Mirae Asset Investment Managers (India) Pvt. Ltd. announced the completion of 10 years of Mirae Asset ELSS Tax Saver Fund (Formerly Known as Mirae Asset Tax Saver Fund) (“the Scheme”), marking a decade-long partnership with investors focused on long-term wealth creation and tax efficiency. First allotted on December 28, 2015, Mirae Asset ELSS Tax Saver Fund is an open-ended equity-linked savings scheme (ELSS) offering tax benefits under Section 80C of the Income Tax Act, with a statutory lock-in period of three years.

The Assets Under Management (AUM) of the Scheme stood at ₹27,271 crore as of November 30, 2025. (Average AUM of the scheme as on November 30, 2025 is ₹ 27,134.54.)

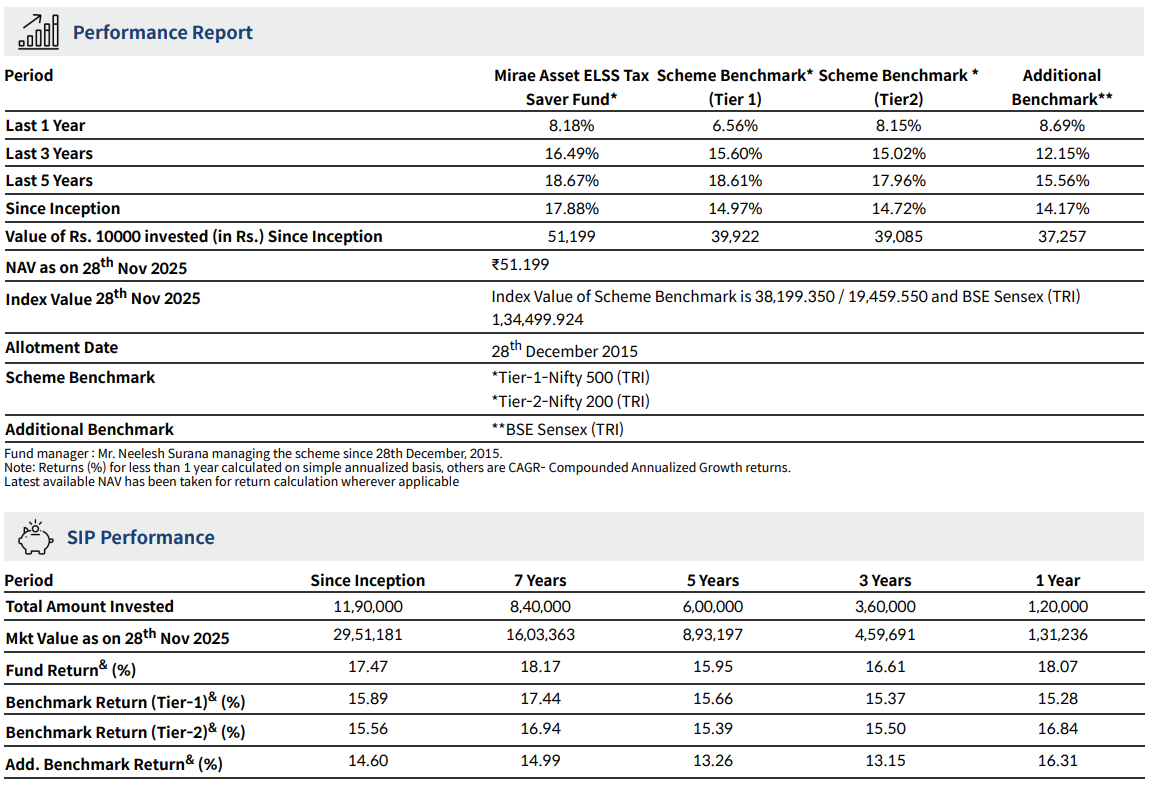

Since inception, the Scheme (Regular Plan – Growth Option) has delivered a CAGR of 17.8%, outperforming the Tier 1 and Tier 2 benchmarks, which returned 14.9% and 14.7%, respectively.

An investment of ₹10,000 made at inception would have grown to ₹51,199 as of November 30, 2025, compared with ₹39,922 for the Tier 1 benchmark. Similarly, a monthly SIP of ₹10,000 would have grown to ₹29,51,181 on a total investment of ₹11,90,000, translating into an XIRR of 17.47%.

The Scheme primarily invests in equity and equity-related instruments and is managed by Mr. Neelesh Surana, Chief Investment Officer. Commenting on the milestone, Mr. Surana stated, “Our investment framework focuses on investing in quality businesses at reasonable valuations. The scheme has consistently adhered to a well-diversified portfolio discipline, which has helped deliver superior risk-adjusted returns over the past decade.

We would like to thank our investors and partners for their unwavering support over the last 10 years, and we remain committed to prioritising their wealth creation.”

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada