Mirae Asset Mutual Fund, one of the fastest growing fund houses in India, has announced the launch of Mirae Asset Multicap Fund, an open-ended equity scheme investing across large cap, mid cap and small cap stocks.

The NFO for the fund opens for subscription on July 28, 2023 and closes on August 11, 2023. The fund will be managed by Mr. Ankit Jain. The benchmark Index for the fund will be the NIFTY 500 Multicap 50:25:25 TRI.

The minimum initial investment in the fund will be Rs 5,000 and multiples of Re 1 thereafter.

Key Highlights:

- One of the investment options for investors with a 5-year plus horizon, who are looking to diversify their equity portfolio across marketcap, or limit the number of schemes they are invested in, as it gives exposure

across the market cap spectrum.

- Each category will have min. 25% & max. 50% allocation, translating to even participation across segments

- The large cap investments will be in the Top 100 stocks by market capitalization, where the businesses are mature with dominant players, and therefore offering relatively lower downside risk & volatility in

comparison to mid & small cap.

- The mid cap comprises of the next 150 (101st to 250th) stocks by market capitalization, largely emerging businesses with reasonable valuations.

- The small caps comprise of the 251st & beyond stocks by market capitalization that consist of young and scalable businesses with unlocked potential. While these stocks may carry a higher downside risk, they

also have higher alpha generating potential.

- The last 25% investments will be more tactical in nature, leveraging opportunities through dynamic allocation across market capitalizations.

Mirae Asset Multicap Fund being capitalisation and sector agnostic offers investors the experience of staying invested across stocks and sectors that are experiencing benefits of excellence as well as technological

changes being ushered into the economy. This is also an opportunity for those investors who do not want their portfolio to be widely spread but enjoy the best of all sectors.

Mr. Ankit Jain Fund Manager for Mirae Asset Multicap Fund said, “Right from the outset, it has been our endeavour to offer our investors various options that enable to optimise their returns in line with their investment

strategies. Mirae Asset Multicap Fund too follows a similar principle, by enabling investors to expand their investments across the market spectrum without necessitating the addition of multiple schemes. The Multicap

fund invests in large cap, mid cap and small cap funds, leading to diversification of opportunities and risk, making it a dynamic option balancing risk and reward,”

Mr. Jain, further added, “despite the turbulence in the global economic environment, the Indian economy continues to charter an impressive growth-route and Mirae Asset Multicap Fund aims to capture and offer the exciting

positive developments across sectors to its investors”.

The Mirae Asset Multicap Fund will be available to investors in both, Regular Plan and Direct Plan. Post NFO, the Minimum Additional Purchase Amount will be Rs. 1000 and in multiples of Re 1 thereafter.

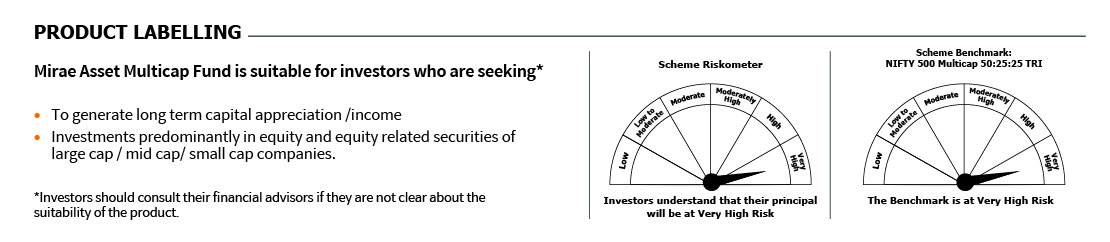

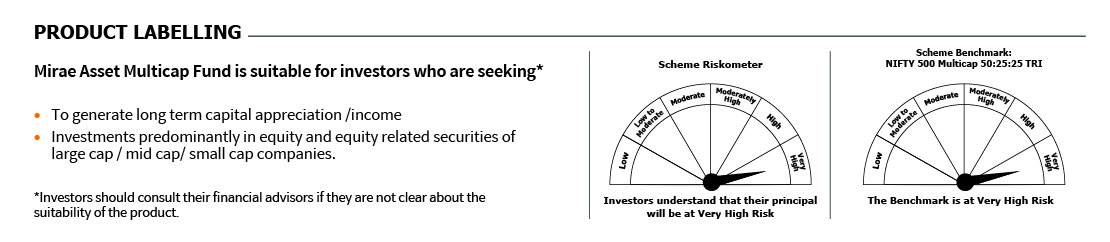

RISKOMETER

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada