Debt funds can give higher returns

Debt funds are fixed income mutual fund schemes which invest in debt and money market instruments like CPs, CDs, Corporate Bond, T-Bills, G-Secs etc. These instruments pay interest (coupon) at pre defined intervals and the face value (principal)

upon maturity. The yields of many of these instruments are usually higher than bank FD interest rates of similar maturities. Yields of AAA rated corporate bonds can be 150 – 200 bps higher than FD interest rates. In addition to higher

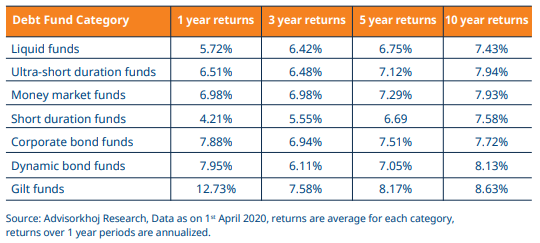

yields, since these instruments are traded in the market, you can benefit from price appreciation. The chart below shows the trailing returns of different debt fund categories over different tenures.

Based on historical data, you can see that across different product categories (risk profiles) and investment tenures, debt funds have the potential to give better returns than bank FDs.

Past performance may or may sustain in future. The returns shown above are returns of the category and do not in any way depict the performance of any individual scheme of any Fund.

Debt funds are tax efficient

Bank FD interest is taxed as per the income tax rate of the investor. Capital gains in debt funds held for over three years are taxed at 20% after allowing for indexation benefits. Indexation benefits can reduce tax obligations substantially

for investors in higher tax brackets. Incidence of taxation in fixed income funds arise only if you redeem (sell) your mutual fund units or if you receive dividends. Capital gains on your redemption proceeds and dividends are taxed differently.

Capital Gains Tax

There are two kinds of capital gains in fixed income funds:-

- Short term capital gains: If units of fixed income funds are sold within 36 months from the date of purchase then capital gains arising out sale of units will be treated as short term capital gains for tax purposes. Short term

capital gains are added to your income and taxed according to your income tax slab rate.

- Long term capital gains: If units of fixed income funds are sold after 36 months from the date of purchase then capital gains arising out of sale of units will be treated as long term capital gains for tax purposes. Long term

capital gains are taxed at 20% after allowing for indexation benefits.

Illustration of Long Term Capital Gains-

If you received the same maturity amount from a bank FD, then your tax outdo would have been Rs 8,280 if you were in the 30% tax bracket (plus surcharge & cess). The long term capital gains tax in the example above is nearly 60% less.

Dividend Tax

Prior to this financial year, mutual fund dividends were tax free in the hands of the investors but the scheme (AMC) had to pay dividend distribution tax (DDT) at the rate of 29.12% for debt funds before paying dividends to investors.

In this Union Budget, the Government has abolished DDT. Dividends will now be added to your income and taxed as per your income tax slab. If you are in the 30% tax bracket, your post tax dividend will now be lower (assuming same

dividend payout rate per unit), but if you are in the lower tax brackets your post tax dividends will be higher. You should decide whether to invest in growth or dividend re-investment option depending on your individual tax situations.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada