Mirae Asset Investment Managers (India) Pvt. Ltd. announces launch of the Mirae Asset Infrastructure Fund, (an open-ended equity scheme following infrastructure theme). The Scheme seeks to invest predominantly in companies

that are part of India’s infrastructure landscape including construction companies, logistics, power, telecom, building material providers, data centres, healthcare infra and infrastructure financing entities etc.

The New Fund Offer (NFO) for the Scheme will open for subscription on November 17, 2025 and close on December 01, 2025. The scheme reopens on December 08, 2025. The minimum initial investment during NFO is ₹5,000 and in multiples of ₹1. The Scheme will be benchmarked against BSE India Infrastructure Total Return Index (TRI). The Scheme will be managed by Ms. Bharti Sawant.

India’s infrastructure expansion has entered a multi-decadal super-cycle. The first phase (FY21–FY26) has been decisively driven by government spending, with central capex rising from ₹4.3 lakh crore in FY21 to ₹11.2 lakh crore

in FY26 (Budget Estimates). Strategic initiatives such as PM Gati Shakti, Bharatmala, Sagarmala, Smart Cities, NIP, and NLMP have laid a strong foundation for logistics, energy, and digital connectivity. The next phase of this

growth story is set to be propelled by a surge in private capital expenditure.

“The coming decade is poised to be driven by robust private capex and sustained government investment, powered by Production Linked Incentives (PLI), import substitution measures, and a strong push toward domestic electronics and

digital infrastructure. This momentum is set to spill over through the value chain from construction materials and equipment manufacturing to Engineering, Procurement, and Construction (EPC) services and logistics—cementing

infrastructure as a long-term structural growth theme," said Ms. Bharti Sawant, Fund Manager, Mirae Asset Investment Managers

(India) Pvt. Ltd.

Policy certainty and long-term capex visibility, combined with improving business metrics and scale efficiencies, are setting the stage for the next wave of infrastructure growth. As capacity utilization nears the 80% threshold,

private capex revival gains momentum. Meanwhile, deepening domestic manufacturing through PLI schemes and the accelerating convergence of digital and physical ecosystems are driving productivity and formalization—key reasons

behind our constructive view on the infrastructure theme.

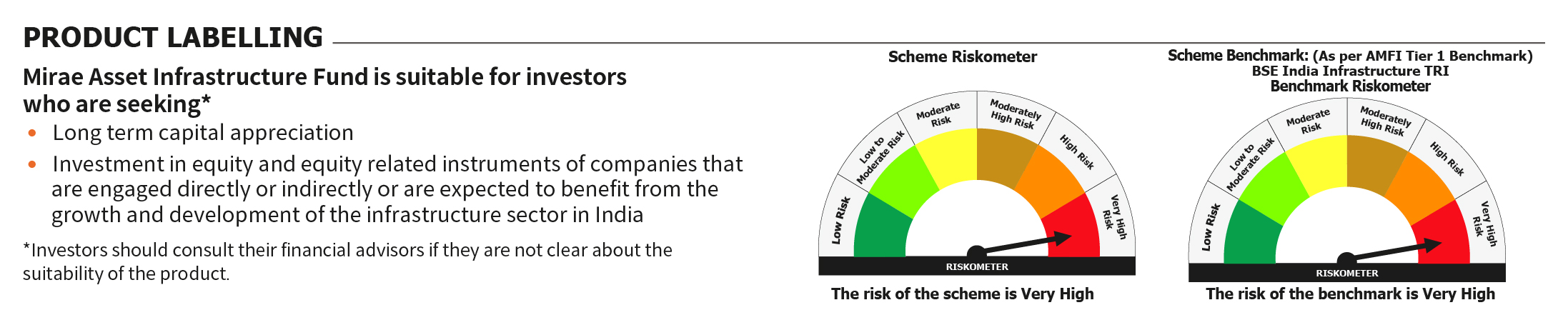

The Scheme is suitable for investors who are looking to generate wealth by investing for the long term. The scheme will invest a minimum of 80% of net assets in equity and equity related instruments of companies that are engaged

in or are expected to benefit from the growth and development of the infrastructure sector in India. It also has the provision to invest upto 10% of net assets in units of REITs and InvITs with the remainder invested in debt

and money market instruments.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada