What is SIP is a very common question asked by investors new to mutual funds. The question

what is SIP or

what is systematic investment plan can be answered very differently by different people. But simply speaking, if you dream to become wealthy and want to work towards it, Systematic Investment Plans (SIP) of mutual funds may

be able to help you achieve that.

What is SIP investment in mutual funds?

SIP is a method of investing a fixed amount, regularly – monthly or quarterly in a mutual fund scheme chosen by you. An investor can invest a pre-determined fixed amount in a chosen

scheme every month or quarter. In this article we will discuss the different aspects of SIP investments.

How does SIP work?

Mutual fund SIPs are designed for your convenience. You can select the scheme, the amount you want to invest, the frequency including the dates you want to invest etc. Let us discuss how to open a SIP account and how does SIP work.

What is SIP frequency?

SIP frequency refers to intervals at which you want to invest in your mutual fund scheme e.g. monthly, quarterly etc. Some asset management companies (AMCs) may provide facilities for daily, weekly or fortnightly SIPs. The most common

SIP frequency is usually monthly because it allows you to invest from your regular monthly savings.

What is SIP date?

This refers to date of the month or quarter when you want to invest through SIPs. Some AMCs have specific SIP dates, while some AMCs may allow investment on any date of the month. You can choose a date as per your convenience. Ideally,

you should choose a date at the beginning of the month just after your salary credit date or just after your EMI date (if you have a loan). Whatever date you choose, you should ensure that you have sufficient balance in your savings

bank account on the SIP date. If you want to change the date for your SIPs you can submit an SIP transaction slip requesting for the change of SIP date to the AMC.

What is SIP amount?

This is the amount you want to invest monthly in your mutual fund through SIP. You can choose any SIP amount according to your investment needs and financial situation. In most fund houses in India, you can start your SIP with minimum

Rs 500 investment every month. There is no upper limit for SIP amount.

What is SIP start date or month?

This is the date or month, when your mutual fund SIP will start. You can choose any start date or month, but there has to be minimum 30 days gap between two instalments. For example, if your SIP date is 2nd of every month and you made

your first SIP investment on 25th April 2022, then your next SIP instalment will be debited from your bank account on 2nd June 2022. The third and subsequent SIP instalments will be debited on 2nd of every month (provided it is

a business day).

What is SIP end date or month?

This is the date or month, when you want your mutual fund SIP to end. There will be no more auto-debits from your bank account after the SIP date. You should understand that the units of your mutual fund schemes purchased through SIP

will not automatically be redeemed on the SIP end date or month. You may continue to remain invested (own the mutual fund units) after the SIP end date. If you want to redeem the units of your mutual fund scheme, you will have

to submit a redemption request to the AMC. You may choose any SIP end date / month depending on your investment needs. Alternatively, you may choose perpetual SIP, which has no end date (or end date of 2099). Please note that you

can stop your perpetual SIP at any time by submitting a SIP closure request to the AMC.

What is a SIP’s payment requirement for new investors?

New investors, who do not have a mutual fund folio with the AMC, should provide cancelled cheque, first SIP cheque details (cheque number, bank, cheque date, account type e.g. savings, current, NRE, NRO etc.) You will also have to

provide the bank mandate for the SIP.

What is SIP bank mandate?

To invest through SIP investment plan, you need to register for Systematic Investment Plan by submitting a bank Electronic Clearing Services (ECS) or National Automated Clearing House (NACH) mandate where you have to specify the SIP

amount, the interval and the SIP date. Through the ECS or NACH mandate, you instruct the bank to debit a certain amount at the specified date(s) of a month and credit to the mutual fund. The ECS or NACH mandate can be submitted

online or through a paper form to the AMC or RTA. Some AMCs may also accept post-dated cheques for SIPs, but there is no advantage for the investor in submitting post- dated cheques; it simply requires more effort on your part

since you will have keep submitting the post-dated cheques to the AMC throughout the SIP tenure.

What is SIP application or registration form?

How to open a SIP account? You should be KYC compliant to invest in mutual funds. If you are not KYC compliant submit the KYC documents to the AMC or RTA or consult with your financial advisor if you need help in getting your KYC done.

To start a SIP, you will have to submit a SIP application or registration form to the AMC or the Registrar and Transfer Agent (RTA). The SIP application or registration form will require all the details mentioned above e.g. SIP

frequency, SIP date, SIP amount, SIP start and end month, bank mandate etc. In addition you will have to provide personal details like the first applicant’s name, first and joint applicants’ PAN, mobile number, email address etc.

You will also have to select the scheme, option (growth, IDCW) and plan (regular, direct).

We have discussed how to open SIP account and how does SIP work above. Let us now discuss the benefits of SIP investments.

What is Systematic Investment Plan’s benefit?

- Disciplined approach to investing: By choosing to invest regularly you bring discipline to your investments as you treat your SIPs like any other fixed expenses in a month, be it paying house rent,

buying groceries, eating out or paying monthly tuition fee for your kids.

- Inculcates the savings habit: It inculcates the habit of savings as you commit a fixed amount and invest it systematically every month or quarter.

- Flexibility: Starting a SIP or closing the same is very easy and there is no penalty for foreclosure.

- Wide choice of schemes: You get a wide choice of Mutual Fund schemes and can invest in one matching your risk profile, investment objective or financial goals.

- Convenience: You need not go to the AMC office or deposit a cheque every month. All you have to do is sign an auto debt / ECS form and the amount will be deducted from your bank account on one of

the dates chosen by you. SIP can also be started online from the AMC’s website.

- Low investment amount: You can start a SIP in India with as low as Rs. 500 per month.

- Diversified investments: Starting a SIP in an equity

mutual fund allows you to take advantage of investing in various sectors and companies thus spread your risk across companies, sectors and market capitalization.

- Power of compounding: Since you can start investing in SIPs with small amounts, you can start investing through SIPs from your regular savings and remain invested over long investment tenures. By

investing over long investment horizons you can create wealth by way of the power of compounding. Compounding is profits made on profits. The power of compounding grows exponentially over long investment tenures.

- Helps achieve your long term goals - Rupee cost averaging - A simple approach to long term investing is discipline and commitment to invest a fixed sum for a fixed period and sticking to this schedule

regardless of the market conditions. Since you invest at different NAVs (price levels) in SIP, you can take advantage of market volatility through Rupee Cost Averaging.

How SIP works for Rupee Cost Averaging?

Rupee cost averaging in a way ensures that you automatically buy more units when the NAV is low and fewer units when the NAV is high. Suppose you are investing Rs 10,000 every month. When the NAV is Rs 20, you will get 500 units because

Rs 10000 ÷ 20 = 500. However, if the market dips and the NAV drops to 18, you will get 555.56 units, as Rs 10000 ÷ 18 = 555.56. As you can see you have bought more units when the markets are at lower level.

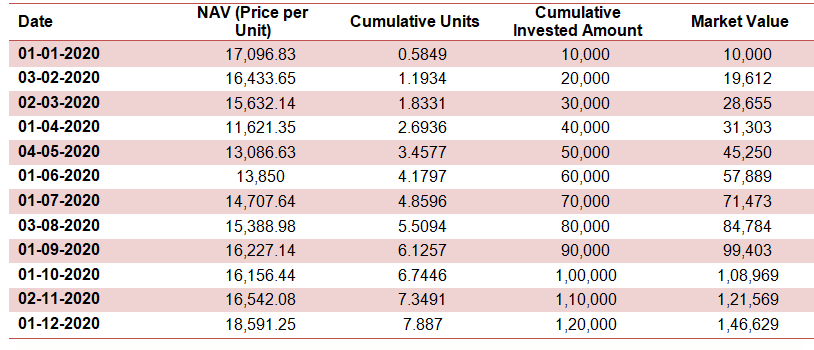

The table below illustrates how Rupee Cost Averaging works in mutual fund Systematic Investment Plan (monthly SIP plan of Rs 10,000) in Nifty 50 TRI in 2020, a year in which the market was highly volatile due to the COVID-19 pandemic.

Over sufficiently long investment tenures, investors can get higher returns by taking advantage of volatility through Rupee Cost Averaging in SIPs.

What is SIP investment goal?

SIPs help you achieve your long term goals, like - Retirement, Children higher education and their marriage or so on. You can actually set a target amount for your goal and invest every month over a period of time in order to achieve the

same. For example – You are aged 30 and want to build a 5 Crores corpus for your retirement at age 55. You need to invest only Rs 27,000 per month for next 25 years (assuming return of 12%).

What is SIP investment’s popularity in India?

Mutual fund SIPs have become very popular among retail investors in India. As per AMFI data, there are 5.17 Crores SIP accounts (as on 28th February 2022). More than Rs 12,000 Crores is invested through SIPs in March 2022. In FY 2021-22,

more than Rs 1.25 lakh Crores had been invested through systematic investment plans (as on 31st March 2022). With rising popularity of SIPs, few AMCs have launched Goal SIP and SIP Top-up facility.

What is Goal SIP?

You can specify the target value for your goal while making you investments. You can choose the mutual fund scheme to your savings on a periodic basis through SIP with the aim of meeting the defined goal. By starting your Goal SIP, you

avoid the hassle of aiming for appropriate market timing, along with the added advantage of compounding and long term wealth creation. Goal based investing add a direction to an investment. It is a well thought out and structured process

where you know the purpose of why each rupee is being invested. The performance of Goal based Plans is measured by how successful are the investments in meeting an individual’s lifestyle and personal goals, discouraging investor’s

short-term impulsive actions.

What is SIP Top-up?

SIP Top-up or SIP Step-up is a SIP facility using which you can increase your SIP instalments at regular intervals e.g. half yearly, annual etc. You can specify the SIP increment either in Rupees or in percentage terms. Let us assume that

you have a monthly SIP of Rs 10,000 in mutual fund scheme. If you opt for Rs 1,000 SIP top-up on an annual basis, your monthly SIP instalments will be Rs 11,000 after one year and Rs 12,000 in the following year. If you opt for 10%

SIP top-up on an annual basis, your monthly SIP instalments will be Rs 11,000 after one year and Rs 12,100 in the following year. Now that you know how SIP top-up works, let us discuss why you should opt for SIP Top-up.

What is SIP Top-up’s main benefit?

As your income grows over time, your savings should also grow. SIP Top-up facility enables invest incremental amounts through SIP by increasing your SIP instalments over time. SIP Top-up can help you reach your financial goals faster and

/ or create additional wealth.

What is Systematic Investment Plans taxation?

Taxation of redemptions in mutual SIPs depends on the type of the scheme and when redemptions are made. In SIPs, the principle of First in First Out (FIFO) applies for taxation; you should consult with your tax consultant or chartered

accountant to understand how FIFO will be applied for taxation of redemption proceeds in SIPs. Taxation of redemption proceeds in SIP investments also depends if the scheme is an equity fund or non-equity fund; consult with your financial

advisor to know which funds are treated as equity or non-equity funds for taxation purposes. Short term capital gains in equity funds are taxed at 15%, while long term capital gains up to Rs 1 lakh is tax free and taxed at 10% thereafter.

Short term capital gains in non-equity funds are taxed as per your income tax rate, while long term capital gains are taxed at 20% after allowing for indexation benefits. If you are investing in IDCW (dividend) options through SIP,

then IDCW (dividend) payments will be taxed as per your income tax rate, both for equity and non-equity fund.

Conclusion

In this article we have tried to address questions like, what is SIP investment, how SIP works, what are the benefits of SIP, value added SIP facilities (e.g. Goal SIP, SIP Top-up), what is SIP taxation etc. SIP is an ideal way

of investing for your long term financial goals like children’s higher education, children’s marriage, retirement planning, and estate planning. Consult with your financial advisor if you want to start a SIP for your long term financial

goals and start investing for wealth creation.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click Here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada