Retirement planning is one of the most ignored topics among the working population because most people feel that retirement is far away and nearer term priorities seem important. Once they get near the retirement date, many people realize

that they have not saved enough for their retirement and fear losing their financial independence. Retirement is the culmination of the decades of hard work you put in your career. This should be the golden period of your life and you

should be free from financial worries.

Why is retirement planning important?

- Inflation: Inflation reduces the purchasing power of money over time. If inflation is 5%, then Rs 100 can buy only Rs 95 worth of goods after 1 year. After 10 years, it can buy only Rs 60 worth of goods

and after 20 years, only Rs 37 worth of goods. Your needs will remain the same but your money will be worth less and less. In order to fight inflation, it is very important that your money also grows over time. You need to plan

for inflation.

- Rising medical costs: With advancing age, health related problems are a concern for senior citizens. However, cost of quality private sector healthcare is increasing at a very fast rate in India. Some

studies show that inflation in the cost of medical expenses is around 15% per annum. A serious illness can eat a big part of your retirement savings and put you under considerable stress.

- Falling interest rates: Senior citizens traditionally rely on bank fixed deposit and government small savings schemes for their regular cash-flows. Over the last 20 years, interest rates of government

small savings schemes have come down significantly. As our economy (GDP) grows, money supply will also grow and interest rates will come down even further. You need to save more and create a larger corpus in order to generate sufficient

income to meet your post retirement expenses.

- No pension: India is largely an un-pensioned society. Private sector employees in India, unlike western nations like United States or United Kingdom, do have not have safety net in the form of a national

pension programme. They need to create their own post retirement income stream by saving and investing systematically during their working lives. As such, retirement planning should be one of your most important financial goals

during your working lives.

How much you need for retirement?

We have many responsibilities in our working lives like taking care of children’s education, caring for aged parents, paying home loan EMIs etc. Many people erroneously assume that most expenses will go away when they retire but they are mistaken.

Financial planners suggest that 70 – 80% of expenses remain even after retirement. Suppose your monthly expenses are Rs 1 lakh and you are 10 years away from retirement. Ten years later, your expenses will be Rs 1.6 lakhs assuming 5% inflation

rate. If your post retirement expense is 70% of your pre-retirement expenses, then your monthly expense post retirement will be Rs 1.1 lakhs.

You will need a corpus if Rs 1.7 Crores to generate a monthly income of Rs 1.1 lakhs if you get 8% return on investment. We ignored inflation and taxes when estimating the corpus. If we assume that your retired life is 25 to 30 years long

and inflation is 5%, you will need a retirement corpus of Rs 2.5 – 2.7 Crores to maintain financial independence throughout your retirement. In addition, you should also have some emergency funds set aside for medical or other exigencies.

If you want to leave behind an estate (inheritance) for your loved ones, then you need to have an even larger corpus.

How much to save and invest?

Let us assume you need Rs 2.7 Crores for retirement and you have 10 years left for your retirement goal. Assuming you get 8% return on your savings, you need to save nearly Rs 1.5 lakhs per month just to meet your retirement goal. For many

investors, it may seem a daunting task because you may have other financial obligations like home loan EMIs, children’s education, saving for children’s marriage etc. While the task is daunting, it is quite achievable if you have a good

financial plan in place and start saving for retirement early in your careers. Mutual funds may help you meet your retirement planning goals, while fulfilling your other aspirations

at the same time.

Mutual funds for retirement planning

Return on investment is one of the most important attributes of wealth creation. Mutual funds help you get exposure to different asset classes and sub-classes, which may enable you to get superior returns. Historical data shows that equity

has been the best performing asset class in the long term and has the potential to create wealth for investors over a long investment horizon.

In the last 10 years, Nifty 50 TRI, the total returns index of 50 largest stocks by market capitalization in India, gave 10.3% CAGR returns (Source: NSE India). If you were saving for retirement by investing in Nifty 50 TRI through monthly

Systematic Investment Plan (SIP) for the last 10 years, then you could have accumulated a corpus of Rs 2.7 Crores with a monthly investment of Rs

1.2 lakhs. If you started 5 years earlier, then you could have accomplished the task of accumulating Rs 2.7 Crores by investing just Rs 55,000 per month through SIP.

Systematic Investment Plans

Mutual fund systematic investment plan (SIP) is one of the best ways to invest for retirement planning. Through SIP, you can invest in a mutual fund scheme of your choice, based on your investment needs and risk appetite, from your regular

monthly savings through auto-debit from your savings bank account. SIP can be a disciplined way of investing because it will make you control your spending habits and invest regularly. SIPs in equity mutual fund schemes also average the cost of your purchase

(Rupee Cost Averaging) by taking advantage of stock market volatility.

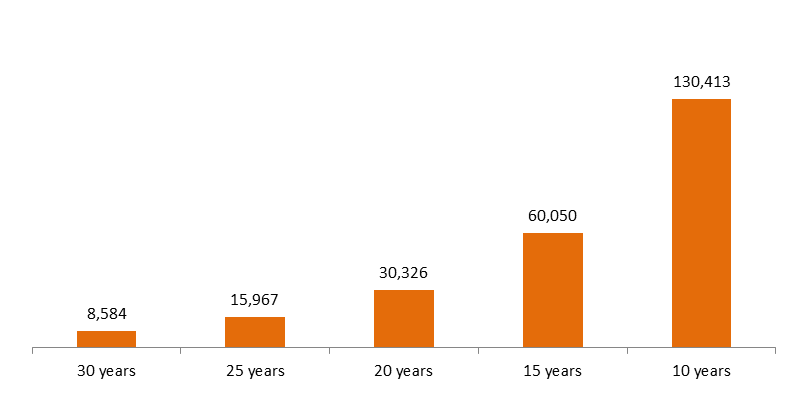

You can start your SIPs with very small monthly (or any other intervals) investments, as low as Rs 1,000. The longer your SIP tenure, the more wealth you may create through the

the power of compounding. The chart below shows monthly investments required through SIP to create a corpus of Rs 3 Crores over different investment tenures assuming 12% annualized return on investment. You can see that over longer

tenures the power of compounding is enormous.

Monthly SIP required to accumulate Rs 3 crores over different

Mutual fund SIPs are very flexible investment options. There are no charges or penalties for SIP instalment missed due to insufficient balance in your bank account. You will simply miss out investing in the months when you do not have sufficient

balance. The SIP will resume next month provided you have sufficient balance in your account and there is no pressure on you. However, you should note that if you miss 3 consecutive SIP instalments due to insufficient balance, then your

SIP may stop. You will have to make an application of fresh SIP registration for your SIP to restart. You can stop your SIP and restart your SIP at any time based on your convenience.

Mutual funds – Horses for courses

There is not a one size fits all approach when it comes to financial planning including retirement. Different people depending on their individual stage of life, risk appetites and financial situations need to have different approaches to

retirement planning. Mutual funds offer a wide range of investment solutions for different investment needs and risk appetites. If you are starting your retirement planning at a young age, you can have maximum exposure to equity, including

riskier equity sub-categories like midcap and small cap funds, which can potentially generate high returns in the long term.

Once you are in the mid-stages of your career with retirement and other stage of life, financial goals getting closer, a more balanced investment approach is more suitable and hybrid mutual fund schemes along with large cap equity funds are prudent investment choices. Once you get closer to retirement, you need to de-risk your investment portfolio upto a greater extent from the vagaries of the stock market and shift your asset

allocation to debt mutual fund schemes, which may offer stability in returns and relative safety. At the same time, you cannot completely discard equity funds from your investment

portfolio when you are nearing retirement or even after retirement because retired lives can be very long and you will aim to grow your wealth over time to fight inflation.

Mutual funds – Horses for courses

Tax efficiency

Many investors ignore tax consequences of their investments but in reality, taxes can eat up a considerable portion of your hard earned wealth. Interest income from many traditional savings options like bank FDs and Government small savings

schemes are taxed as per the income tax rate of investors. Mutual funds, on the other hand, are one of the tax friendly investment options in India. Long term capital gains (investment holding period of more than 1 year) from equity and

equity oriented hybrid funds (more than 65% gross exposure to equity) are tax free up to Rs 1 lakh per year. Long term capital gains from equity or equity oriented funds exceeding Rs 1 lakh are taxed at 10%. Long term capital gains (investment

holding period of more than 3 years) from debt funds or debt oriented hybrid funds are taxed at 20% after allowing for indexation benefits.

Summary

Retirement planning should be one of our most important financial priorities during our working lives. Many people sacrifice their retirement plans for the sake of their children’s higher education or marriage. What they do not realize is

that, if they lose their financial independence during retirement they may end up becoming a financial burden on their children. Mutual funds are one of the investment solutions for retirement planning, while meeting your other financial

goals at the same time. You should discuss how to use mutual funds for retirement planning with your financial advisors.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada