MIRAE ASSET

FOCUSED FUND - (MAFF)

(Focused Fund - An open ended equity scheme investing in a maximum of 30 stocks intending to focus in large cap, mid cap and small cap category (i.e., Multi-cap))

| Type of Scheme | Focused Fund - An open ended equity scheme investing in a maximum of 30 stocks intending to focus in large cap, mid cap and small cap category (i.e., Multi-cap) |

| Investment Objective | To generate long term capital appreciation/income by investing in equity & equity related instruments of up to 30 companies. There is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Mr. Gaurav Misra (since inception) |

| Allotment Date | 14th May, 2019 |

| Benchmark Index | Nifty 200 Index (TRI) |

| Minimum Investment Amount |

₹5,000/- and in multiples of ₹1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹1,000/- (multiples of ₹1/- thereafter), minimum 5 installments |

| Load Structure | Entry load: NA Exit load: I. For investors who have opted for SWP under the plan: a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil. b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO): •If redeemed within 1 year (365 days) from the date of allotment: 1% •If redeemed after 1 year (365 days) from the date of allotment: NIL II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out): •If redeemed within 1 year (365 days) from the date of allotment: 1% •If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and Dividend Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on February 28, 2021 | 5,130.16 |

| Net AUM (₹ Cr.) |

5,179.58 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on February 28, 2021 |

Regular Plan: 1.94% Direct Plan: 0.32% |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 16.010 | ₹ 15.545 |

| Dividend | ₹ 16.007 | ₹ 15.547 |

| Portfolio Turnover Ratio^ | 0.24 times |

@The Volatility, Beta, R Squared, Sharpe Ratio & Information Ratio are calculated on returns from last three years Monthly data points. # Risk free rate: FBIL OVERNIGHT MIBOR as on 27th February, 2021. ^Basis last rolling 12 months. |

|

| New Position Bought |

| Stock |

| Finance |

| Muthoot Finance Limited |

| Positions Exited |

| Stock |

| Consumer Durables |

| Whirlpool of India Limited |

| Positions Increased |

| Stock |

| Banks |

| HDFC Bank Limited |

| State Bank of India |

| Cement |

| JK Cement Limited |

| Consumer Durables |

| Voltas Limited |

| Finance |

| Cholamandalam Investment and Finance Company Limited |

| HDFC Life Insurance Company Limited |

| Max Financial Services Limited |

| Gas |

| Gujarat State Petronet Limited |

| Healthcare Services |

| Dr. Lal Path Labs Limited |

| Petroleum Products |

| Hindustan Petroleum Corporation Limited |

| Telecom - Services |

| Bharti Airtel Limited |

| Positions Decreased |

| Stock |

| Auto |

| Ashok Leyland Limited |

| Maruti Suzuki India Limited |

| Banks |

| ICICI Bank Limited |

| Consumer Non Durables |

| Britannia Industries Limited |

| Dabur India Limited |

| Kansai Nerolac Paints Limited |

| Healthcare Services |

| Gland Pharma Limited |

| Software |

| Infosys Limited |

| Larsen & Toubro Infotech Limited |

| MphasiS Limited |

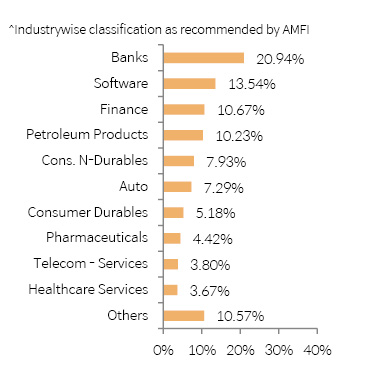

| Portfolio Holdings | % Allocation | |

| Banks | ||

| HDFC Bank Ltd | 9.48% | |

| ICICI Bank Ltd | 8.35% | |

| State Bank of India | 3.11% | |

| Software | ||

| Infosys Ltd | 9.57% | |

| Larsen & Toubro Infotech Ltd | 2.17% | |

| MphasiS Ltd | 1.80% | |

| Finance | ||

| Max Financial Services Ltd | 2.93% | |

| HDFC Life Insurance Company Ltd | 2.28% | |

| Cholamandalam Investment and Finance Company Ltd | 1.97% | |

| Muthoot Finance Ltd | 1.75% | |

| Indian Energy Exchange Ltd | 1.73% | |

| Petroleum Products | ||

| Reliance Industries Ltd* | 8.27% | |

| Hindustan Petroleum Corporation Ltd | 1.96% | |

| Consumer Non Durables | ||

| Dabur India Ltd | 2.68% | |

| Kansai Nerolac Paints Ltd | 2.64% | |

| Britannia Industries Ltd | 2.61% | |

| Auto | ||

| Maruti Suzuki India Ltd | 3.39% | |

| Ashok Leyland Ltd | 2.27% | |

| Eicher Motors Ltd | 1.63% | |

| Consumer Durables | ||

| Voltas Ltd | 2.79% | |

| Orient Electric Ltd | 2.39% | |

| Pharmaceuticals | ||

| Torrent Pharmaceuticals Ltd | 2.68% | |

| Syngene International Ltd | 1.75% | |

| Telecom - Services | ||

| Bharti Airtel Ltd | 3.80% | |

| Healthcare Services | ||

| Gland Pharma Ltd | 2.59% | |

| Dr. Lal Path Labs Ltd | 1.08% | |

| Cement | ||

| JK Cement Ltd | 3.05% | |

| Industrial Products | ||

| SKF India Ltd | 2.86% | |

| Industrial Capital Goods | ||

| Bharat Electronics Ltd | 2.69% | |

| Gas | ||

| Gujarat State Petronet Ltd | 1.97% | |

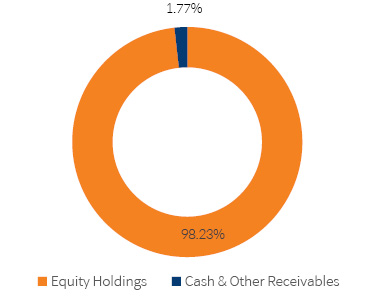

| Equity Holding Total | 98.23% | |

| Cash & Other Receivables | 1.77% | |

| Total | 100.00% | |

*Includes "Partly Paid Shares"

| Returns (%) | ||||

| 1 Yr | SI | |||

| MAFF | 39.11 |

27.92 |

||

| Scheme Benchmark* | 32.24 |

17.54 |

||

| Additional Benchmark** | 30.00 |

18.04 |

||

| NAV as on 26th Febraury, 2021 | 15,545 | |||

| Index Value (26th February, 2021) | Index Value of Scheme benchmark is 9,622.62 and S&P BSE Sensex (TRI) is 72,642.78. | |||

| Allotment Date | 14th May, 2019 | |||

| Scheme Benchmark | *Nifty 200 Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Note:1. Different Plans under the scheme has different expense structure. The reference and details provided herein are of Regular Plan - Growth Option

2. Fund manager : Mr. Gaurav Misra managing the scheme since May, 2019

| Period | Total Amount Invested | Mkt Value as on 26-Febraury-2021 |

SI |

210,000 |

291,350 |

1 Yr |

120,000 |

165,007 |

Returns (%) |

Period |

|

SI |

1yr |

|

Fund Return& (%) |

41.19 |

77.76 |

Benchmark Return& (%) |

32.80 |

67.04 |

Add. Benchmark Return& (%) |

31.04 |

62.49 |

& The SIP returns are calculated by XIRR approach assuming investment of ₹ 10,000/- on the 1st working day of every month.

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income.

• Investment in a concentrated portfolio of equity & equity related instrument of up to 30 companies across large, mid and small cap category.

• Degree of risk – Very High

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.00. The performance of other funds managed by the same fund manager is given in the respective page of the schemes