The recent rise in domestic and global bond yields has spooked investors of debt funds – an increase in yields leads to a fall in the value of traded bonds, thereby denting fund returns. However, as with any other asset class, debt instruments

have their ups and downs; they closely track the interest rate movement. Interest rates have a significant impact on debt funds based on their yield to maturity (YTM). For instance, long-duration debt funds with higher YTM perform well when

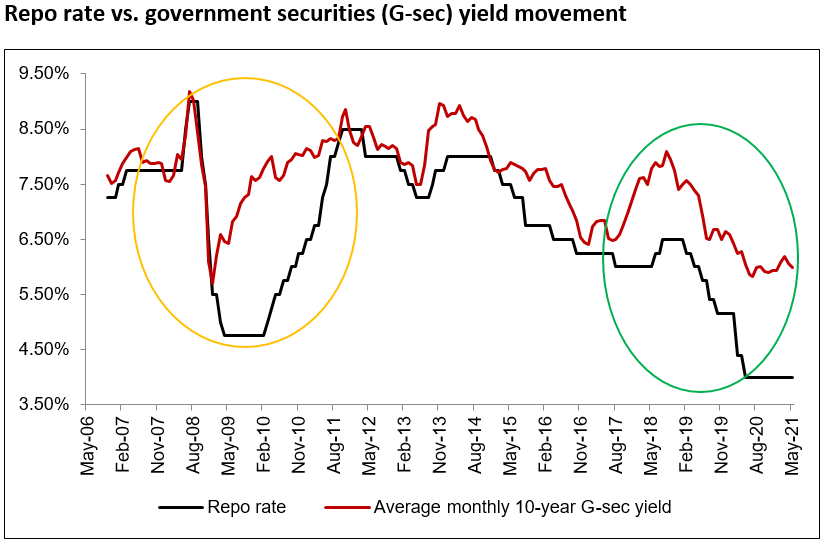

interest rates fall, whereas funds that follow accrual strategies to minimise interest rate risk do well during flat and high interest rates. The chart below shows how yields move in tandem with interest rates (repo rates).

Ride interest rate cycles through debt mutual funds

Even seasoned investors find it difficult to take the right interest rate call. Investors can instead allocate their money to different debt fund categories of varying maturity. For instance, they can look at medium-duration funds such as corporate

bond funds, banking and PSU debt funds, and dynamic bond funds. These funds tend to have their maturity profile in between the long- and short-maturity funds, thus they may provide the investors with the benefit of both the worlds. Corporate

bond funds invest 80% of their assets in the highest-rated corporate bonds, and may invest a small portion in G-sec. They normally follow the accrual strategy, aiming to generate returns through the accrual of interest on bonds, which are

mostly of shorter duration and are held until maturity. As a result, these funds are less exposed to interest rate volatility. Similarly, banking and PSU debt funds invest 80% of their assets in debt instruments of banks, PSUs, public financial

institutions, and municipal bodies. Most of the schemes in these two categories aim to maintain an optimal balance of yield, safety, and liquidity. Their strategy is to mitigate credit risk and generate returns through a blend of accruals

and active duration management. Meanwhile, dynamic bond funds can move across the maturity spectrum, based on the interest rate in the underlying market.

Systematic investment plan (SIP) – the best route to beat volatility

It is difficult for individual investors to take the right call on when to invest as per the interest rate scenarios. They might miss most of a market phase, landing up entering or exiting at the fag end of phases and missing superior gains. This

is where SIPs can play an important role as regular SIP investments negate the need to time the market across different interest rate environments. Investors also have the opportunity to lower their average cost of investment, known as rupee

cost averaging, by investing through SIPs. Further, debt fund SIPs can be used for an investor’s financial planning. Considering the anticipated future obligation and time horizon, investors with a low-to-moderate risk appetite can begin SIPs

in appropriate categories to meet their goals, as an alternative to recurring bank deposits.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada