Mirae Asset Investment Managers (India) Pvt. Ltd. announces launch of New Fund Offers (NFOs) for two distinct funds, catering to evolving investor preferences in a dynamic rate and liquidity environment. The two new funds offer differentiated approaches— 1) A dynamic strategy blending arbitrage and debt allocations and 2) A passively managed constant maturity strategy focused on the AAA-rated financial services segment.

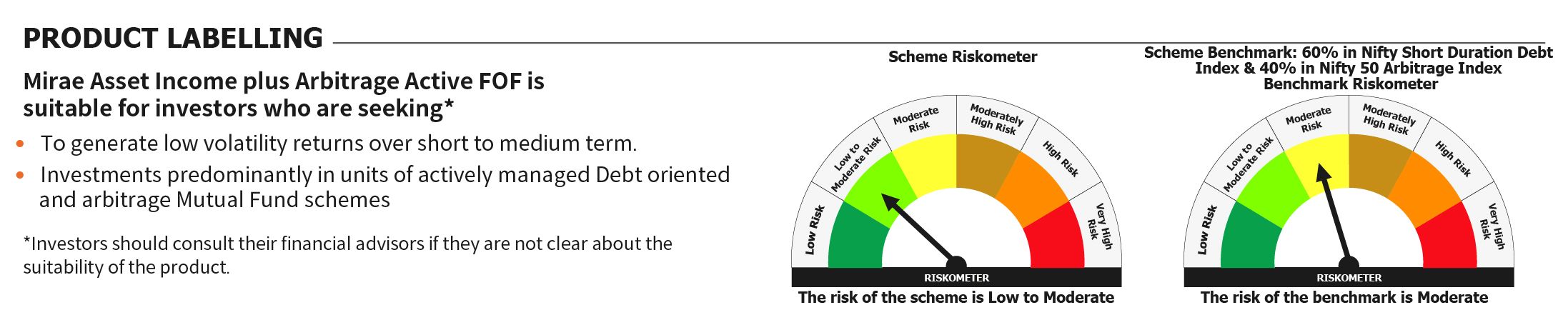

The new funds are Mirae Asset Income Plus Arbitrage Active FOF, (An open-ended fund of funds scheme investing in units of actively managed Debt oriented and arbitrage Mutual Fund schemes; and Mirae Asset CRISIL IBX Financial Services 9-12 Months Debt Index Fund, an open-ended index fund tracking CRISIL-IBX Financial Services 9-12 Months Debt Index.

The New Fund Offer (NFO) for Mirae Asset Income Plus Arbitrage Active FOF will open for subscription on June 16, 2025, and close on June 30, 2025, while the New Fund Offer for Mirae Asset CRISIL IBX Financial Services 9-12 Months Debt Index Fund will open on June 17, 2025, and close on June 23, 2025. Mirae Asset Income Plus Arbitrage Active FOF will Scheme re-open on July 07, 2025 while Mirae Asset CRISIL IBX Financial Services 9-12 Months Debt Index Fund Scheme re-open on June 26, 2025.

“We are optimistic about the potential of the Mirae Asset Income plus Arbitrage Active FOF to adapt to diverse market environments. While on one hand, active allocation across debt fund categories will help deal with a volatile fixed income space, ability to opt for Arbitrage funds when it offers a better opportunity will be an additional feature” said, Mahendra Kumar Jajoo, CIO – Fixed Income, Mirae Asset Investment Managers (India) Pvt. Ltd.

“The Mirae Asset CRISIL IBX Financial Services 9-12 Months Debt Index Fund offers a low duration, low credit risk strategy through a passively managed index approach. It tracks a basket of AAA-rated financial sector issuers including banks, NBFCs, and HFCs with 9–12-month maturities. With a roll-down strategy and attractive term spreads in the sector, it offers a good option for accrual strategy orientation with a bit of capital gains possibility” said Mr. Amit Modani, Dealer -Fixed Income & Fund Manager, Mirae Asset Investment Managers (India) Pvt. Ltd.

For both schemes, the minimum initial investment during New Fund Offer will be ₹5,000/- (Rupees Five Thousand) with subsequent investments in multiples of Re. 1 thereafter. SIP will be available starting from ₹99.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada