Is investment an art or science? Theoreticians will say it is science because it follows a logical process, based on data, quantitative research and financial models. However, many practitioners will tell you that investment is an art as well

since it often involves relying on experience, intuition and judgement. However, there is a problem with relying too much on intuition and judgement because they can be based on pre-conceived notions, which are not backed by solid evidence.

This leads to what is known in behavioural sciences as, confirmation bias.

Confirmation bias meaning

Investors have their own opinions or pre-conceived notions. Seeking information or opinions that supports their ideas or pre-conceived notions and ignoring information that is contrary to their pre-conceived notions is confirmation bias. Confirmation

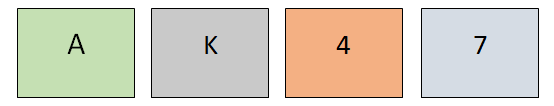

bias is tested by a simple experiment. Investors are given 4 cards like the ones shown below. They are told that there is a letter or number on back of each card. Then they are asked to pick maximum 2 cards to test the hypothesis that

“there will always be an even number of the back a card with a vowel”. Which 2 cards will you pick?

Most people pick up “A” and “4”. Having vowel behind “4” does not conclusively prove the hypothesis is right or wrong. At best you can say that hypothesis may be true. Instead if you picked 7 and found a vowel behind it, you would have conclusively

said the hypothesis is wrong. Please remember this is not an intelligence test. It is a psychology test. When you were told that “there will always be an even number of the back a card with a vowel” you believed it to be true and try to

confirm that it is true. This is confirmation bias meaning that, you favour information that confirms your previously existing beliefs or biases and ignore information which challenges your beliefs or biases.

Examples of confirmation biases

Confirmation bias is seen in many aspects of life. For example, if you have a certain set of political beliefs, you would like to associate with friends you share your beliefs or like to follow political commentators, analysts, journalists

or publications that affirm your belief. Similarly, if you like one sport star e.g. cricketer, footballer, tennis player etc, you will like to discuss to about your favourite sports star with friends who are also fans of your favourite

player and be less inclined to discuss with people who may have unfavourable opinion of your favourite player, even though they may have some valid criticism about your favourite star.

If you have a favourite actor or actress and his / her movie is about to release, you would like to read only the positive reviews about the movie and ignore the critical reviews. Another example of confirmation bias is a person with diabetes,

for who the doctor has prescribed a particular diet, which he / she is unable to follow strictly due to his / her food preferences. The person will get his / her blood sugar levels tested regularly. There may be reports where the blood

sugar level is higher than normal, which this person will ignore considering it to be part of normal blood sugar level fluctuations. On the other hand, they will take every report which shows normal blood sugar level that their diet plan

is working and diabetes is under control. You can see that people with confirmation bias, tend to seek information which seems to affirm their beliefs. People with confirmation biases are highly subjective and do not apply objectivity.

Examples of confirmation biases

Confirmation bias meaning that you base your decisions and opinions on pre-existing beliefs is often seen in decisions. Investors of a certain age group in India may have heard from their parents that avoid investing in stock market; life

insurance policy is actually an investment; fixed deposits are the best investing your savings etc. If they form pre-conceived notions about investments based what they may heard in childhood, then the first time they make a loss in equities

will re-affirm their belief that equity should be avoided, even though they may have made profits in equity before. If a friend told you that Gold is always better than Equity and believed it, you may look at returns over the periods where

Gold outperformed Equity and feel confident about your friend’s opinion. You would ignore the period where Gold underperformed Equity.

How confirmation bias affects investment behaviour?

Confirmation bias is affirmation seeking behaviour. If you think Fixed Deposits (FDs) are better than debt mutual funds, every time a bond gets downgraded or when yields rise and fund returns are impacted, you will seek to confirm your bias

for FDs often ignoring other relevant information like returns of high credit quality debt funds, debt fund returns in favourable interest rate environments or tax efficiency of debt funds. An investor with confirmation bias often ignores

useful information like interest rate environment and cycles, how bond prices can be affected by interest rate changes, which types of debt funds are affected more by interest rate changes compared to others etc.

Another example of pre-conceived notions leading to confirmation seeking behaviour can be a particular stock / company that you like or dislike for whatever reasons. You may like a company because your father or a relative may have worked

there and had great things to say about the company or it may have been one of your earliest investments and given good returns; whatever the reason you have an emotional attachment to it. If the share price of this company falls, you

think it is normal market volatility, even though the market may have gone up on the day when the stock price fell. However, every time the share price of the company goes up, it reaffirms your faith in the stock. You biased more by your

beliefs than the fundamentals e.g. financial performance, industry sector outlook, earnings outlook etc.

Similarly, you may have a personal preference for a particular mutual fund manager or mutual fund house not based on track record, but how you feel or what you may have heard about the fund manager / fund house from friends, colleagues, relatives

etc. You will tend to favour the fund manager by comparing his / her performance with peer funds which would have underperformed hid / her funds and ignore funds which would have outperformed the scheme managed by the fund manager you

favour.

People with confirmation biases tend to recall events that affirm their beliefs. For example, people who have pre-conceived notions or bias against equity may recall only the bear markets or periods when the market crashed e.g. 9/11 terrorist

attack, global financial crisis, COVID-19 outbreak etc, and ignore the fact that the equities may have given more than 12% returns in the last 20 years, despite these crashes.

Confirmation bias leads to overconfidence about your investment strategy. More often than not, confirmation bias leads to sub-optimal investment decisions or even wrong investment decisions. Confirmation bias cause bulls to remain bullish

or bears to remain bearish even when the market is too high or too low. Confirmation bias can provide explanations as to why some stocks trade at completely unreasonable valuations relative to their intrinsic value or why it may sometimes

trade even below book value.

Negative effects of confirmation bias

- Investors with confirmation bias hold on to underperforming stocks or funds because they have pre-conceived notions about the stock or fund and will ignore financial data that suggests otherwise. This behavioural bias can be harmful

for your financial interest.

- Investors with confirmation bias often miss out attractive investment opportunities. For example, if markets are falling and you form an opinion that it will fall further, you will look for information that reaffirms your belief that

the market will fall. Even if market bottoms out and bounces back from lows, your pre-conceived notion will result in missing out on attractive investment opportunities.

- Investors with confirmation bias disregard diversification or asset allocation. If you view investments as good or bad, irrespective of factors like your financial goals, risk appetite, asset class risk profile, market cycles, performance

track record etc, you may disregard diversification or asset allocation. Confirmation bias can encourage investors to become obsessed with a few companies or a few investment types ignoring diversification or asset allocation.

- Investors with confirmation biases are often driven by herd mentality. Since many people in your circle of friends or acquaintances are investing in something, you can form a confirmation bias that it is a good investment. Investors

with such bias can fall victims to asset bubbles or even fraudulent investments schemes.

We have discussed the negative effects of confirmation bias. Let us now discuss how to prevent confirmation bias.

How to avoid confirmation bias?

- Seek contrary opinions, even if those opinions may seem uncomfortable to you at first. Try to understand the rationale behind the contrarian opinions.

- Do not rely on just one source of information to form opinions about a product. Look at multiple sources of information.

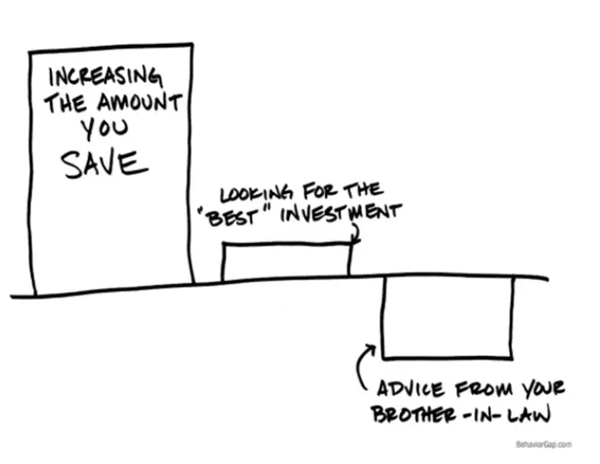

- Knowledge is your biggest friend in overcoming investor biases. Increase your investment knowledge about different investment concepts, financial markets and the economy to make better investment decisions.

- Consult with your financial advisor and he / she can help with regards to a disciplined / systematic way of investing and how to avoid confirmation bias.

Conclusion

Confirmation bias is a psychological phenomenon which affects how we perceive things and make investment decisions. In this article, we have discussed confirmation bias meaning, how it affects your behaviour as an investor, its negative effects

and how to avoid confirmation bias. You should always be open to learning irrespective of what stage of life you are in. You should also consult with your financial advisor if you need help.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada