Mutual funds are increasingly becoming the preferred options for Indian households to invest their savings to beat inflation and create wealth. As per AMFI, total equity funds (including ELSS) AUM in March 2000 was around Rs 34,000 crores.

As on 31st March 2020, equity funds AUM stood at Rs 650,000 crores, growing at a CAGR of 16% over the last 20 years.

If you align your investments with your financial goals, you have a much higher potential for achieving success in your goals. The following factors should be considered while making investments in equity funds:-

- What is your investment goal?

- What is your investment horizon?

- What is your risk appetite?

Investment goal

Your investment goals can be retirement planning, children’s higher education, children’s marriage, making down payment for home purchase, planning for a foreign vacation etc. Most investors will have multiple goals. There are several benefits

for associating investments with your financial goals.

- Since we have an emotional attachment with many of these goals, we stay committed to our investment plan which helps us in the long run.

- A clearly defined goal (in quantitative terms) will help you estimate how much you need to save and invest for that goal.

- Associating investments with goals can help you make the right investment decisions, e.g. investment in fixed income for short term goals, investment into equity for long term goals etc.

Investment Time horizon

One of the most important aspects of goal planning is defining goal timelines. If your investment goal is retirement planning, if you assume your retirement age to be 60 years and you are 35 years old then your time horizon is 25 years. Knowing

your investment horizon helps you invest in the right asset class. If you have a long investment horizon, then short term volatility has very little impact on the absolute returns over your investment horizon. Equity can be an ideal asset

class for your long-term goals. Even though equity is volatile and can correct in value from time to time, it may eventually recovers and grows in value giving you potential capital appreciation.

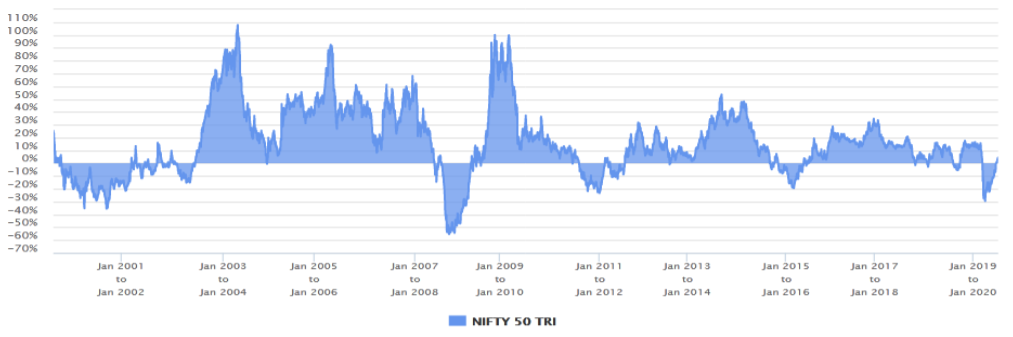

Volatility reduces over longer investment horizon

The chart below shows the 1 year rolling returns of Nifty 50 TRI since 1st July 1999 to 30th April 2020

Source: Advisorkhoj Research. Past performance may or may not sustain in future.

Now if you compare the 1 year rolling returns with 10 year rolling returns. You can see that 10 year rolling returns are even less volatile. That is why equity funds are the best asset class for your long term investment goals.

Source: Advisorkhoj Research. Past performance may or may not sustain in future.

Risk appetite and volatility

There are two aspects of risk appetites – your risk capacity and your risk tolerance. Risk capacity is your actual capacity to take risk depending on your investment horizon and age among other factors. Your risk capacity is higher for long

investment horizons because your investments have enough time to recover from short term volatility. Similarly, risk capacity depends on your age. You can take more risks when you are younger because you have a long working life ahead

of you during which you can save and invest. Risk capacity declines with age. Among other factors, financial situation of the investor, particularly financial liabilities influence risk capacity.

Risk tolerance is a person’s attitude or preference towards risk. Some investors are inherently more risk averse than others irrespective of their age / stage of life and financial situation. Risk tolerance also depends on the investment experience

of investors e.g. new investors will have less risk tolerance than experienced investors who may have experienced multiple investment cycles (bull and bear market cycles).

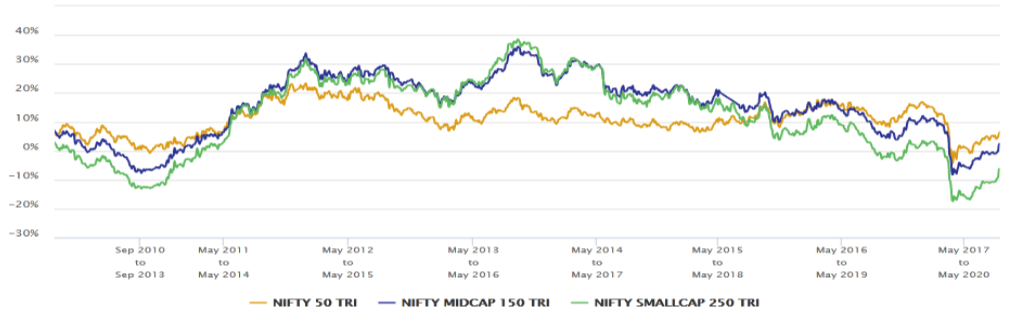

Your risk appetite will be a combination of your risk capacity and risk tolerance. You should take both into consideration when making investment decisions. Some categories of equity funds are more volatile than others, e.g. small cap funds

are more volatile than midcap and large cap funds. The chart below shows the 3 year rolling returns of Nifty 50 TRI (large cap), Nifty Midcap 150 TRI (mid cap) and Nifty Small Cap 250 TRI (small cap) since 1st January 2010.

Source: Advisorkhoj Research. Past performance may or may not sustain in future.

The chart above clearly shows the relative risk profiles of large cap, midcap and small cap market segments – small cap being the riskiest and large cap being the least risky. The chart also reinforces the relationship between risk and return,

i.e. higher the risk, higher the potential returns.

You should factor in both risk and returns potential when selecting equity funds and ensure that you are investing according to your risk appetite. If you have higher risk appetite, you can have larger allocations to midcap and small cap funds.

However, if you do not have sufficiently high risk appetite, your mutual fund portfolio should be predominantly large cap oriented.

Summary

You should have a diversified portfolio of mutual funds comprising of different asset classes e.g. fixed income, equity etc and different types of funds e.g. large cap, midcap, multicap etc. Though there are some thumb rules which suggest

70 – 80% of your equity portfolio to be in large cap funds and the 20 – 30% in mid and small cap, you should develop your own investment plan based on your investment goals, risk appetite and liquidity needs. It is always advisable to

engage a financial advisor who can help you define your financial goals, understand your risk appetite and help you with selection of the right mutual fund schemes. Your advisor should also help you monitor your investment portfolio to

ensure that you are on track of your investment goals.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click Here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada