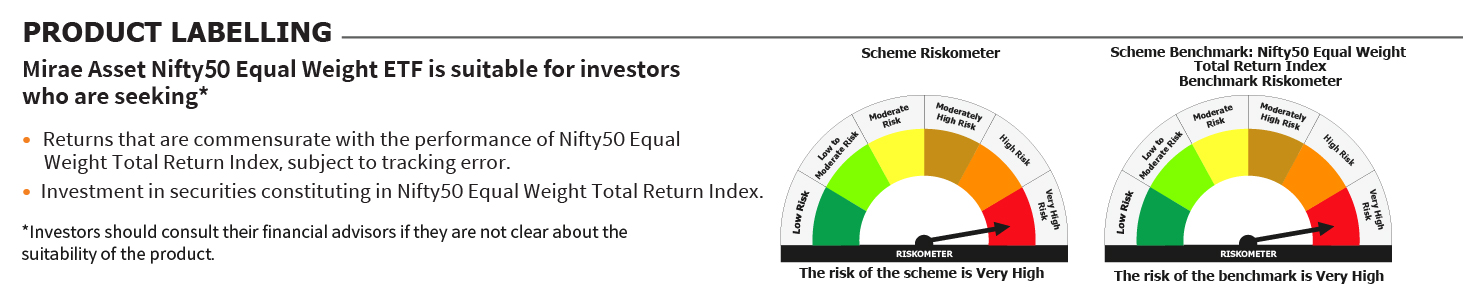

Mirae Asset Investment Managers (India) Pvt. Ltd. announces the launch of ‘Mirae Asset Nifty50 Equal Weight ETF’, an open-ended scheme replicating/tracking Nifty50 Equal weight Total Return Index. The fund aims to provide

investors with an opportunity to invest with equal weight across Nifty 50 stocks.

Nifty50 equal weight index gives equal weight to all Nifty 50 large cap companies reducing concentrated exposure to individual stocks and providing better diversification. Each stock weight is around 2%, limiting overexposure to

a few large-cap stocks and providing relatively more weightage to tail stocks and thus making index more representative of broader market trends.

Nifty50 Equal Weight Index exhibits cyclical behaviour where it may potentially outperform during broad market rally, on the other side it may underperform during market corrections or during phases when market is driven by select

large cap stocks.

The New Fund Offer (NFO) for Mirae Asset Nifty50 Equal Weight ETFwill open for subscription on April 30, 2025, and close on May 6, 2025. The scheme will re-open for continuous sale and repurchase on May 12, 2025.

In the scheme, the minimum initial investment during New Fund Offer will be Rs 5,000/- (Rupees Five Thousand) with subsequent investments being multiples of Re 1.

“Mirae Asset Nifty50 Equal Weight ETF seeks to capitalise on opportunities in large cap segment when market is driven by a wider set of companies typically during broad based economic growth, in a disciplined manner by providing

equal opportunity to each and every company in the Nifty 50 portfolio,” said Siddharth Srivastava, Head – ETF products and Fund Manager, Mirae Asset Investment Managers (India).

Investing in portfolio of Nifty50 Equal Weight index may be suitable for investors who are looking for more diversified exposure in Nifty 50 companies with lower top stock concentration and higher potential contribution from tail

stocks. This strategy may work well when there is a broad market performance and when market is not driven by select larger Nifty 50 companies.

The fund will be managed by Ms. Ekta Gala & Mr. Akshay Udeshi.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada