All Mirae Asset Schemes

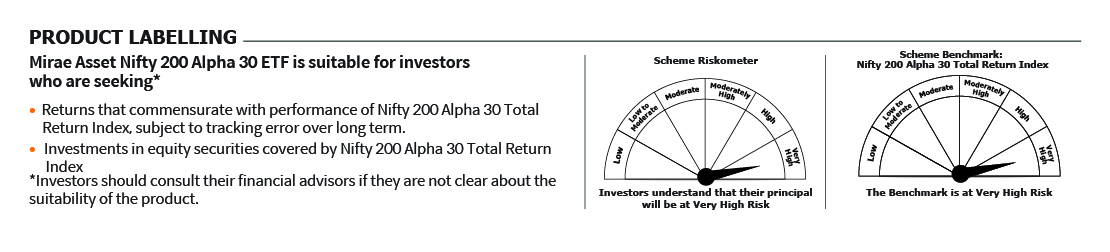

Mirae Asset Nifty 200 Alpha 30 ETF

(An open ended scheme replicating/tracking Nifty 200 Alpha 30 Total Return Index )

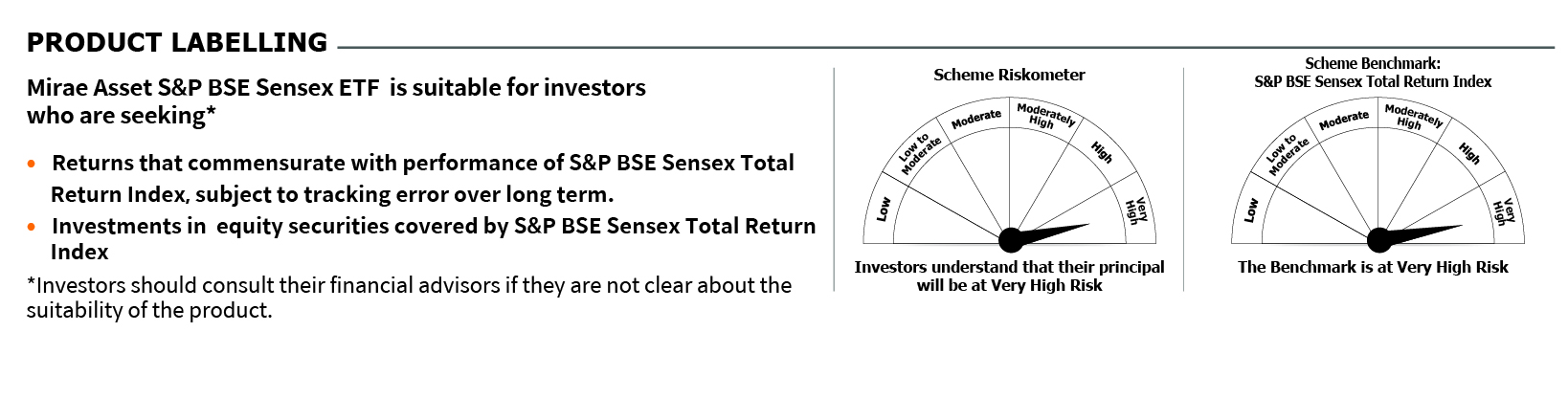

Mirae Asset S&P BSE Sensex ETF

(An open-ended scheme replicating/tracking S&P BSE Sensex Total Return Index)

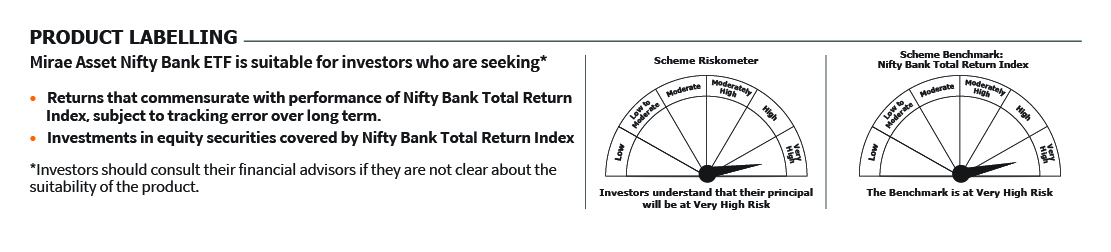

Mirae Asset Nifty Bank ETF

(An open-ended scheme replicating/tracking Nifty Bank Total Return Index)

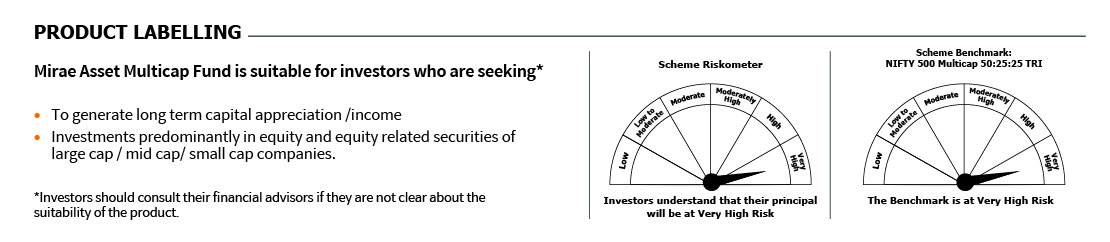

Mirae Asset Multicap Fund

(Multi Cap - An open-ended equity scheme investing across large cap, mid cap and small cap stocks)

Mirae Asset Silver ETF

(An open-ended scheme replicating/tracking Domestic Price of Silver)(NSE: SILVRETF BSE:543922)

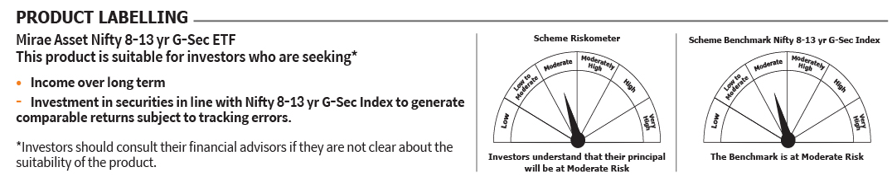

Mirae Asset Nifty 8-13 yr G-Sec ETF

(An Open-Ended Index Exchange Traded Fund tracking Nifty 8-13 yr G-Sec Index. Relatively High interest rate risk and Relatively Low Credit Risk) (NSE: MAGS813ETF BSE:543875)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III |

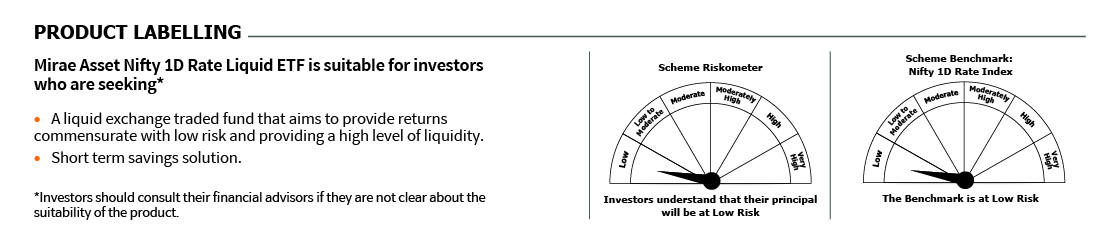

Mirae Asset Nifty 1D Rate Liquid ETF

(An open-ended listed liquid scheme in the form of an Exchange Traded Fund tracking Nifty 1D Rate Index, with daily Income Distribution cum capital withdrawal (IDCW) and compulsory Reinvestment of IDCW option. A relatively low interest rate risk and relatively low credit risk) (NSE:LIQUID BSE:543946)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

(A scheme with relatively high interest rate risk and relatively low credit risk)

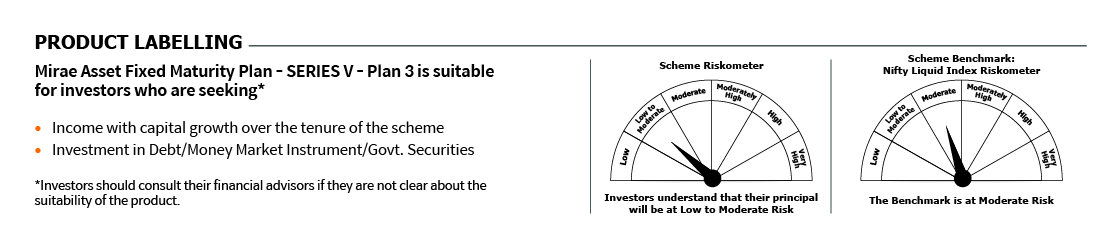

Mirae Asset Fixed Maturity Plan - SERIES V - Plan 3

(A Close Ended Income Scheme with Tenure 91 Days, A relatively Low Interest Rate Risk and Moderate Credit Risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | B-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

(A scheme with relatively high interest rate risk and relatively low credit risk)

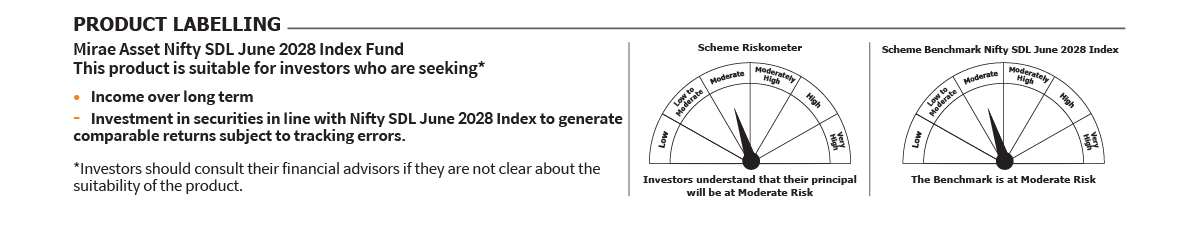

Mirae Asset Nifty SDL June 2028 Index Fund

(An open-ended target maturity Index Fund investing in the constituents of Nifty SDL June 2028 Index. A scheme with relatively high interest rate risk and relatively low credit risk)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III |

(A scheme with relatively high interest rate risk and relatively low credit risk)

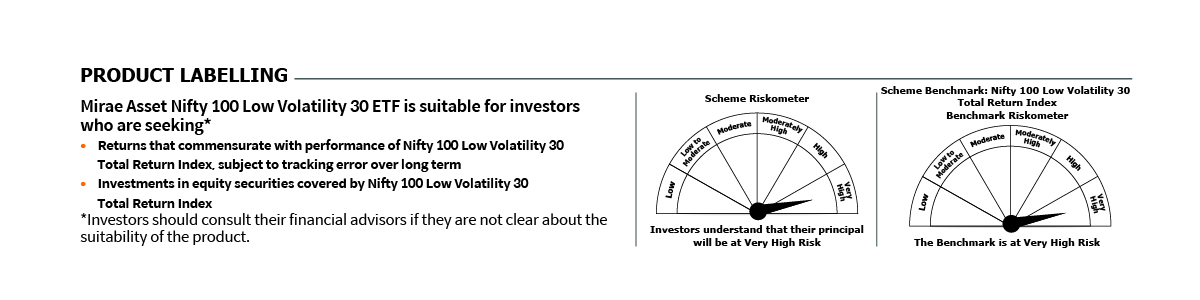

Mirae Asset Nifty 100 Low Volatility 30 ETF

(An open ended scheme replicating/tracking Nifty 100 Low Volatility 30 Total Return Index) (NSE: LOWVOL BSE:543858)

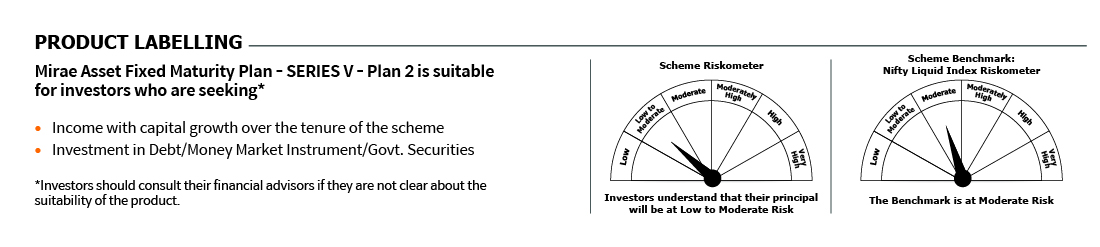

Mirae Asset Fixed Maturity Plan - SERIES V - Plan 2

(A Close Ended Income Scheme with Tenure 91 Days, A relatively Low Interest Rate Risk and Moderate Credit Risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | B-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

(A scheme with relatively high interest rate risk and relatively low credit risk)

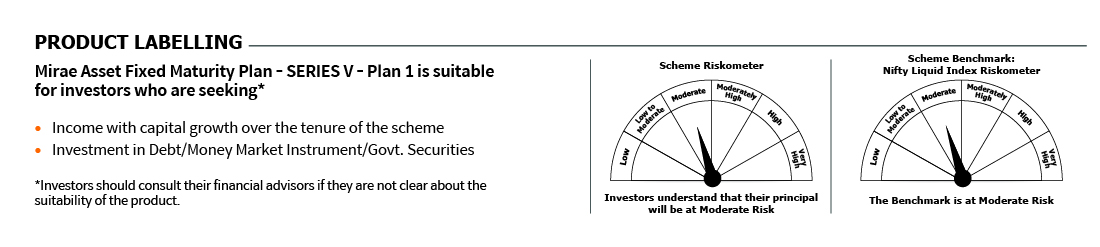

Mirae Asset Fixed Maturity Plan - SERIES V - Plan 1

(A Close Ended Income Scheme with Tenure 91 Days, A relatively Low Interest Rate Risk and Moderate Credit Risk)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | B-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

(A scheme with relatively high interest rate risk and relatively low credit risk)

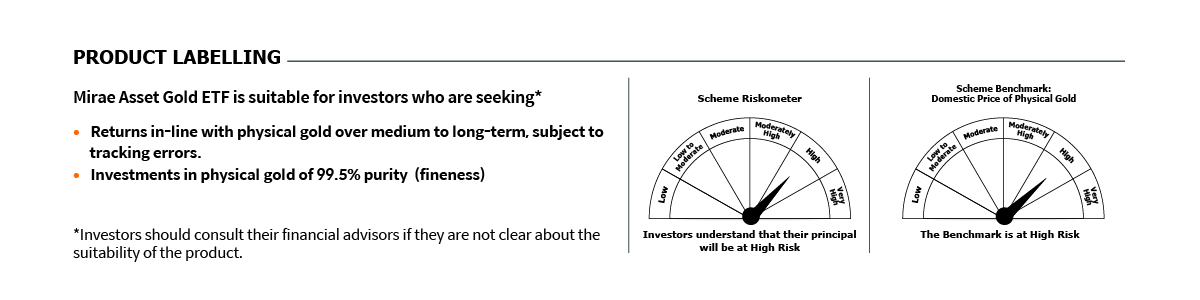

Mirae Asset Gold ETF

(An open-ended scheme replicating/tracking Domestic Price of Gold) (NSE:GOLDETF BSE:543781)

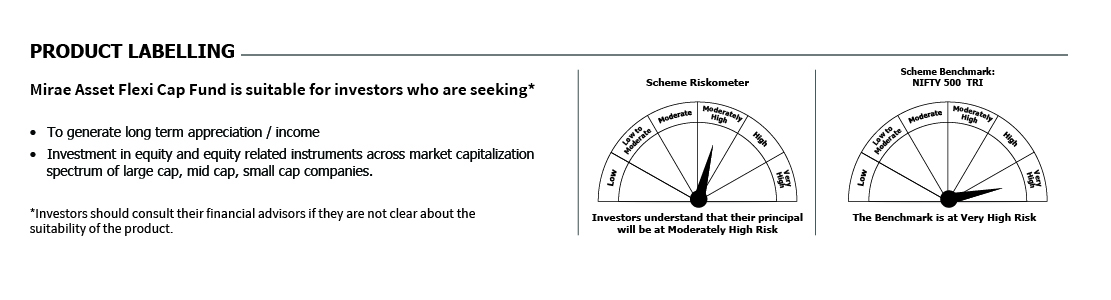

Mirae Asset Flexi Cap Fund

(An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

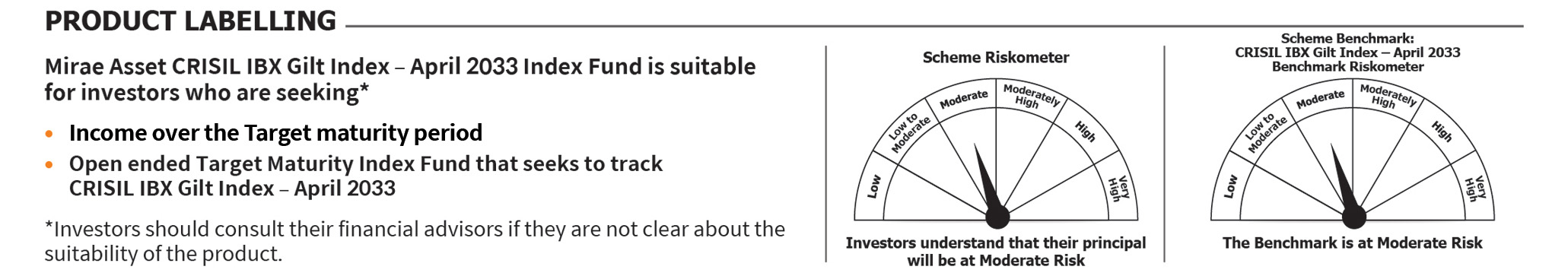

Mirae Asset CRISIL IBX Gilt Index – April 2033 Index Fund

(An open-ended target maturity Index Fund investing in the constituents of CRISIL IBX Gilt Index – April 2033. A scheme with relatively high interest rate risk and relatively low credit risk)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III |

(A scheme with relatively high interest rate risk and relatively low credit risk)

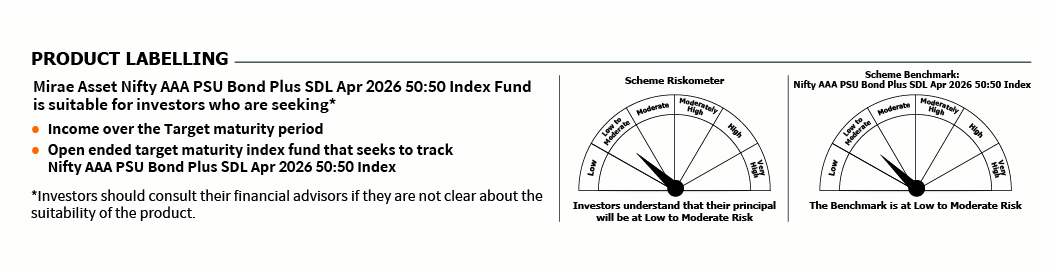

Mirae Asset Nifty AAA PSU Bond Plus SDL Apr 2026 50:50 Index Fund

(An open-ended target maturity Index Fund investing in the constituents of Nifty AAA PSU Bond Plus SDL Apr 2026 50:50 Index. A scheme with relatively high interest rate risk and relatively low credit risk)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III |

(A scheme with relatively high interest rate risk and relatively low credit risk)

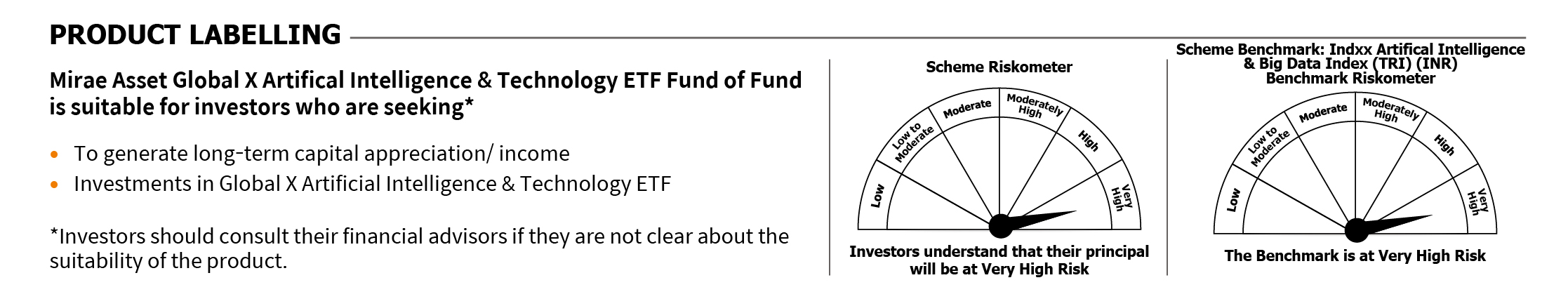

Mirae Asset Global X Artificial Intelligence & Technology ETF Fund of Fund

(An open ended fund of fund scheme investing in units of Global X Artificial Intelligence & Technology ETF)

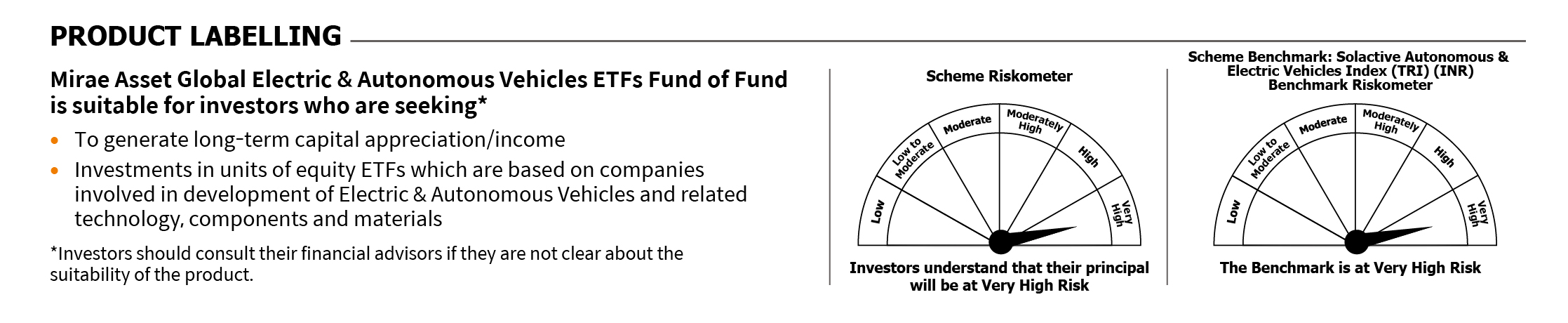

Mirae Asset Global Electric & Autonomous Vehicles ETFs Fund of Fund

(An open-ended fund of fund scheme investing in overseas equity Exchange Traded Funds which are based on companies involved in development of Electric & Autonomous Vehicles and related technology, components and materials)

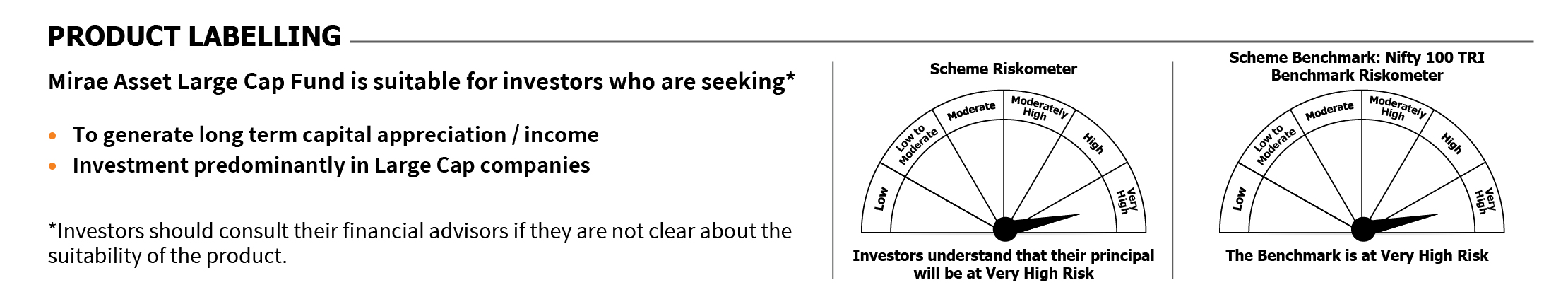

Mirae Asset Large Cap Fund

(Large Cap Fund - An open ended equity scheme predominantly investing across large cap stocks)

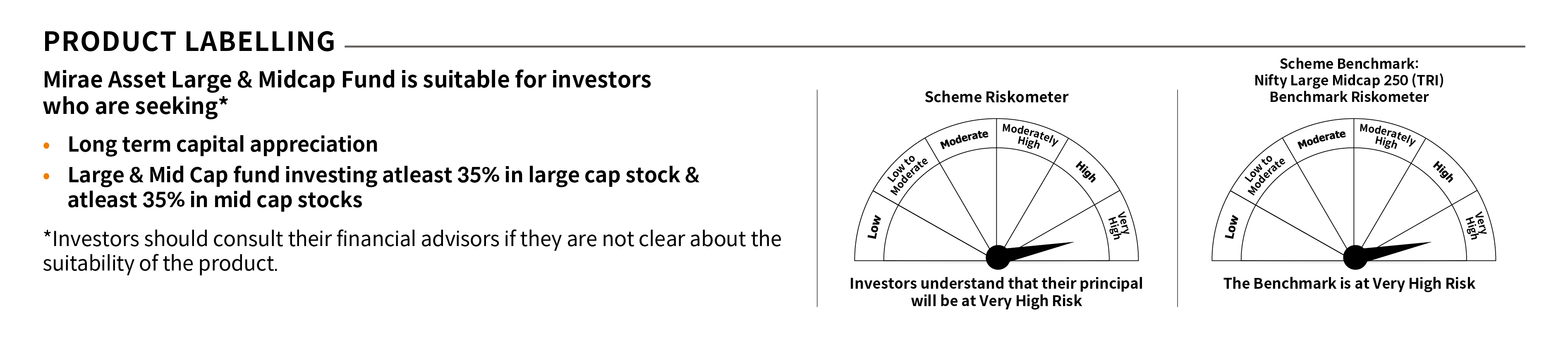

Mirae Asset Large & Midcap Fund

(Erstwhile known as Mirae Asset Emerging Bluechip Fund)

(Large & Mid Cap Fund - An open-ended equity scheme investing in both large cap and mid cap stocks)

Mirae Asset ELSS Tax Saver Fund

(Erstwhile known as Mirae Asset Tax Saver Fund)

(ELSS - An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit)

Mirae Asset Focused Fund

(Focused Fund - An open ended equity scheme investing in a maximum of 30 stocks intending to focus in Large Cap, Mid Cap & Small Cap category (i.e., Multi-Cap))

Mirae Asset Great Consumer Fund

(Sectoral/Thematic Fund - An open ended equity scheme following consumption theme)

Mirae Asset Healthcare Fund

(Sectoral/Thematic Fund - An open ended equity scheme investing in healthcare and allied sectors)

Mirae Asset Mid Cap Fund

(Midcap Fund - An open ended equity scheme predominantly investing in mid cap stocks)

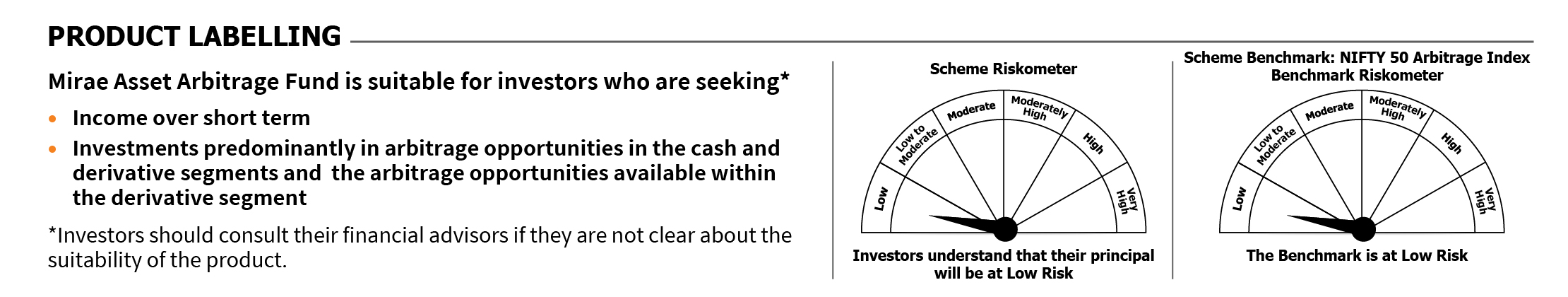

Mirae Asset Arbitrage Fund

(An open ended scheme investing in arbitrage opportunities)

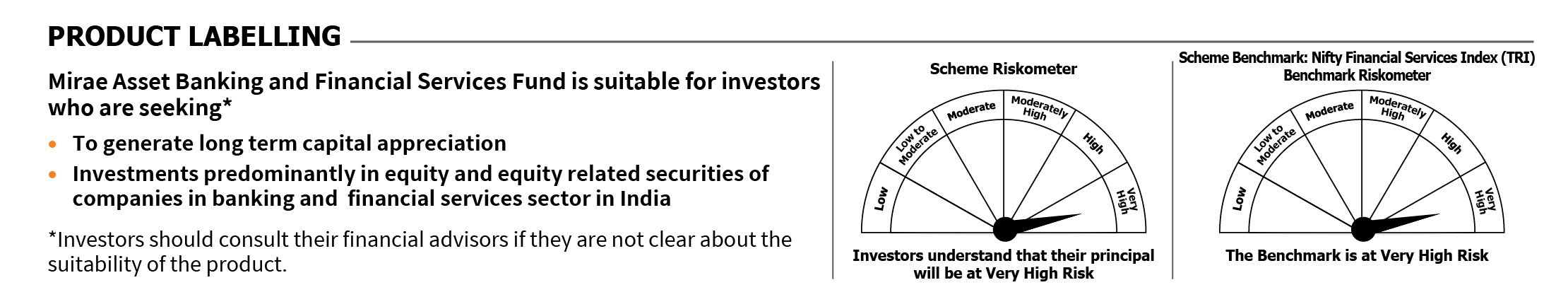

Mirae Asset Banking and Financial Services Fund

(Sectoral / Thematic Fund - An open-ended equity scheme investing in Banking & Financial Services Sector)

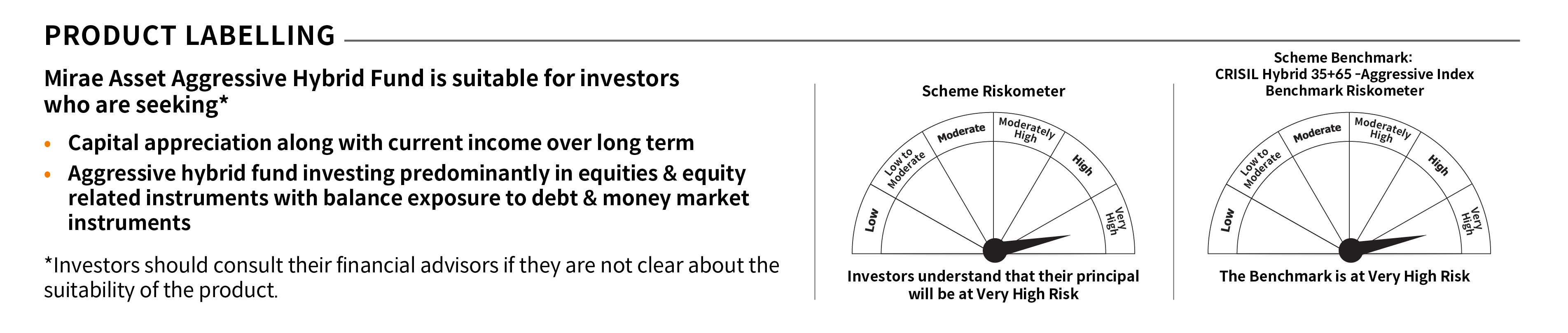

Mirae Asset Aggressive Hybrid Fund

(Erstwhile known as Mirae Asset Hybrid-Equity Fund)

(Aggressive Hybrid Fund - An open-ended hybrid scheme investing predominantly in equity and equity related instruments)

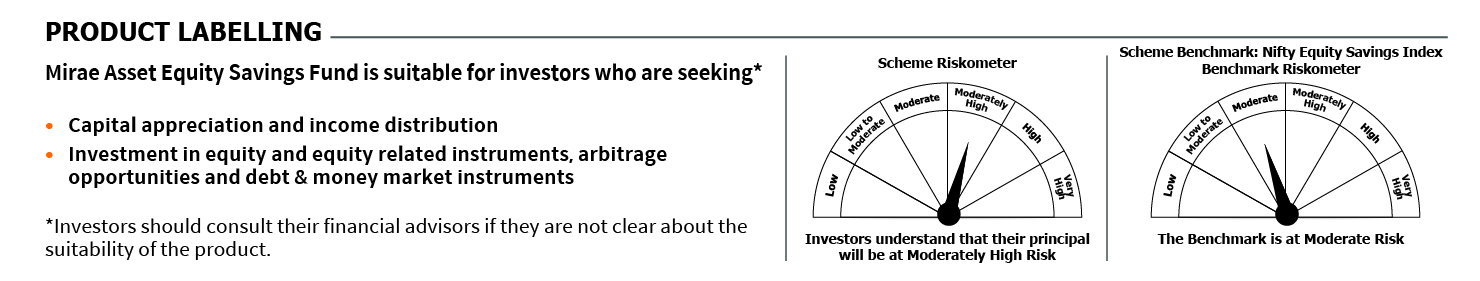

Mirae Asset Equity Savings Fund

(An open ended scheme investing in equity, arbitrage and debt)

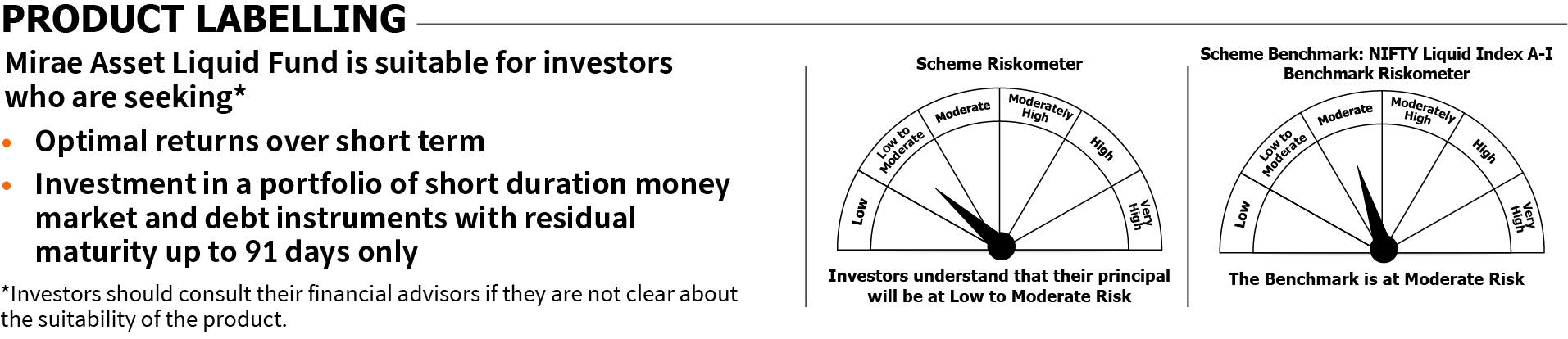

Mirae Asset Liquid Fund

(Erstwhile known as Mirae Asset Cash Management Fund)

((Liquid Fund - An open ended liquid scheme) A relatively low interest rate risk and moderate credit risk).

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | B-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

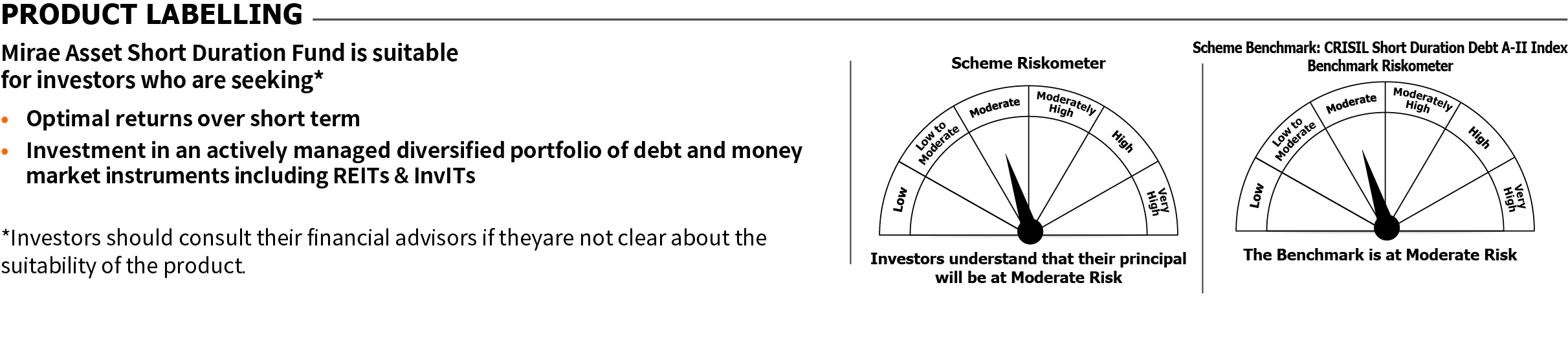

Mirae Asset Short Duration Fund

(Erstwhile known as Mirae Asset Short Term Fund)

(An open-ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 year to 3 years (please refer to page no. 31 of the SID). A relatively high interest rate risk and moderate credit risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | B-III |

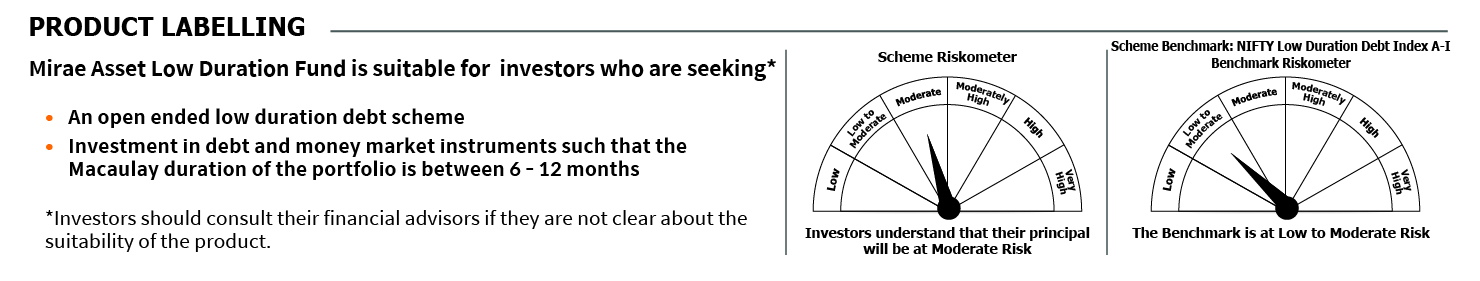

Mirae Asset Low Duration Fund

(Erstwhile known as Mirae Asset Savings Fund)

(Low Duration Fund - An Open ended low duration Debt Scheme investing in instruments with Macaulay duration of the portfolio between 6 months and 12 months (please refer to page no. 37 of SID) A moderate interest rate risk and moderate credit risk)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | B-II | ||

| Relatively High (Class III) |

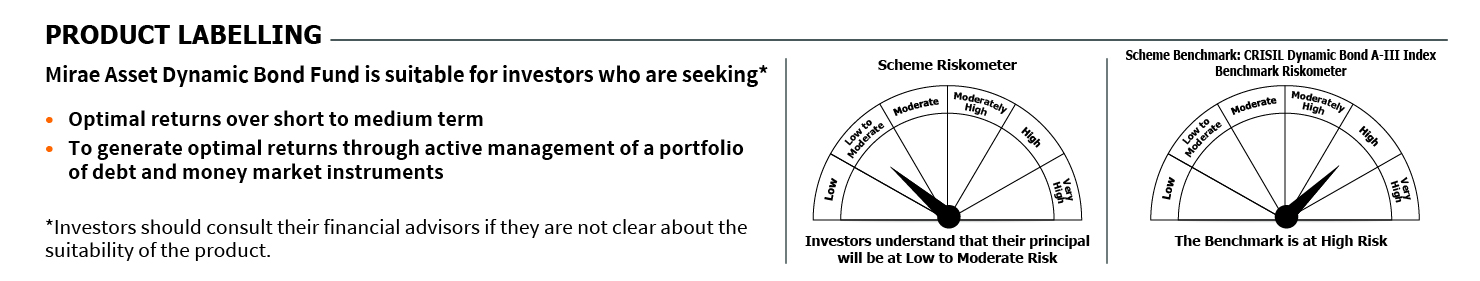

Mirae Asset Dynamic Bond Fund

(An Open-ended dynamic debt scheme investing across duration. A relatively high interest rate risk and relatively high credit risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | C-III |

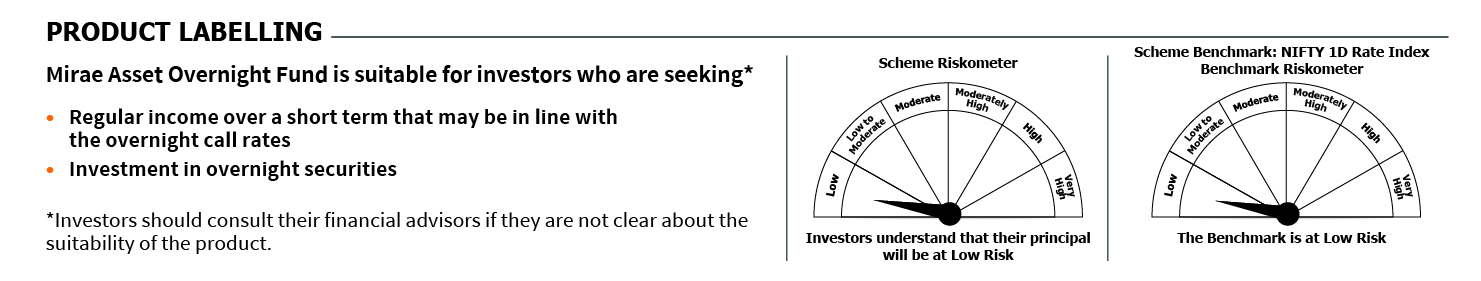

Mirae Asset Overnight Fund

(An open ended debt scheme investing in overnight securities. A relatively low interest rate risk and relatively low credit risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

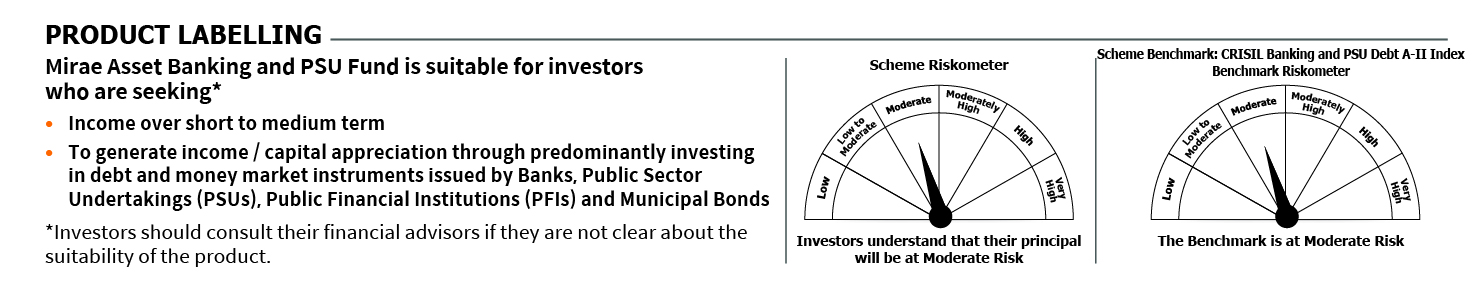

Mirae Asset Banking and PSU Fund

(Erstwhile known as Mirae Asset Banking and PSU Debt Fund)

(Banking and PSU Fund - An open ended debt scheme predominantly investing in debt instruments of banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds) A relatively high interest rate risk and moderate credit risk)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | B-III |

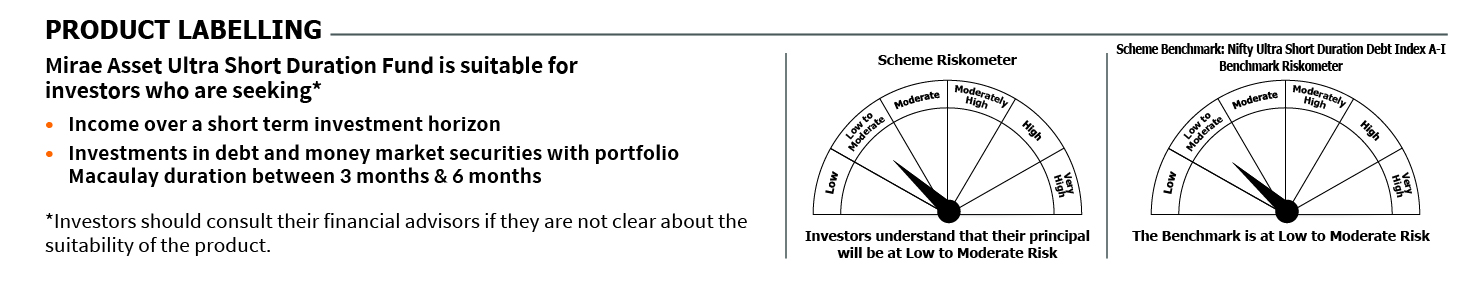

Mirae Asset Ultra Short Duration Fund

(An Open ended ultra-short term debt scheme investing in instruments such that the Macaulay duration* of the portfolio is between 3 months to 6 months (*please refer to page no.33 of the SID). A relatively low interest rate risk and moderate credit risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | B-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

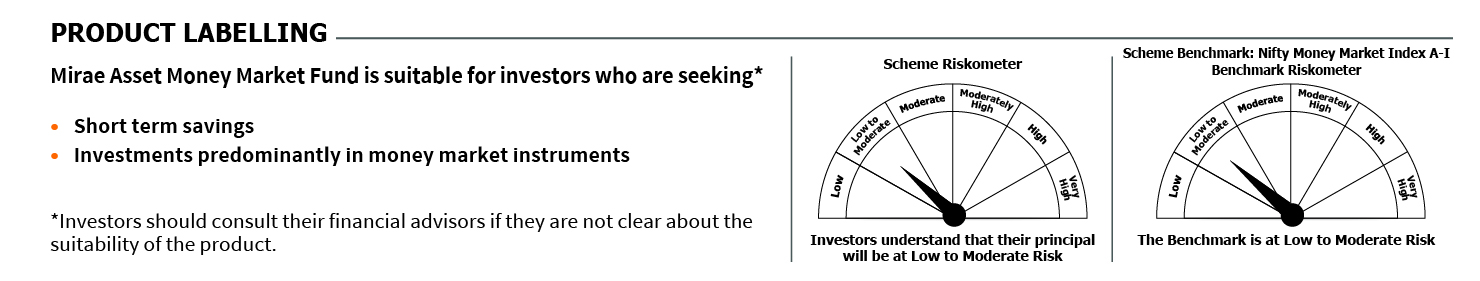

Mirae Asset Money Market Fund

(An Open ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | B-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) |

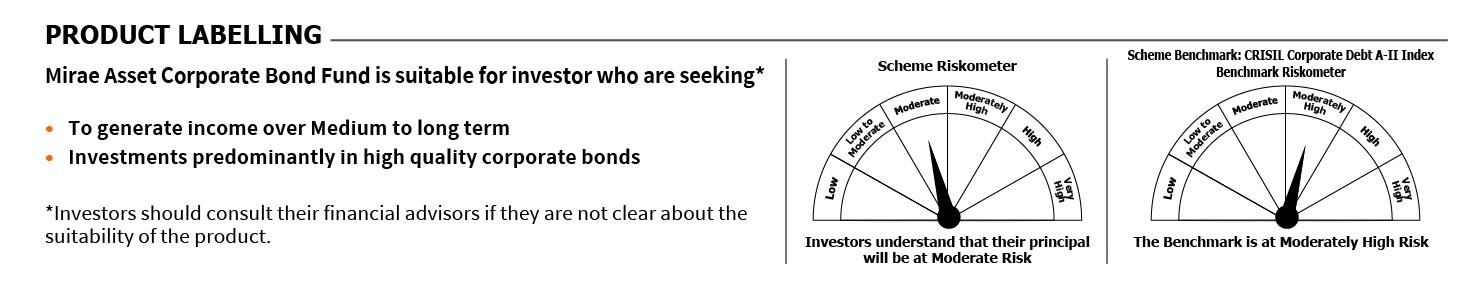

Mirae Asset Corporate Bond Fund

(An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and moderate credit risk.)

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | B-III |

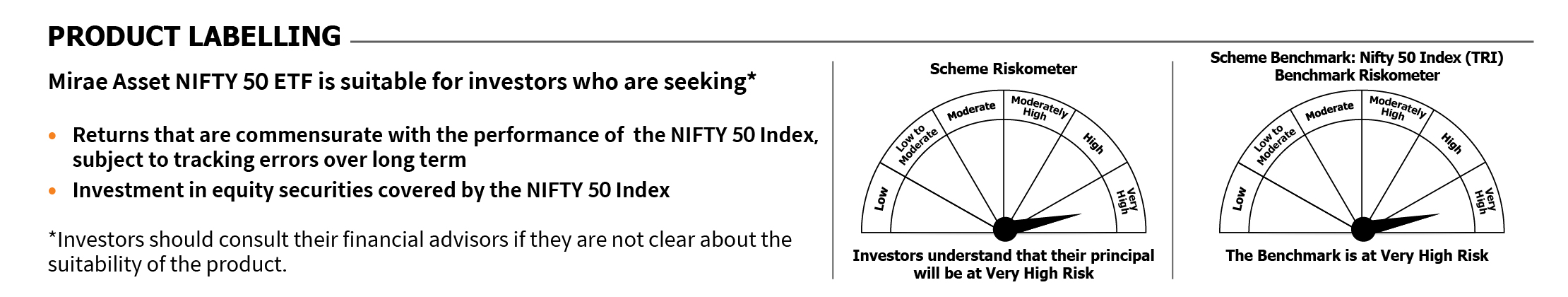

Mirae Asset Nifty 50 ETF

(An open ended scheme replicating/tracking Nifty 50 Index)(NSE: NIFTYETF BSE:542131)

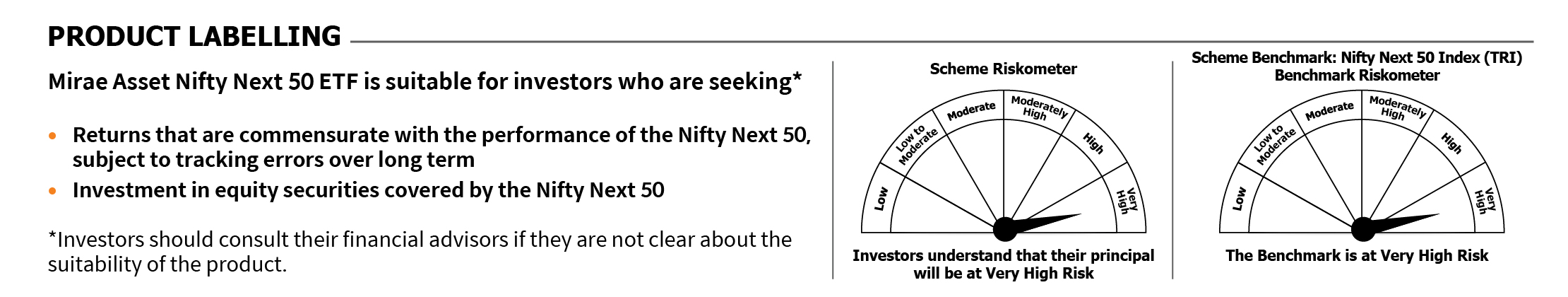

Mirae Asset Nifty Next 50 ETF

(An open ended scheme replicating/tracking Nifty Next 50 Total Return Index)(NSE: NEXT50 BSE:542922)

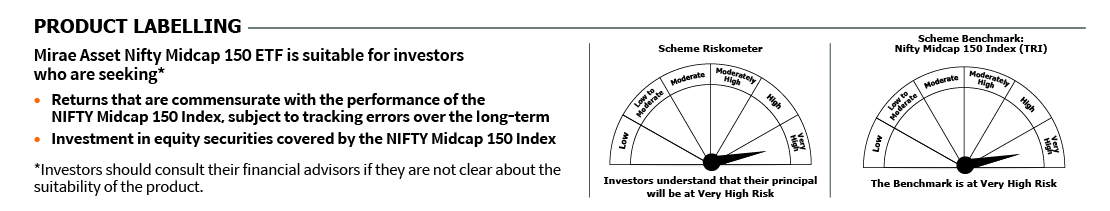

Mirae Asset Nifty Midcap 150 ETF

(An open-ended scheme replicating/tracking Nifty Midcap 150 Total Return Index)(NSE: MIDCAPETF BSE:543481)

Mirae Asset S&P 500 Top 50 ETF

(An open ended scheme replicating/tracking S&P 500 Top 50 Total Return Index)(NSE: MASPTOP50 BSE:543365)

Mirae Asset S&P 500 Top 50 ETF Fund of Fund

(An open ended fund of fund scheme predominantly investing in Mirae Asset S&P 500 Top 50 ETF)

Mirae Asset Nifty 100 ESG Sector Leaders Fund of Fund

(An Open-ended fund of fund scheme predominantly investing in Mirae Asset ESG Sector leaders ETF)

Mirae Asset Nifty 100 ESG Sector Leaders ETF

(An open ended scheme replicating/tracking Nifty100 ESG Sector Leaders Total Return Index)(NSE: ESG BSE:543246)

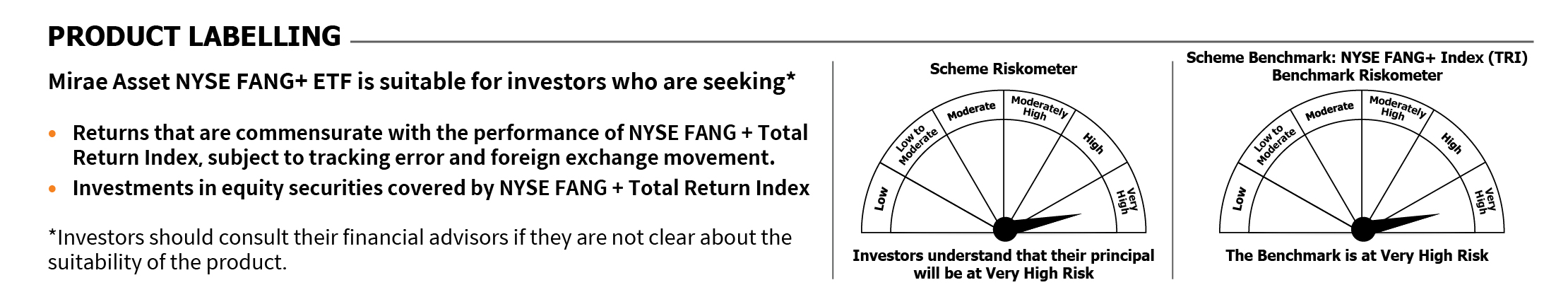

Mirae Asset NYSE FANG+ ETF (MAFANGETF)

(An open-ended scheme replicating/tracking NYSE FANG+ Total Return Index)(NSE: MAFANG BSE:543291)

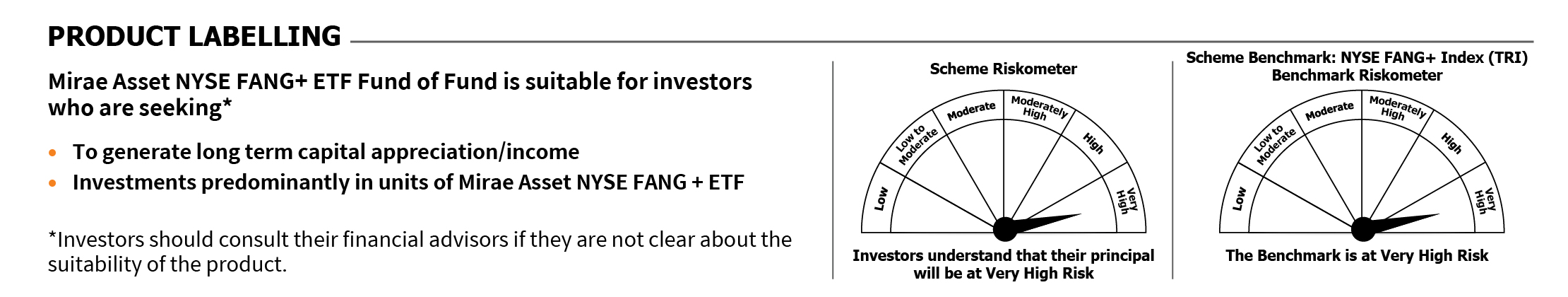

Mirae Asset NYSE FANG+ ETF Fund of Fund

(An Open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF)

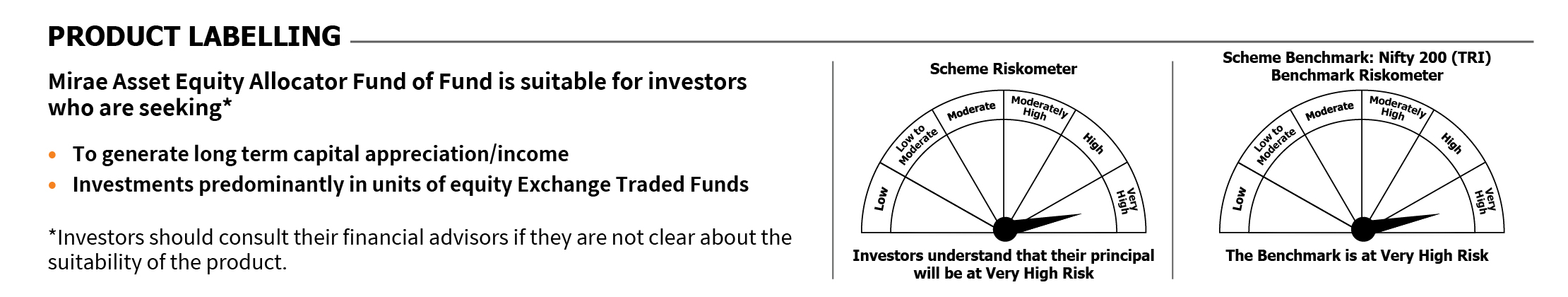

Mirae Asset Equity Allocator Fund of Fund

(An open ended fund of fund scheme predominantly investing in units of domestic equity ETFs)

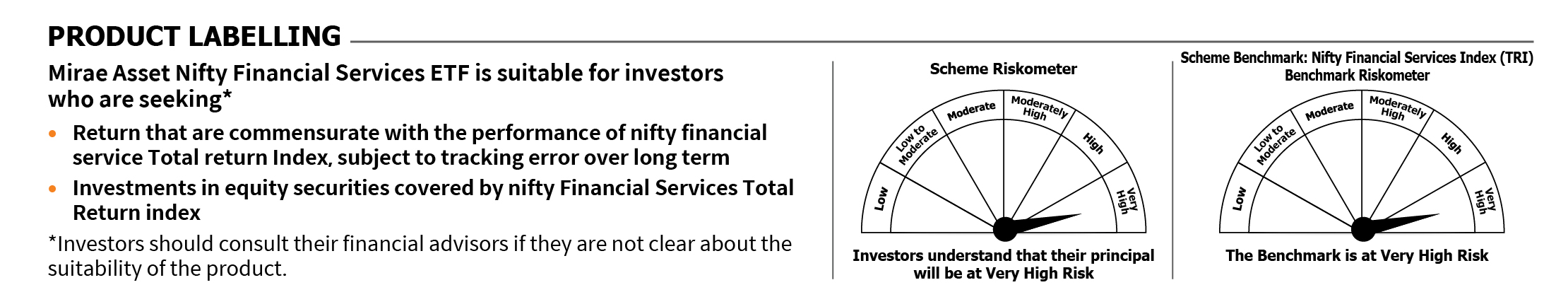

Mirae Asset Nifty Financial Services ETF

(An open-ended scheme replicating/tracking Nifty Financial Services Total Return Index)(NSE: BFSI BSE:543323)

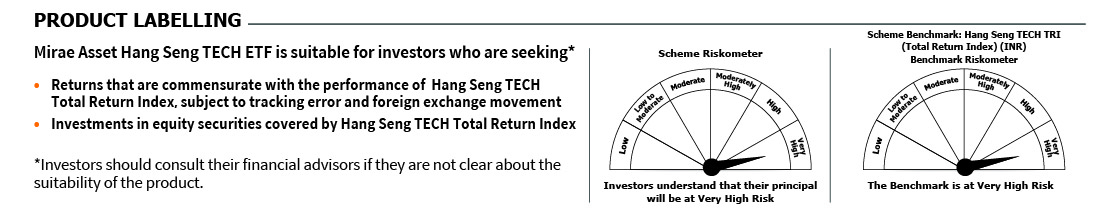

Mirae Asset Hang Seng TECH ETF

(An open ended scheme replicating/tracking Hang Seng TECH Total Return Index(INR))

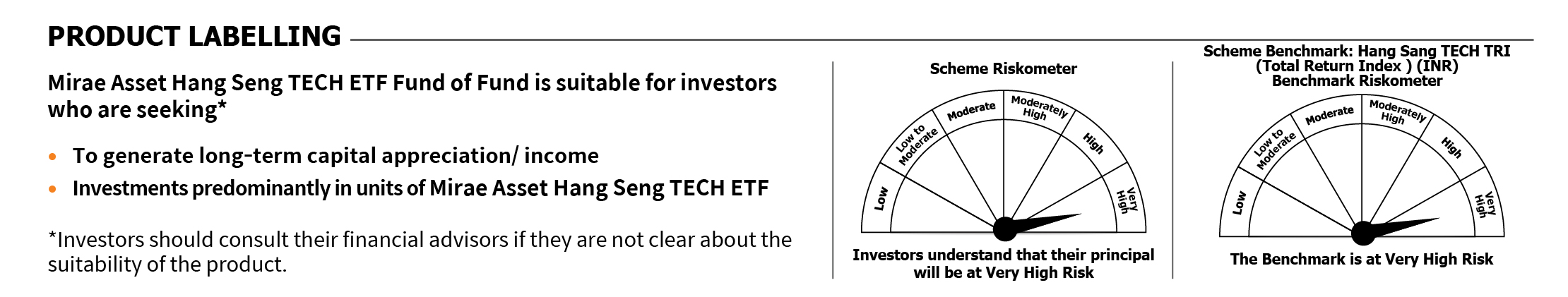

Mirae Asset Hang Seng TECH ETF Fund of Fund

(An open ended fund of fund scheme predominantly investing in Mirae Asset Hang Seng TECH ETF)

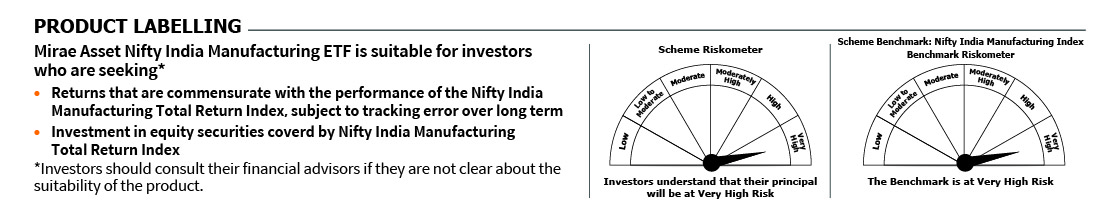

Mirae Asset Nifty India Manufacturing ETF

(An open-ended scheme replicating/tracking Nifty India Manufacturing Total Return Index) (NSE: MAKEINDIA, BSE: 543454)

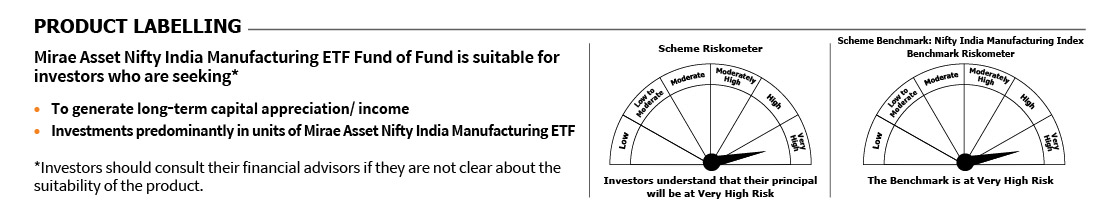

Mirae Asset Nifty India Manufacturing ETF Fund of Fund

(An open-ended fund of fund scheme predominantly investing in Mirae Asset Nifty India Manufacturing ETF)

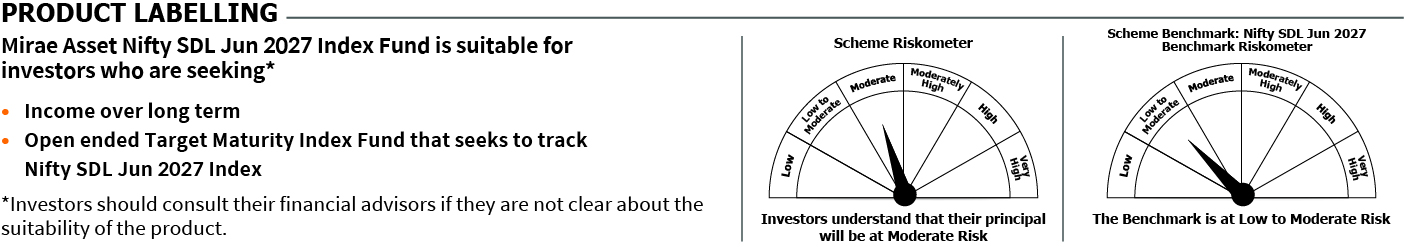

Mirae Asset Nifty SDL Jun 2027 Index Fund

(An open-ended target maturity Index Fund investing in the constituents of Nifty SDL Jun 2027 Index. A scheme with relatively high interest rate risk and relatively low credit risk)

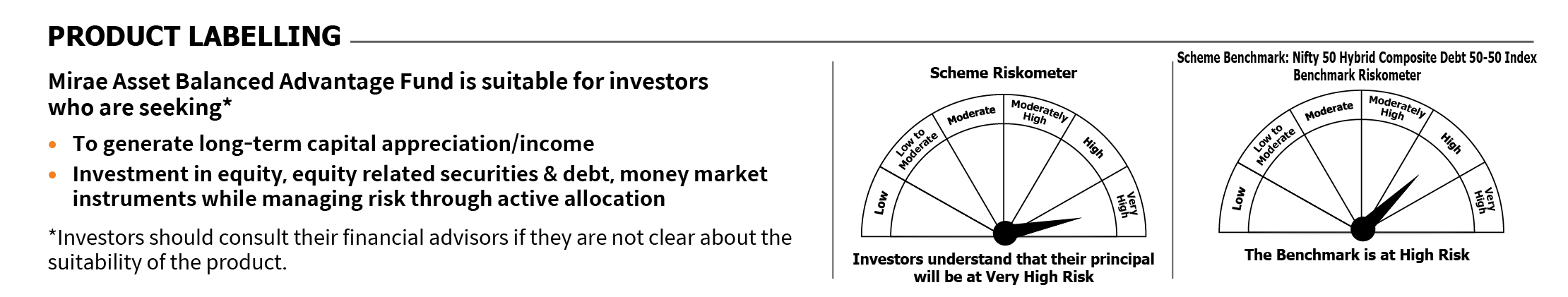

Mirae Asset Balanced Advantage Fund

(An open ended dynamic asset allocation fund)

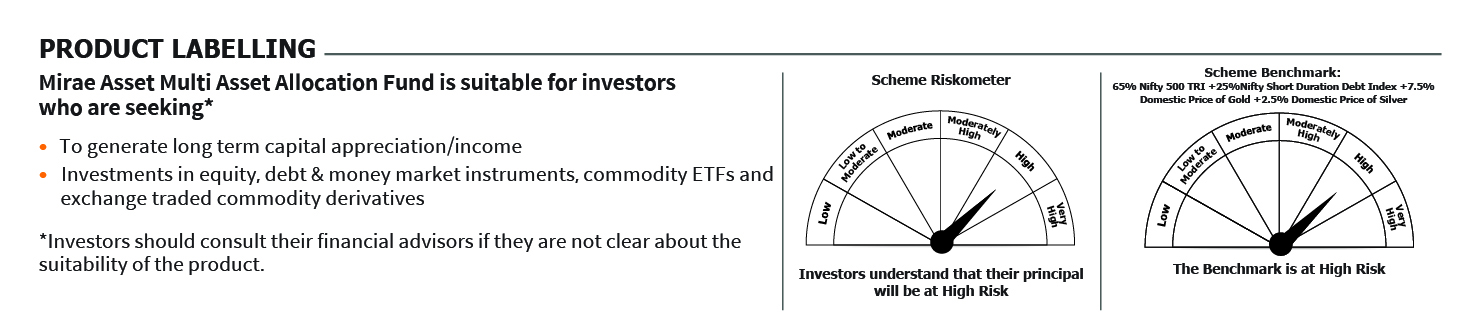

Mirae Asset Multi Asset Allocation Fund

(An open-ended scheme investing in equity, debt & money market instruments, Gold ETFs, Silver ETFs and exchange traded commodity derivatives)

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF

(An open-ended scheme replicating/tracking Nifty Smallcap 250 Momentum Quality 100 Total Return Index)

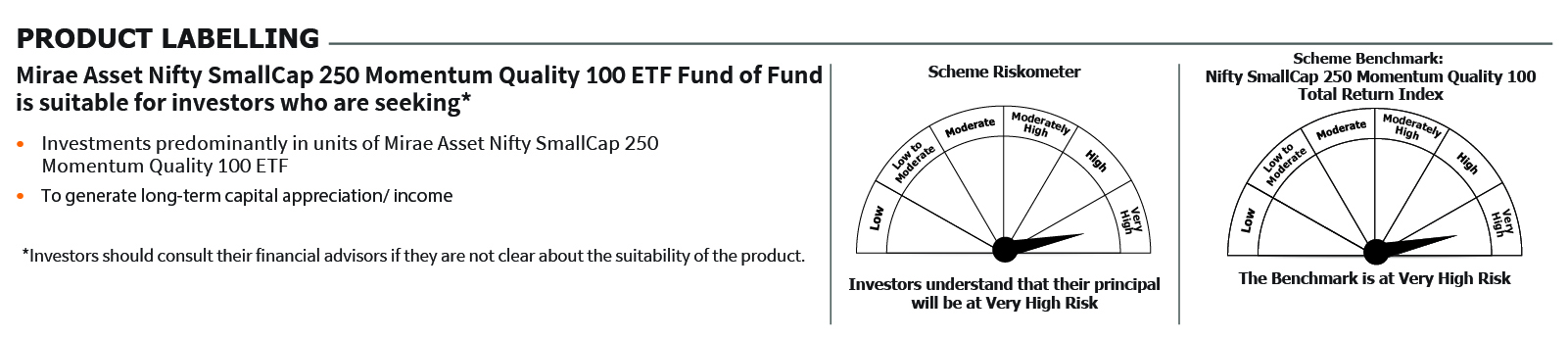

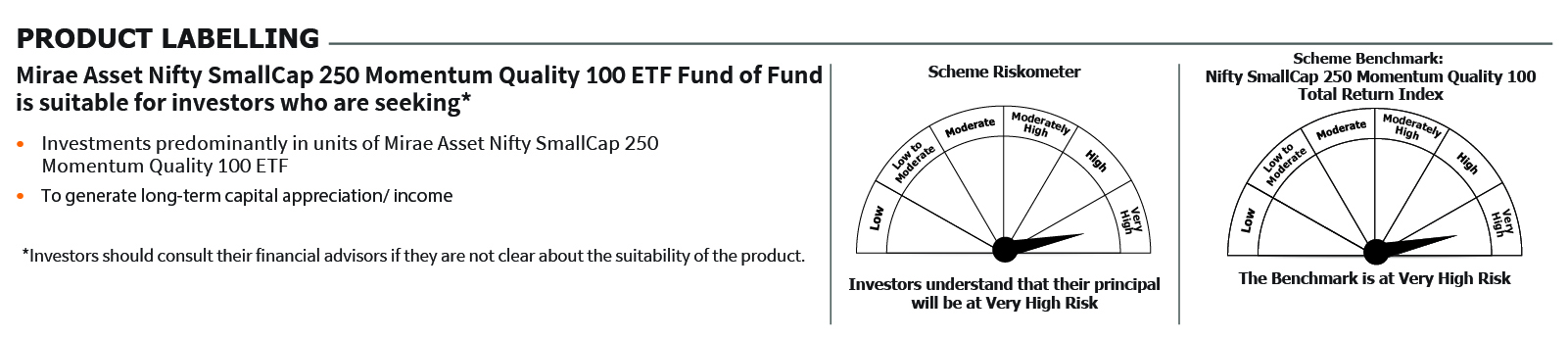

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Fund of Fund

(An open-ended fund of fund scheme investing in units of Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF)