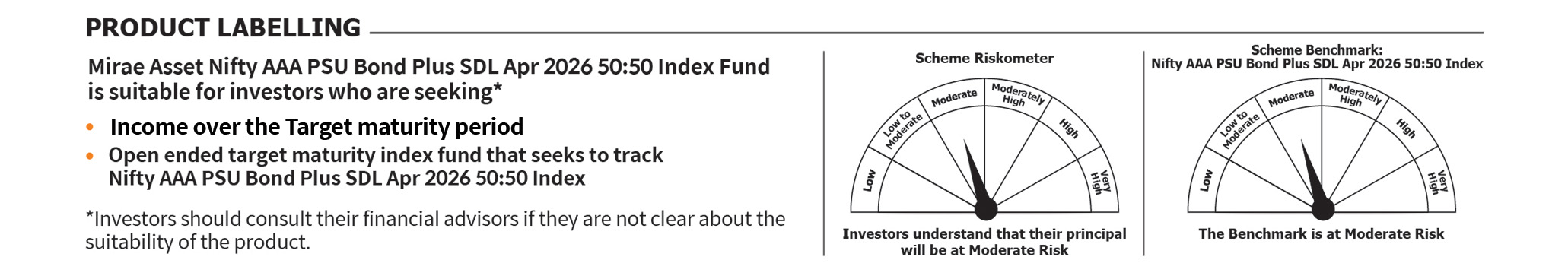

Mirae Asset Mutual Fund, one of the fastest growing fund houses in India, has announced the launch of its two new funds – Mirae Asset Nifty AAA PSU Bond Plus SDL Apr 2026 50:50 Index Fund (An open-ended target maturity Index Fund investing in the constituents of Nifty AAA PSU Bond Plus SDL Apr 2026 50:50 Index Fund. A scheme

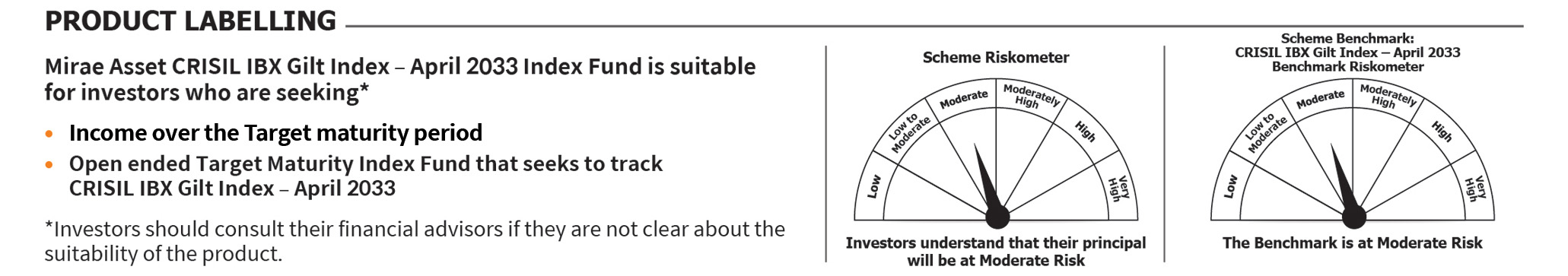

with relatively high interest rate risk and relatively low credit risk) and Mirae Asset CRISIL IBX Gilt Index – April 2033 Index Fund (An open-ended target maturity Index Fund investing in the constituents of CRISIL IBX Gilt Index – April 2033. A scheme with relatively high interest rate risk and relatively low credit risk.)

Mirae Asset Nifty AAA PSU Bond Plus SDL Apr 206 50:50 Index fund is to track Nifty AAA PSU Bond Plus SDL Apr 2026 50:50 Index by investing in AAA rated Public Sector Undertaking (PSU) Bonds and State Development Loans (SDL),

maturing on or before April 30, 2026, subject to tracking errors . It is a fixed maturity index fund with relatively lower credit risk and has no lock-in like fixed maturity plans which means Investor has the option to

subscribe or redeem anytime during the lifecycle of the fund**. The fund is tax efficient compared to traditional investment avenues, as Long Term Capital Gain (LTCG) is taxed at 20% post indexation benefit*, there is potential

to avail 4% indexation benefit depending upon the investors holding period.

Mirae Asset CRISIL IBX Gilt Index – April 2033 Index Fund is to track the CRISIL IBX Gilt Index – April 2033 by investing in dated Government Securities (G-Sec), maturing on or before April 29, 2033, subject to tracking errorsIt’s

an opportunity to lock-in 10 Year at relatively higher yield as going forward Indian 10 Yr. G-sec is expected to move in range bound manner if CPI remains in RBI tolerance limit and outlook to economic growth is not deterrent.

Both New Fund Offers (NFOs) will be open on October 10, 2022 and closes on October 18, 2022. Both the funds will be managed by Mr. Mahendra Jajoo, CIO- Fixed Income, Mirae Asset Investment Managers (India) Pvt Ltd. The minimum

initial investment in the funds will be Rs. 5,000/- and multiples of Re. 1/- thereafter.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada