Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households. As per Reserve Bank of India’s Quarterly Estimates of Household Financial Assets and Liabilities, Rs 4,753 billion

was invested in bank FDs in FY 2018 (latest year for which data is available from RBI). On the other hand, despite its growing popularity, share of mutual funds in household fixed income assets is still relatively quite small. As per AMFI

data (February 2020), retail and HNI net investment in debt mutual funds in the last one year (ending Feb 2020) was Rs 260 billion.

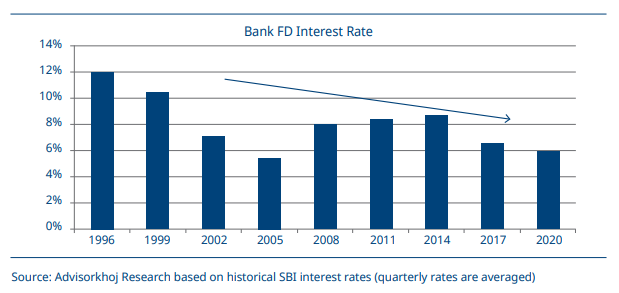

FD and small savings schemes’ interest rates on declining trend Bank FD interest rates have generally been declining over the last 20 years, from 10 – 11% in 1999 to just around 6% in 2020.

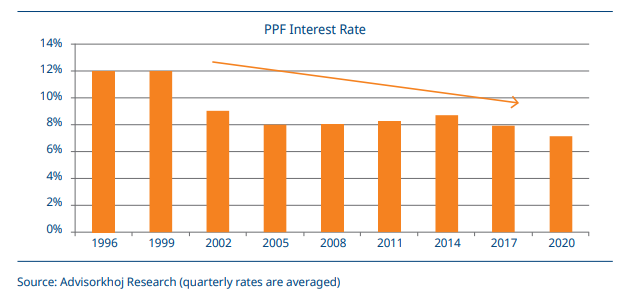

Similarly, Government (Post Office) small savings schemes’ interest rates are also on a declining trend over the last 20 years from 12% to around 7% in 2020.

The Government has already announced cut in interest rates of small savings schemes. In the long term also, we may see further decline in interest rates as inflation goes down in our economy.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada