How does SIP in Debt mutual funds work?

By investing a fixed amount every month (or any other interval) from your regular savings, you can invest over a long period of time and benefit from the power of compounding. Power of compounding does not only work for equity, it also works

for fixed income over long investment tenures.

By investing a fixed amount at regular intervals (monthly or any other), you will be investing at various price points and average out your purchase cost. This is known as Rupee Cost Averaging. Since fixed income funds are market linked schemes

their prices are also subject to volatility (albeit lesser than equity funds). Through SIP you can take advantage of volatility even in fixed income funds

especially in longer duration fund which are more sensitive to interest rates.

Fixed income can outperform even in the long term

Extreme market conditions often challenge popularly held views. One view is that equity always outperforms in the long term. This is largely correct because historical data shows that, equity has been best performing asset class in the long

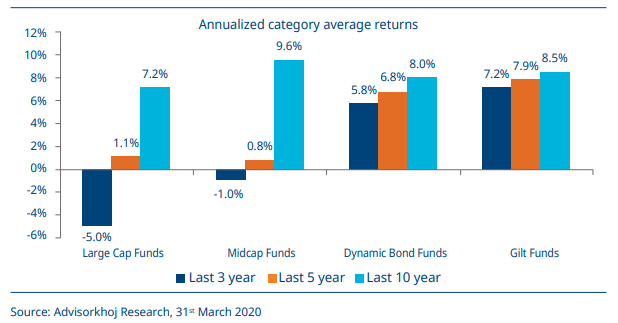

term. However, conventional thinking about what constitutes long term is now being challenged. The chart below shows the annualized average returns of some equity and fixed income categories over the last 3, 5 and 10 years. You can see

that in certain market conditions, fixed income funds can outperform equity even over fairly long tenures.

Past performance may or may sustain in future. The returns shown above are returns of the category and do not in any way depict the performance of any individual scheme of any Fund.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada