Financial Services Financial Services is one of the most important sectors of an economy. Financial Services sector comprises of both Banks and Non-Banking Lending Institutions; Insurance and Asset Management Companies are also part of Financial

Services Sector. A strong and well regulated Financial Services Sector can be critical for the growth of an economy.

Financial Services in India

The Indian banking system consists of 12 Public Sector Banks, 22 Private Sector Banks, 46 Foreign Banks, 56 Regional Rural Banks, 1485 Urban Cooperative Banks and 96,000 Rural Cooperative Banks in addition to co-operative credit institutions (source:

RBI, data as on: 31st March 2021). Most Investors associate Financial Services Sector with Banks. However, the ambit of Financial Services Sector is broader. Apart from Banks, we have Non-Banking Lending Institutions like Term Lending, Housing

Finance, Commercial Vehicle Finance, Leasing and Hire Purchase Companies, etc.

Passive investing in financial services

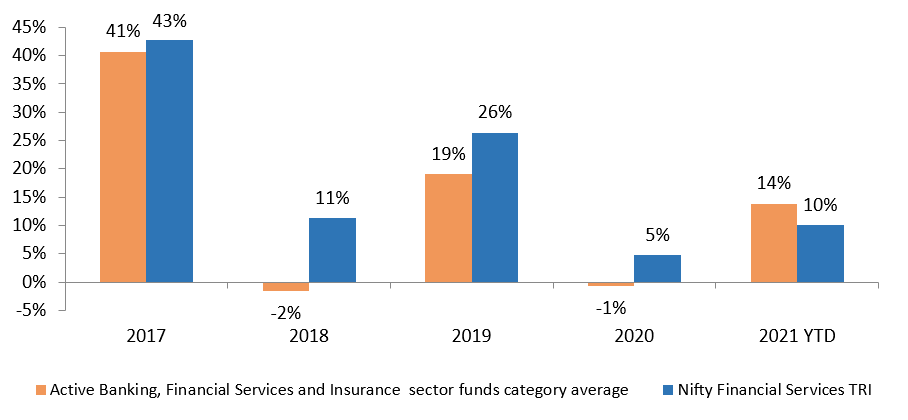

Apart from diversified equity funds, which have financial services in their portfolios, there are sectoral funds which invest only in financial services. However, most of these funds have failed to beat Nifty Financial Services TRI (see the chart

below). In 3 out of the last

5 years, even most of the top quartile funds in the category were unable to beat the Nifty Financial Services TRI. Therefore, a passive exposure to this sector through ETFs or Index Funds may make sense.

Benefits of passive investing

- No unsystematic risks: Fund managers of active funds are overweight/underweight on some stocks relative to the index with the aim of creating alphas. This gives rise to unsystematic risks. ETFs and index funds aim to replicate the performance

of the index. There is no unsystematic risk.

- Rule based Portfolio construction: Rule based selection and weighing ensures that indices are faithful representative of the intended objective with scheduled rebalancing of stocks ensuring inclusion of more relevant stock and exclusion

of stock which doesn’t satisfy or capture the objective anymore

- Lower costs: Total Expense Ratios (TERs) of passive funds are much less than active funds. Costs are deducted in the NAVs of Mutual Fund Schemes. Therefore, a scheme with the lower costs will have higher returns for the same performance

of under lying portfolio.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada