Investors have realized that equity mutual funds are one of the good investment options which aim for long term wealth creation. The benefits of investing in equity mutual funds are as follows:-

- Equity mutual funds provide risk diversification by investing in a portfolio of stocks across different industry sector. By diversifying across stocks and sectors, mutual fund schemes aim to reduce stock and sector specific risks to large

extent.

- Mutual funds work by pooling money from a large number of investors making them ideal product for small investors. The minimum investment in mutual funds can be as low as Rs 5,000. If you are investing through systematic investment plans

(SIP) then you can start with instalments of just Rs 1,000 or Rs 500 in case of ELSS mutual funds.

- Mutual fund schemes are managed by professional fund managers who have experience and expertise of investing in stock markets. Fund managers are tasked with outperforming the market benchmarks and generate superior returns for investors.

- Open ended mutual fund schemes (with the exception of Equity Linked Savings Schemes) offer high liquidity. You can redeem units of open ended schemes partially or fully at any time by sending redemption request to the Asset Management

Company (AMC). Investors should note that redemptions in the exit load period may attract charges.

- Mutual funds are highly transparent investments. AMCs disclose the underlying securities of mutual fund scheme and various performance related metrics in their monthly factsheets.

- Mutual funds are regulated by Securities Exchange Board of India (SEBI) whose primarily role is to protect interest of investors. SEBI’s oversight make mutual funds relatively safer compared to other investment options which may not have

regulatory oversight.

- Equity mutual funds are one of the most tax efficient investment options. We will discuss tax advantages of equity funds later in this article.

Mutual Fund outperformance

As mentioned earlier, mutual funds aim to outperform the market index and generate superior returns for investors over sufficiently long investment horizons. Experienced fund managers have the ability the identify stocks with higher earnings

growth potential or stocks which are available at a discount to their intrinsic value or stocks with high earnings growth potential trading at a reasonable price.

In addition to superior stock selection, fund managers can also be overweight / underweight in certain industry sectors relative to the market index based on their outlook for different sectors. By being overweight on sectors which have higher

growth potential, fund managers can outperform the market. From time to time fund managers also book profits in stocks which they think have become expensive. These profits can be distributed to investors as dividends (in dividend options)

or re-invested in the scheme (in growth option).

Tax advantage of equity funds

Apart from wealth creation potential, equity mutual funds are one of the most tax efficient investment options. Income from traditional investment options like bank FDs and many Government (Post Office) small savings schemes are added to the

income of the investor and are taxed according to the income tax rate of the investors. In mutual funds incidence of taxation arise only on redemption or dividend pay-out. There is no taxation during the period you remain invested in the

scheme unlike bank FDs.

Capital gains in equity funds held for less than 12 months (short term capital gains) are taxed at 15% plus applicable surcharge and cess. If your holding period is more than 12 months, then long term capital gains of up to Rs 1 lakh is tax

exempt. Long term capital gains in excess of Rs 1 lakh in a financial year are taxed at 10% plus applicable surcharge and cess. Lower rate of capital gains taxation makes equity funds one of the most tax efficient instruments.

Prior to this financial year (FY 2020-21) dividends paid by mutual funds were tax free in the hands of the investors, but the scheme had to pay dividend distribution tax (DDT) before paying dividends to investors. From this financial year

(2020-21), the Government has abolished dividend distribution tax (DDT) and dividends will be treated as income in hands of the investors. In other words, dividends will be added to your income and taxed according to your income tax rate.

Investors should understand the tax consequences of their investments and make informed decisions.

Summary

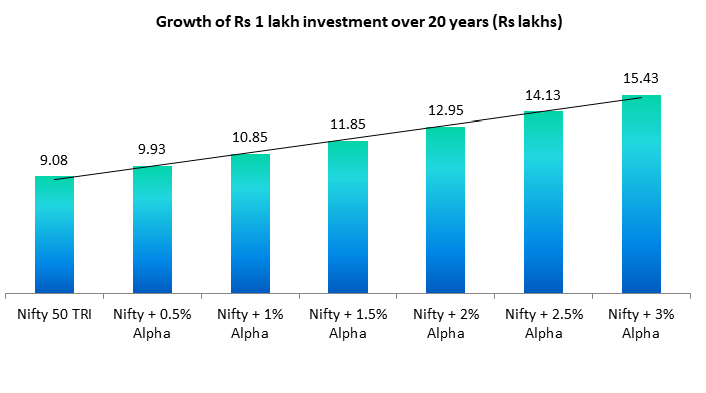

In the last 20 years (1st May 2000 to 30th Apr 2020) Rs 1 lakh invested in Nifty 50 TRI would have grown to Rs 9.75 lakhs. The chart below shows the extra wealth creation for every additional 50 bps of alpha.

Source: Advisorkhoj Research (01.07.2000 to 30.06.2020). Past performance may or may not sustain in future.

Historical performance of top performing equity mutual funds across different category has shown consistent alpha creation over long investment horizons. In addition to wealth creation potential equity mutual funds are also one of the most

tax efficient investment options. You should review your investments and see if you have adequate investments in equity funds to meet your long term financial goals.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada