MIRAE ASSET

NIFTY Next 50 ETF - (MANXT50ETF) $

An open ended scheme replicating/tracking Nifty Next 50 Total Return Index

| Type of Scheme | An open ended scheme replicating/tracking Nifty Next 50 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty 50 Index, subject to tracking error. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Ms. Bharti Sawant (since inception) |

| Allotment Date | 24th January, 2020 |

| Benchmark Index | Nifty Next 50 TRI (Total Return Index) |

| Minimum Investment Amount |

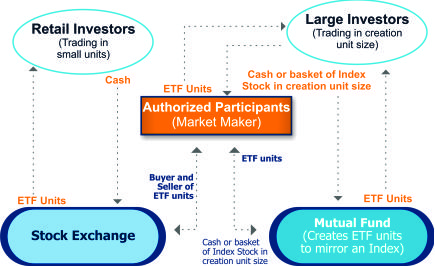

Other Investors(Including Authorized Participants/ Large Investors): Application for subscription of the Units in Creation unit size can be made either:In exchange of Cash*[as determined by the AMC equivalent to the cost incurred towards the purchase of predefined basket of securities that represent the underlying index (i.e. Portfolio Deposit)], Cash component and other applicable transaction charges; or in exchange of Portfolio Deposit [i.e. by depositing basket of securities constituting Nifty 50 Index] along with the cash component and applicable transaction charges." There is no minimum investment, although units can be purchased/subscribed in round lots of 1 on the BSE/NSE (Stock Exchanges) on all the trading days. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MANXT50ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on August 31, 2020 | 35.42 |

| Net AUM (₹ Cr.) | 34.92 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on August 31, 2020 | 0.14% |

| ANY DATE SIP provides one of the better investment experiences by allowing the investor to choose any investment date of the month (i.e., from 1st to 28th) depending upon the investors' expense and income flow. | |

| **For experience of Fund Managers Click Here | |

| ₹ 269.351 (Per Unit) |

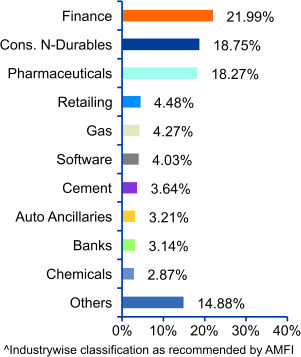

| Portfolio Holdings | % Allocation |

| Finance | |

| SBI Life Insurance Company Ltd | 4.35% |

| ICICI Lombard General Insurance Company Ltd | 3.41% |

| Piramal Enterprises Ltd | 2.09% |

| ICICI Prudential Life Insurance Company Ltd | 2.08% |

| Bajaj Holdings & Investment Ltd | 1.82% |

| HDFC Asset Management Company Ltd | 1.81% |

| Shriram Transport Finance Company Ltd | 1.72% |

| Muthoot Finance Ltd | 1.64% |

| Power Finance Corporation Ltd | 1.45% |

| SBI Cards and Payment Services Ltd | 1.13% |

| General Insurance Corporation of India | 0.49% |

| Consumer Non Durables | |

| Dabur India Ltd | 3.70% |

| Godrej Consumer Products Ltd | 3.27% |

| Marico Ltd | 2.58% |

| Colgate Palmolive (India) Ltd | 2.49% |

| United Spirits Ltd | 2.18% |

| Berger Paints (I) Ltd | 1.77% |

| United Breweries Ltd | 1.49% |

| Procter & Gamble Hygiene and Health Care Ltd | 1.28% |

| Pharmaceuticals | |

| Divi's Laboratories Ltd | 5.40% |

| Aurobindo Pharma Ltd | 3.26% |

| Lupin Ltd | 3.05% |

| Biocon Ltd | 2.29% |

| Torrent Pharmaceuticals Ltd | 1.79% |

| Cadila Healthcare Ltd | 1.29% |

| Abbott India Ltd | 1.18% |

| Retailing | |

| Avenue Supermarts Ltd | 4.48% |

| Gas | |

| Petronet LNG Ltd | 2.39% |

| Indraprastha Gas Ltd | 1.88% |

| Software | |

| Info Edge (India) Ltd | 3.08% |

| Oracle Financial Services Software Ltd | 0.95% |

| Cement | |

| Ambuja Cements Ltd | 2.11% |

| ACC Ltd | 1.53% |

| Auto Ancillaries | |

| Motherson Sumi Systems Ltd | 1.72% |

| Bosch Ltd | 1.50% |

| Banks | |

| Bandhan Bank Ltd | 1.70% |

| Bank of Baroda | 0.81% |

| Punjab National Bank | 0.64% |

| Chemicals | |

| Pidilite Industries Ltd | 2.87% |

| Transportation | |

| InterGlobe Aviation Ltd | 1.41% |

| Container Corporation of India Ltd | 1.41% |

| Consumer Durables | |

| Havells India Ltd | 2.08% |

| Petroleum Products | |

| Hindustan Petroleum Corporation Ltd | 2.05% |

| Power | |

| Adani Transmission Ltd | 0.97% |

| NHPC Ltd | 0.73% |

| Textile Products | |

| Page Industries Ltd | 1.50% |

| Industrial Capital Goods | |

| Siemens Ltd | 1.40% |

| Construction | |

| DLF Ltd | 1.33% |

| Minerals/Mining | |

| NMDC Ltd | 1.23% |

| Non - Ferrous Metals | |

| Hindustan Zinc Ltd | 0.77% |

| Equity Holding Total | 99.54% |

| Cash & Other Receivables | 0.46% |

| Total | 100.00% |

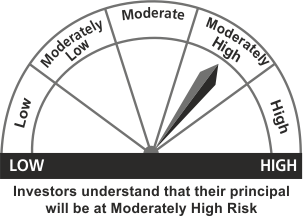

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of the NIFTY 50, subject to tracking errors over long term

• Investment in equity securities covered by the NIFTY 50

• Degree of risk – MODERATELY HIGH

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : Since the scheme is in existence for less than 1 year, as per SEBI regulation performance of the scheme has not been shown. The performance of other funds managed by the same fund manager is given in the respective page of the schemes