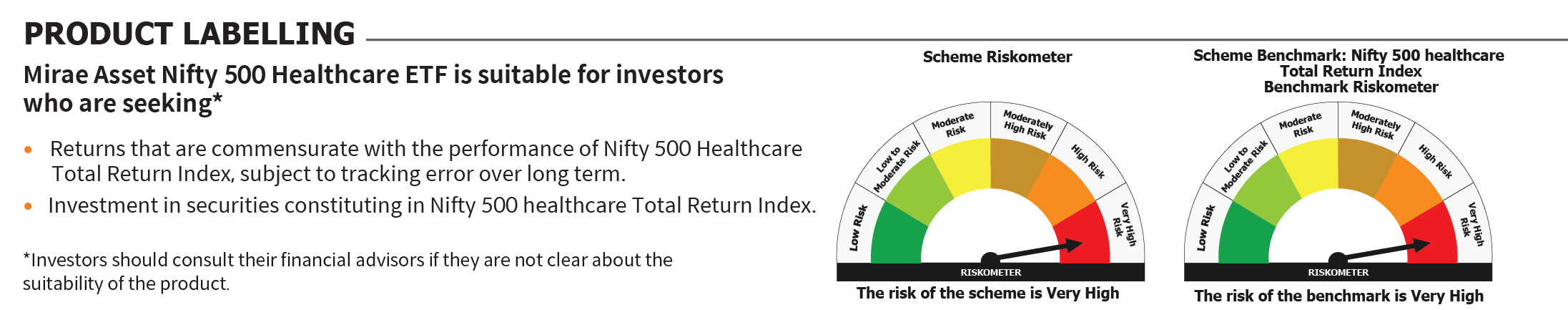

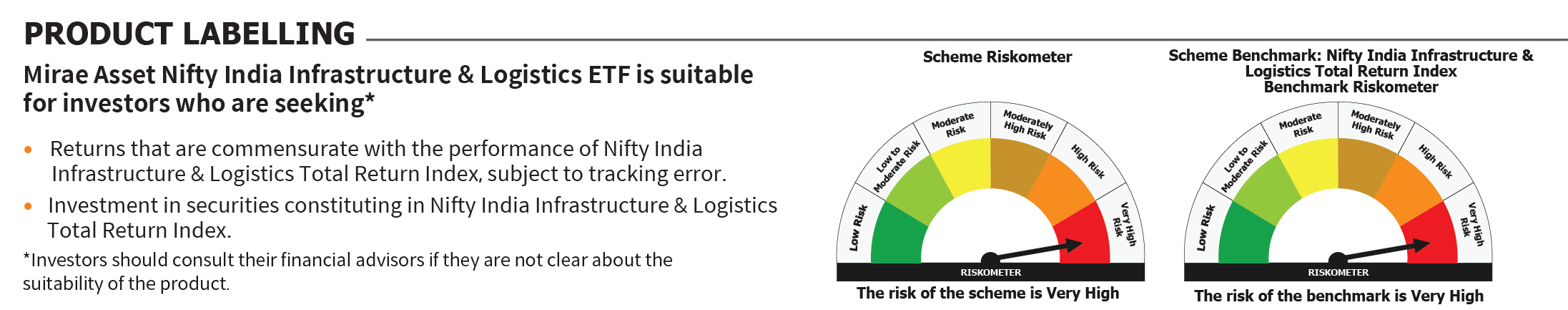

Mirae Asset Investment Managers (India) Pvt. Ltd. today announced the launch of Mirae Asset Nifty 500 Healthcare ETF, an open-ended scheme replicating/tracking the Nifty500 Healthcare Total Return Index, and Mirae Asset Nifty India Infrastructure & Logistics ETF, an open-ended scheme replicating/tracking Nifty India Infrastructure & Logistics Total Return Index.

While the Mirae Asset Nifty 500 Healthcare ETF provides exposure to diversified set of companies across pharma, hospitals, diagnostics, med tech, and healthcare tech, Mirae Asset Nifty India Infrastructure & Logistics ETF provides exposure to companies across multiple sectors involved in developing India’s infrastructure capacity.

The New Fund Offers (NFOs) for the ETFs will open for subscription on January 27, 2026. The NFO for Mirae Asset Nifty500 Healthcare ETF will close on February 6, 2026, for Mirae Asset Nifty India Infrastructure & Logistics ETF, it will close on February 9, 2026. Both schemes will re-open on February 11, 2026, and February 13, 2026, respectively.

“India’s healthcare market is expected to be driven by multiple long-term factors such as a growth runway due to low penetration, export potential, expanding domestic market and government policy support. A diversified investment approach through Mirae Asset Nifty500 Healthcare ETF offers a robust, transparent and cost-efficient way to gain exposure across the healthcare value chain, including pharmaceuticals, hospitals and healthcare service providers,” said Siddharth Srivastava, Head - ETF Products & Fund Manager, Mirae Asset Investment Managers (India). “On the other hand, the Mirae Asset Nifty India Infrastructure & Logistics ETF offers a diversified play on infrastructure and logistics, which remain key focus areas for the government and continue to benefit from strong structural tailwinds. Given the breadth of the theme across multiple sectors such as power, capital goods, telecom, construction, transport and logistic services and real estate, a diversified fund structure helps investors stay aligned with India’s long-term infrastructure growth story

Minimum investment during NFO in both funds will be Rs 5,000 and in multiples of Rs 1 thereof. Mirae Asset Nifty 500 Healthcare ETF will be managed by Ms. Ekta Gala and Mr. Ritesh Patel and Mirae Asset Nifty India Infrastructure & Logistics ETF will be managed by Ms. Ekta Gala and Mr. Akshay Udeshi.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada