We make investments with the expectation of future cash flows either as capital appreciation or income. Assets are economic resources which generate these cash-flows. For individual investors, there are four major asset classes:-

- Equity – shares of companies which trade in stock exchanges and other related securities (e.g. derivatives) which derives its values from the underlying shares.

- Fixed Income – assets which give periodic interest payments and returns the principal on maturity of the asset. Fixed income assets can be market linked or non-market linked.

- Commodity – raw materials which are used to make products which have economic value. For individual investors Gold is the most popular commodity.

- Read Estate – residential or commercial for rental income or capital appreciation.

Assets can be financial or physical. Equity and fixed income are financial assets. Gold can be purchased both in physical form (e.g. gold jewellery, bars, coins etc) or financial form (ETFs, Gold Funds). Real estate investments for individual

investors are usually in physical assets.

While the main objective of investing in an asset is to get returns (capital appreciation or income) two important factors should always be considered– liquidity and transparency. One of the biggest advantages of financial assets

over physical assets is liquidity.

For example, you can sell shares of companies or units of open-ended mutual funds on any business day, but the sale of property may take several months or even years to materialize. The other main advantage of financial asset over a physical

asset is transparency. Financial markets are regulated and asset prices are transparent but in absence of a regulated secondary market, physical assets lack transparency in prices. Let us now discuss the two fundamental characteristics

of asset classes – risk and return.

Risk and Returns

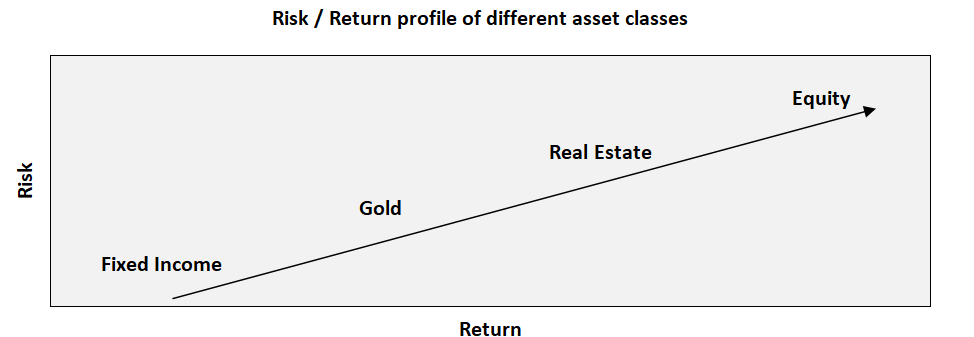

The relationship between risk and return is fundamental in investments – higher the risk, higher the expected returns. Different asset classes have different risk profiles.

Equity has the highest risk but also the highest return potential among all asset classes. We will compare the historical performance of equity versus other asset classes.

Equity versus Fixed income

Fixed income is the most popular financial asset of most Indian households. Household Savings is mainly invested in traditional fixed income investments like bank Fixed Deposits (FDs), Government small savings schemes etc.

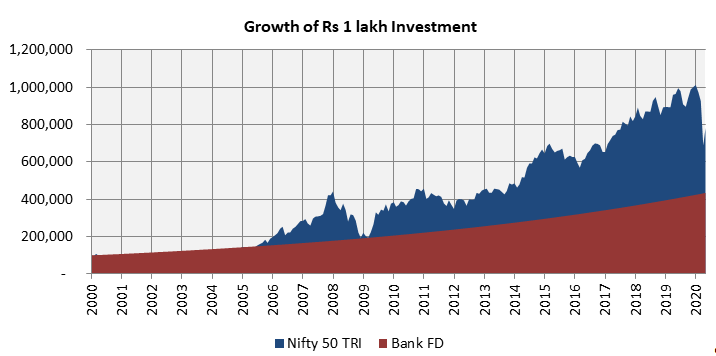

Equity has greater wealth creation potential over long investment horizons. The chart below shows the growth of Rs 100,000 investment in Nifty 50 (the index of 50 largest stocks by market capitalization) and Bank Fixed Deposits over the last

20 years (from 1st January 2000 to 28th April 2020).

Source: National Stock Exchange, Advisorkhoj Research (1st Jan 2000 to 28th Apr 2020). Past performance may or may not sustain in future.

You can see in the chart that the Nifty 50 despite several deep corrections in prices e.g. 2000-01, 2008, 2011, 2015-16, created much more wealth than fixed deposits. Over the last 20 years or so (from 1st January 2000 to 28th April 2020),

your Rs 1 lakh investment in Nifty 50 TRI would have grown to Rs 7.82 lakhs at a compounded annual growth rate (CAGR) of 10.65%. Your investment in FD would have grown to only Rs 4.15 lakhs at an annualized rate of 7.25%.

Source: National Stock Exchange. Advisorkhoj Research(1st Jan 2000 to 28th 2020). Past performance may or may not sustain in future.

Equity prices in the short term depend on demand and supply of stocks in the market, but in the long term are driven by fundamental factors like overall economic growth, inflation, industry growth, market share, how efficiently management

uses capital etc. Fixed income returns on the other hand, are largely dependent on prevailing interest rates. In an inflationary environment, fixed income returns struggle to beat inflation whereas equity aims to give superior inflation

adjusted returns in the long term.

Equity versus Gold

Gold in physical form, especially jewellery is a popular investment in many Indian households due to the cultural significance of the precious metal in our society. Physical gold, especially as jewellery however, has several drawbacks like

impurity, risk of theft, storage costs etc. Gold in form of financial asset e.g. Gold ETFs, Gold funds etc has more economic value than physical gold. As an investment gold is used for risk diversification and hedge against inflation in

the long term. But how does gold compare versus equity in terms of long-term returns.

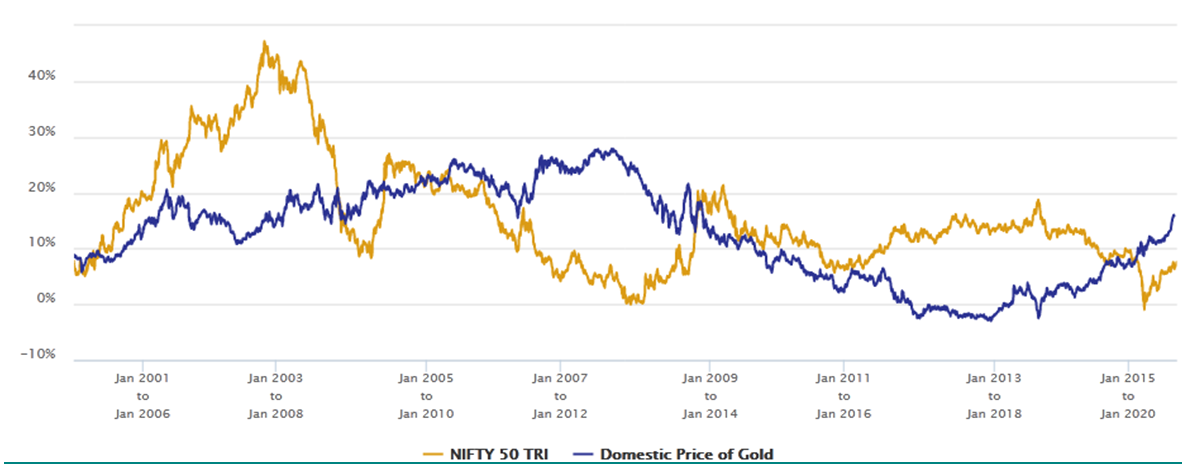

Equity and gold price movements usually have a negative correlation, i.e. gold underperforms in equity bull market and outperforms in bear market. To compare gold and equity performance in different market conditions we looked at 5 year rolling

returns of Nifty 50 TRI versus Gold (see chart below) over last 20 years. You can see that over 5 year investment periods across different market conditions, Nifty outperformed gold most of the time.

5 year rolling returns

Source: Advisorkhoj Research (1st Jan 2000 to 28th Apr 2020). Past performance may or may not sustain in future.

Taxation of equity versus other asset classes

Taxation of proceeds from sale of assets should be one of the most important considerations in making informed investment decisions. In India, equity as an asset class is one of the most tax efficient investment options. Interest paid by bank

FDs and most Government small savings schemes is taxable as per income tax rate of the investors. Short term capital gains (investments held for less than 3 years) arising out of sale from debt mutual funds, gold and real estate are also

taxed as per the income tax slab rate of the investors. Long term capital gains (investments held for more than 3 years) arising out of sale from debt mutual funds, gold and real estate are taxed at 20% after allowing for indexation benefits.

Short term capital gains (investments held for less than 1 year) arising out of sale from equity shares, units of equity or equity oriented mutual funds are taxed at 15%. Long term capital gains (investments held for more than 1 year) arising

out of sale from equity shares, units of equity or equity oriented mutual funds of up to Rs 1 lakh are tax exempt. Long term capital gains arising out of sale from equity shares, units of equity or equity oriented mutual funds in excess

of Rs 1 lakh is taxed at 10%. For investors in the higher brackets, equity is a much more tax efficient compared to other asset classes.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada