Recency bias is a psychological phenomenon where we give more importance to recent events compared to what happened a while back. For example, if you are asked to name 30 movies that you have seen there is likely to be a tendency of recalling

movies you have seen in the recent 1 or 2 years more than movies you saw 10 – 15 years back. Recency bias is seen in many aspects of our lives. For example, it has been noted that in performance evaluations, managers tend to give more

importance to last 3 – 4 months of work done by their employees rather than the performance over the entire year. Similarly cricket fans often judge a batsman or bowler based on his performance in the last series or the last ODI / T20

championship and not based on their long-term career statistics. Recency bias is also extremely common in investing.

Recency bias in investing

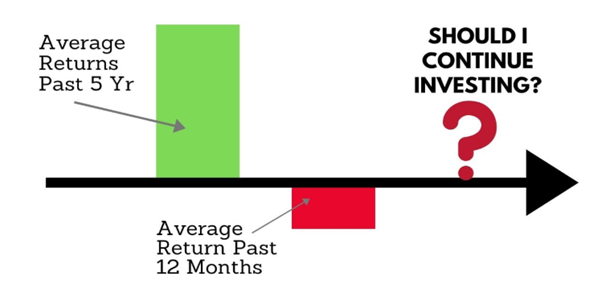

Recency bias is very common in investing; investors tend to give more importance to short term performance compared to long term performance. For example, an investor invests Rs 100,000 in a mutual fund. Over 5 years the market value of his

investment grows to Rs 175,000. Then in the last three months, the value falls to Rs 150,000. The investor may look at his investment performance of as a loss of Rs 25,000 in 2 months and not an overall profit of Rs 50,000 in 5 years.

This is recency bias. Investors often stay away from equities when market has fallen sharply when on the contrary, they should be investing because they can buy further at attractive prices. Recency bias clouds our judgment and is detrimental

to our financial interests in the long term.

How to avoid recency bias

- Understand how market works:Equity markets always work in cycles. There are periods when prices go up (bull market) and there are periods when prices fall (bear market). Markets eventually recover from the lows and goes on to make

a new peak, higher than the previous one. Rs 100,000 invested in the Sensex 20 years back, despite several bear markets, would have grown to Rs 881,000 (as on 30th July 2020).

- Invest according to your financial goals:You should clearly define your financial goals and invest accordingly. You should have a financial plan to meet your different goals – short term, medium term and long term. You should always

stick to your financial plan. Goal based investing will keep you disciplined and not get affected by recent events in the market.

- Portfolio approach and asset allocation:You should focus on the performance of your overall portfolio and not get too riled up by the short-term performance of one or two funds. Asset allocation is the most important factor in the

performance of your portfolio. You should maintain your asset allocation and rebalance regularly to get the best portfolio performance according to your needs.

- Consult a financial advisor in making investment decisions:In turbulent times, often talking to a person who is knowledgeable and experienced about how market works can help you avoid recency bias. Financial advisors can be of great

help in volatile markets. Talk to your advisor about concerns regarding your investments and seek his / her guidance.

Think of funds in your portfolio as players in your team and you as the captain. If you are the captain of a team will you drop players, who may have scored lots of runs or taken many wickets in the past or have great potential, but may have

performed badly in one match or one series? There can be a number of reasons why your batsman or bowler underperformed. A good captain will try to understand the reasons for underperformance but he will never act impulsively based on short

term performance.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada