF