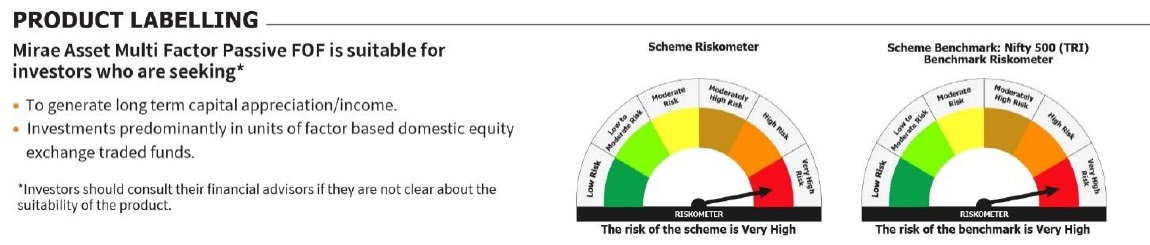

Mirae Asset Investment Managers (India) Pvt. Ltd. announces launch of New Fund Offers (NFOs) for two Fund of Funds (FoFs) - Mirae Asset Multi Factor Passive FOF (An open-ended fund of fund scheme predominantly investing

in units of factor based domestic equity ETFs) and Mirae Asset Gold Silver Passive FoF (an open-ended fund of fund scheme predominantly investing in units of Mirae Asset Gold ETF and Mirae Asset Silver ETF). These open-ended

FoFs are designed to provide investors with exposure to factor based domestic equity ETFs and precious metals i.e. Gold & Silver ETFs respectively, through a disciplined, systematic approach.

The Mirae Asset Multi Factor Passive FOF seeks to invest predominantly in units of factor-based domestic equity ETFs. Factor based investing aims to provide diversified exposure through different investment styles, though

it is subject to cycles of relative underperformance depending on market conditions. Ability to hold on to investments gets properly tested when factors underperform. Additionally, investors are typically unable to pick the

right factors for a given market regime or shift allocation to preferred factors as market regime changes. This Fund of Fund which will take exposure in multiple factors like momentum, low volatility, equal weight, quality,

value etc. and dynamically manage the allocation based on a given market regime. Hence allocation may shift to aggressive or defensive factors based on market cycle. The intent is to capture the potential of smart beta factors

while having a relatively lower drawdowns by mitigating single factor risk.

The Mirae Asset Gold Silver Passive FoF will invest primarily in units of Mirae Asset Gold ETF and Mirae Asset Silver ETF, offering exposure to both gold and silver. The intent is to capture the potential of both the precious

metals while seeking a relatively lower drawdown. Gold and silver are two precious metals that offer different advantages to investors. While gold is generally seen as a store of value and a hedge against risk, silver on the

other hand is also an industrial metal and its price gets impacted by supply demand dynamics. Both Gold and Silver might be cyclical and they don’t always perform together. Between gold and silver, timing and allocation shifts

can be the key to derive best of both precious metals. Based on relatively better expectations and outlook, the scheme allocation will shift towards gold or silver or towards a balanced allocation.

In both the schemes, since change in allocation is being handled by the fund itself, there will be no tax impact due to such allocation changes whereas if same is done by the investors themselves, it will possibly invoke tax incidences,

providing an advantage to manage and shift asset allocation via such Fund of Fund schemes.

Both NFOs will be open for subscription from August 11, 2025, to August 25, 2025, and the Scheme reopens on September 1, 2025. The minimum initial investment is ₹5,000, with subsequent investments in multiples

of ₹1. Systematic Investment Plans (SIPs) start at ₹99.

Both the funds Mirae Asset Multi Factor Passive FOF and Mirae Asset Gold Silver Passive FoF will be managed by Mr. Ritesh Patel.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada

.jpg)