MIRAE ASSET NIFTY MIDSMALLCAP400

MOMENTUM QUALITY 100 ETF (NSE Symbol : MIDSMALL, BSE Code: 544180)

(An open-ended scheme replicating/tracking Nifty MidSmallcap400 Momentum Quality 100 Total Return Index)

| Type of Scheme | An open - ended scheme replicating / tracking Nifty MidSmallcap400 Momentum Quality 100 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty MidSmallcap400 Momentum Quality 100 Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment objective of the scheme would be achieved. |

Fund Manager**

|

Ms. Ekta Gala & Mr. Vishal Singh (since May 22, 2024) |

| Allotment Date | 22nd May 2024 |

| Benchmark Index | Nifty MidSmallcap400 Momentum Quality 100 TRI |

| Minimum Investment Amount^ |

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange In multiple of 1 units Directly with AMC In multiple of 2,00,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load:NIL |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on June 30, 2024 | 159.1979 |

| Net AUM (₹ Cr.) | 185.66 |

| Tracking Error Value~ ~Since Inception Tracking Error is |

0.32% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on June 30, 2024 | 0.35% |

| **For experience of Fund Managers Click Here | |

| ^The applicability of said threshold limit for all investors (other than Market Makers) has been extended for the below categories of investors till October 31, 2024:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 51.9104 (Per Unit) |

| Portfolio Holdings | % Allocation |

Equity Shares |

|

Industrial Products |

|

Cummins India Limited |

4.92% |

Supreme Industries Limited |

1.92% |

Polycab India Limited |

1.71% |

KEI Industries Limited |

1.50% |

Astral Limited |

1.19% |

APL Apollo Tubes Limited |

1.08% |

Finolex Cables Limited |

0.68% |

Timken India Limited |

0.64% |

Godawari Power And Ispat limited |

0.44% |

KSB Limited |

0.32% |

Usha Martin Limited |

0.28% |

IT - Software |

|

Persistent Systems Limited |

1.96% |

Oracle Financial Services Software Limited |

1.73% |

Coforge Limited |

1.42% |

Tata Elxsi Limited |

1.12% |

KPIT Technologies Limited |

1.12% |

Birlasoft Limited |

0.52% |

Zensar Technologies Limited |

0.39% |

Capital Markets |

|

HDFC Asset Management Company Limited |

2.56% |

Central Depository Services (India) Limited |

1.18% |

Nippon Life India Asset Management Limited |

0.82% |

360 One WAM Limited |

0.78% |

Indian Energy Exchange Limited |

0.76% |

Motilal Oswal Financial Services Limited |

0.76% |

ICICI Securities Limited |

0.35% |

Electrical Equipment |

|

CG Power and Industrial Solutions Limited |

3.09% |

Thermax Limited |

1.77% |

Apar Industries Limited |

1.20% |

Triveni Turbine Limited |

0.38% |

Consumer Durables |

|

Dixon Technologies (India) Limited |

3.75% |

Voltas Limited |

2.24% |

Kajaria Ceramics Limited |

0.41% |

Pharmaceuticals & Biotechnology |

|

Aurobindo Pharma Limited |

1.58% |

Glenmark Pharmaceuticals Limited |

1.14% |

Alkem Laboratories Limited |

0.98% |

GlaxoSmithKline Pharmaceuticals Limited |

0.82% |

Abbott India Limited |

0.71% |

Natco Pharma Limited |

0.56% |

AstraZeneca Pharma India Limited |

0.22% |

Caplin Point Laboratories Limited |

0.15% |

Industrial Manufacturing |

|

Cochin Shipyard Limited |

2.21% |

Titagarh Rail Systems Limited |

1.07% |

Jupiter Wagons Limited |

0.74% |

Honeywell Automation India Limited |

0.68% |

Praj Industries Limited |

0.40% |

Elecon Engineering Company Limited |

0.30% |

Construction |

|

Rail Vikas Nigam Limited |

1.80% |

NCC Limited |

1.02% |

NBCC (India) Limited |

0.83% |

IRCON International Limited |

0.57% |

Engineers India Limited |

0.46% |

RITES Limited |

0.28% |

Power |

|

NHPC Limited |

2.10% |

Torrent Power Limited |

1.70% |

Chemicals & Petrochemicals |

|

Solar Industries India Limited |

1.82% |

Linde India Limited |

1.08% |

Deepak Nitrite Limited |

0.69% |

Auto Components |

|

Amara Raja Energy & Mobility Ltd |

1.58% |

UNO Minda Limited |

0.92% |

Endurance Technologies Limited |

0.46% |

HBL Power Systems Limited |

0.45% |

Gas |

|

Petronet LNG Limited |

1.36% |

Indraprastha Gas Limited |

0.70% |

Gujarat Gas Limited |

0.51% |

Mahanagar Gas Limited |

0.45% |

Oil |

|

Oil India Limited |

2.33% |

Banks |

|

Indian Bank |

1.05% |

Karur Vysya Bank Limited |

0.90% |

Bank of Maharashtra |

0.36% |

Non - Ferrous Metals |

|

National Aluminium Company Limited |

1.34% |

Hindustan Copper Limited |

0.91% |

Transport Services |

|

Container Corporation of India Limited |

1.55% |

The Great Eastern Shipping Company Limited |

0.62% |

Minerals & Mining |

|

NMDC Limited |

2.00% |

Gujarat Mineral Development Corporation Limited |

0.16% |

Ferrous Metals |

|

Jindal Stainless Limited |

1.88% |

Aerospace & Defense |

|

Bharat Dynamics Limited |

1.39% |

Garden Reach Shipbuilders & Engineers Limited |

0.43% |

Finance |

|

Housing & Urban Development Corporation Limited |

1.58% |

Agricultural, Commercial & Construction Vehicles |

|

Escorts Kubota Limited |

0.73% |

Action Construction Equipment Limited |

0.45% |

Realty |

|

Oberoi Realty Limited |

1.17% |

Fertilizers & Agrochemicals |

|

Coromandel International Limited |

0.93% |

Gujarat State Fertilizers & Chemicals Limited |

0.24% |

Petroleum Products |

|

Castrol India Limited |

0.71% |

Chennai Petroleum Corporation Limited |

0.37% |

Leisure Services |

|

EIH Limited |

0.65% |

BLS International Services Limited |

0.23% |

Telecom - Services |

|

Tata Communications Limited |

0.82% |

Healthcare Services |

|

Dr. Lal Path Labs Limited |

0.38% |

Narayana Hrudayalaya Limited |

0.37% |

Personal Products |

|

Emami Limited |

0.74% |

IT - Services |

|

L&T Technology Services Limited |

0.56% |

Entertainment |

|

Sun TV Network Limited |

0.27% |

Saregama India Limited |

0.22% |

Cigarettes & Tobacco Products |

|

Godfrey Phillips India Limited |

0.42% |

Transport Infrastructure |

|

Gujarat Pipavav Port Limited |

0.32% |

Household Products |

|

Jyothy Labs Limited |

0.26% |

Agricultural Food & other Products |

|

Triveni Engineering & Industries Limited |

0.23% |

Food Products |

|

Avanti Feeds Limited |

0.12% |

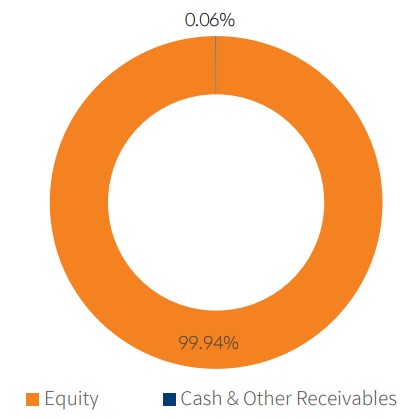

Equity Holding Total |

99.94% |

Cash & Other Receivables Total |

0.06% |

Total |

100.00% |

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol :MIDSMALL

BSE Code:544180

Bloomberg Code:MAS250MQ IN Equity

Reuters Code: MIRA.NS

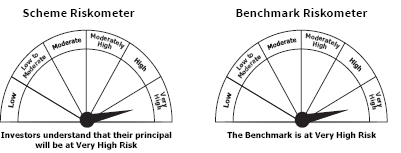

This product is suitable for investors who are seeking*

• Returns that commensurate with performance of Nifty MidSmallcap400 Momentum Qualiy 100 Total Return Index, subject to tracking error over long term

• Investments in equity securities covered by Nifty MidSmallcap400 Momentum Quality 100 Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

$Pursuant to clause 13.2.2 of SEBI master circular dated June 27, 2024, the scheme is in existence for less than 6 months, hence performance shall not be provided