- Myth: Debt mutual funds are as risky as equity

The risk of fixed income instruments is usually lesser than equity because issuer of fixed income instruments is contractually obliged to pay a certain rate of interest and principal on maturity of the instrument. The management of a company

has no such obligations to pay the Dividend to the shareholders, i.e. only when there is profit and the Management decides to share the profits among their Shareholders the Management proposes to the Shareholders to declare dividends.

Dividends are distributed after paying interest and taxes. In debt instruments, there is a possibility of issuers not being able to meet their debt obligations. If a company goes into bankruptcy and its assets liquidated, bondholders

are paid before shareholders. Further, usually most of the underlying instruments in longer duration debt funds are G-Secs, which have probably no credit risk because they have sovereign guarantee. Purely from the point of view of

underlying instruments, fixed income funds are less risky than equity. Even if you take interest rate risk into account, longer duration fixed income funds are less risky than equity.

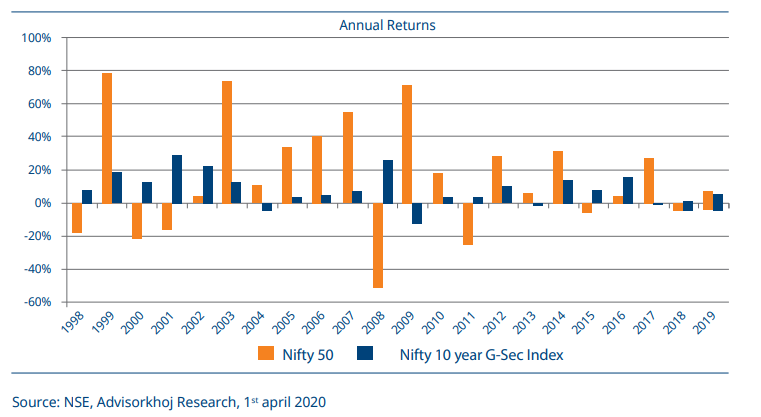

The chart below shows the annual returns of Nifty 50 versus Nifty 10 year G-Sec Index over the last 20 years.

Past performance may or may sustain in future.

- Myth: Fixed deposit usually give higher returns

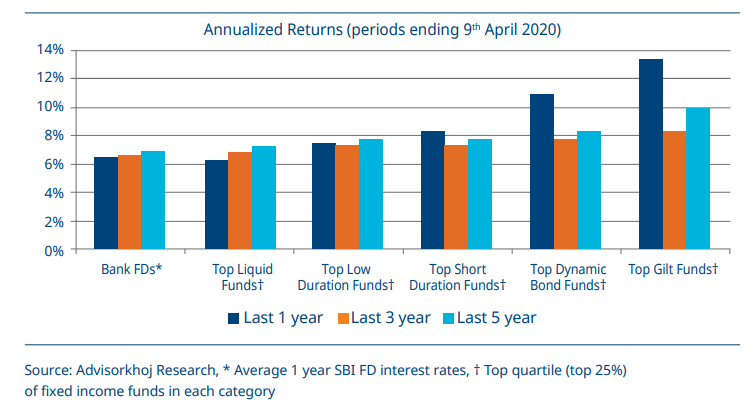

The reality is that on an average and over a period of time, well managed debt funds have been able to outperform fixed deposits. Fixed deposits are seen as risk free investments. Investors should understand that risk free investments

usually give the lowest returns. The yields of many fixed income instruments are higher than bank FD interest rates of similar maturities. Yields of AAA rated corporate bonds can be 150 – 200 bps higher than FD interest rates. The

chart below shows bank FD returns versus top performing (top quartile) fixed income fund returns across different categories and periods. You can see that the top performing debt funds were able to outperform FDs on average (across

different categories) over time.

Past performance may or may sustain in future. The returns shown above are returns of the category and do not in any way depict the performance of any individual scheme of any Fund.

- Myth: Invest in the debt funds aiming highest returns

Different types of debt funds have different risk characteristics. There are two main risk factors in debt funds – interest rate risk and credit risk. Longer the duration of a fund, higher is its price sensitivity to interest rates, e.g.

Gilt and dynamic bond funds are highly sensitive to interest rate changes while liquid and overnight funds have very little sensitivity to interest rate changes. Similarly funds which invest predominantly in Government and highly rated

papers have much less credit risk than funds which invest in lower rated papers to capture higher yields. Point to point returns in debt funds are driven largely by the interest rate and credit environment. For example, you should

not select debt funds purely on the basis of recent returns. You should always invest according to risk appetite and investment needs and if need be consult your financial advisor before investing.

Source: Advisorkhoj Research as of 1st April 2020.

- Myth: Liquid funds seek positive return

Historically, liquid funds has sought potential returns. These funds invest in money market instruments like CPs, CDs, and Treasury Bills etc. CPs and CDs are unsecured money market instruments and only issuers with strong financial standing

are able to get investors investing in such money market instruments. However, events over the past 30 months or so have shown that some liquid funds can give negative returns over certain periods. This has opened the eyes of many

investors who were earlier blissfully unaware of credit risks in liquid funds. Investors should check the credit quality profile and investment track record of liquid funds before investing among other factors to be considered while

investing.

Source: Advisorkhoj Research

- Myth: Debt funds are meant for corporate and institutions, isn’t it?

While corporate and institutions account for a very large percentage of debt fund assets under management (AUM), these funds offer excellent investment solutions to retail investors for a variety of investment needs and risk appetites.

You do not need huge sums of money to invest in debt funds – you can start with just Rs 5,000. You can also invest in debt funds through SIP. Apart from investing for your short term, medium term and long term investment goals, debt

funds are also useful for asset class diversification and reducing the risk profile of your investment portfolio.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada