Information bias is the tendency to seek and evaluate information, even if it may not be irrelevant from the perspective of the investor’s needs. The traditional view on information related to investments and finance was that investors did

not have sufficient information. Regulators tried to address this issue by asking AMCs to disclose all the relevant fund related information in the monthly fund factsheets. In addition to the AMCs, there are a number of third party research

firms / analysts who provide information related to fund and stock performance to investors. The advent of internet and spread of broadband heralded the information age. Today, investors had much more information than before and this fuelled

their thirst for more information.

Through social media we are now being bombarded with new information almost every hour and sometimes every few minutes. Too much information can cause bias if you take all information which you receive very seriously without checking their

veracity or even if it is relevant at all. If you have information bias in investing, you may get confused or even worse; make wrong investment decisions based on irrelevant information which harm your financial investments.

Information bias in investing

You should ask yourself, if some of the information you are getting is relevant at all. Information like daily NAV movement, 52 weeks high or low NAVs, best performing funds of the

month etc. are useless in our view. Should you buy or sell a fund based on its last 7 days or 30 days performance? However, with interesting captions they are made to look as if it is very important information that you should pay attention.

But mostly they are irrelevant or cause you to make wrong investment decisions.

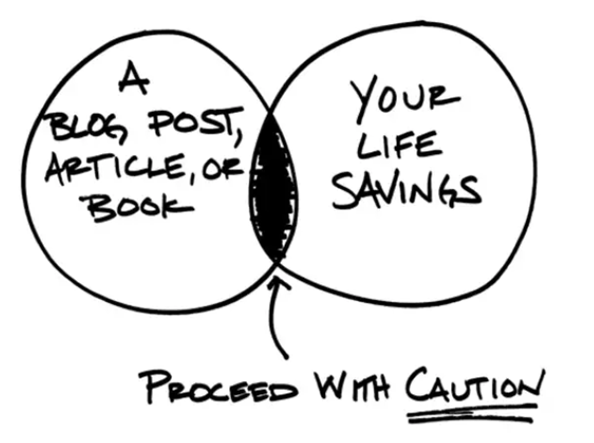

Likewise, for mutual fund investors, top stocks bought or sold by fund managers every month is mostly not relevant. When you are investing in mutual funds, you rely on professional

fund managers to do the stock selection because you do not have their expertise or experience. Top stocks bought or sold by fund managers can be an interesting article on the internet but is it really useful for you as a mutual fund investor

in making investment decisions?

Another danger of information bias is investing in wrong product. There is a lot of content online almost on any topic. Let us suppose you want to buy life insurance. You will find a lot of information on insurance products which will also

say “grow your investments”. Though your objective was life insurance, because of the information overload, you can be distracted from your primary objective of getting adequate life insurance and lead you to a product which addresses

neither your insurance nor investment needs optimally.

How to avoid information bias

- Financial planning: Financial planning with clearly defined financial goals and investment plans to achieve different goals can help you avoid information bias. Make sure that you are committed to your financial plan.

- Know the fundamentals of investing: Know what is important and what is not. You need to understand what will make your financial goals successful and filter out the unimportant information.

- Do not track your portfolio on a daily basis: It is important to monitor your portfolio regularly, but you not need to track it on a daily basis. Short term price movements have no impact on long term portfolio returns. If you track

your portfolio on a daily basis, then you are likely to be prone to information biases.

- Seek counsel before you react to information: Information that you get every day or every hour usually has no bearing on longer term portfolio performance. If you want, you can seek more information about investments, but seek the

guidance of a financial advisor before you act on the information you have. A lot of information you get daily may be totally irrelevant and can harm your financial interests, if you act on it without considering other factors.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada